Semiconductor skilled Cirrus Logic ( NASDAQ: CRUS) may not be a house identify like a number of of its market friends, but the agency has truly performed remarkably nicely on {the marketplace} up till now this 12 months with positive factors of 69% since this writing.

Cirrus, which is known for offering chips for Apple‘s ( NASDAQ: AAPL) items, has actually outmatched the wider Nasdaq -100 Technology Sector index’s positive factors of 10% by a big margin. The wonderful info is that Cirrus’ spectacular growth is true right here to stay, and the agency can find yourself the 12 months extremely many because of its greatest consumer. What’s way more, the arrival of artificial intelligence (AI)– allowed good units is most probably to open a big lasting growth chance for Cirrus Logic.

Let’s take a more in-depth check out the explanations capitalists have to consider buying Cirrus Logic provide hand over clenched fist previous to it’s far too late.

Cirrus Logic’s present outcomes direct in direction of an excellent future

Cirrus Logic launched monetary 2025 first-quarter outcomes (for the three months completed June 29) onAug 6. The agency’s income boosted 18% 12 months over 12 months to $374 million and was nicely upfront of the settlement quote of $318 million. What’s way more, Cirrus’ modified income leapt a powerful 67% 12 months over 12 months to $1.12 per share, squashing Wall Street’s $0.61 per share quote.

The favorable info actually didn’t end proper right here, as Cirrus anticipates its monetary Q2 income to land in between $490 million and $550 million. The center of the recommendation selection stands at $520 million, which’s nicely over the Wall Street quote of $485 million. Cirrus clocked income of $481 million in the exact same quarter in 2015, suggesting that its main line will get on observe to lift by 8% on a year-over-year foundation.

Cirrus’ main line can land nearer to the better finish of its recommendation selection many because of its greatest consumer, Apple, which made up an incredible 88% of its main line final quarter. Cirrus administration defined on the present income teleconference that its income surpassed the main finish of its preliminary recommendation selection many because of “stronger than expected shipments into smartphones.”

Because Apple is Cirrus’ greatest consumer, the stronger-than-expected effectivity implies that Cirrus obtained much more orders for its chips final quarter. That’s not surprising, as Apple seems to be planning for a hostile rollout of its next-generation apples iphone which can be all set to support generative AI features.

Apple’s reported apple iphone 16 is anticipated to strike {the marketplace} following month and the expertise titan is anticipated to ship 90 million units of its upgraded good gadget schedule this 12 months. That will surely be a ten% rise over in 2015. But at the exact same time, provide chain information recommend that Apple is stockpiling on 120 million show display panels, recommending that it would wind up producing way more units than what {the marketplace} is presently anticipating.

If that’s no doubt the scenario, Cirrus Logic’s growth within the current quarter is most probably to surpass assumptions as soon as extra. But way more notably, the assimilation of the Apple Intelligence assortment of generative AI features proper into the expertise titan’s upcoming good units is anticipated to set off a powerful improve cycle. Apple’s good gadget deliveries are anticipated to lift by 10% in 2025 and 2026, in line with JPMorgan‘s worth quotes.

Cirrus is anticipated to land much more buck net content material sooner or later era of apples iphone, which means that it must have the power to acquire much more income from every gadget of the apple iphone that Apple creates. So, the section seems established for Cirrus Logic to complete the 12 months extremely, and it must have the power to keep up its just lately found power sooner or later too many because of Apple’s entrance proper into the AI good gadget market, an space that’s presently in its very early levels of growth.

A pair way more components to accumulate the availability

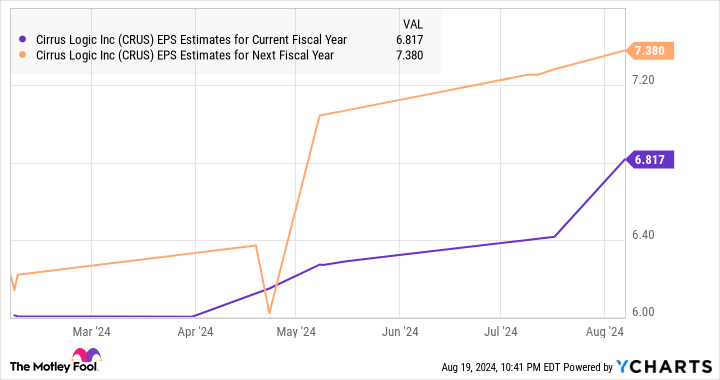

Analysts have truly fasted to raise their income growth assumptions for Cirrus Logic, as seems from the graph under.

Cirrus Logic ended up monetary 2024 (upright March 30) with non-GAAP income of $6.59 per share. The over graph informs us that specialists weren’t anticipating a lift in Cirrus’ income within the current , but that has truly reworked of late. Additionally, the agency’s basic growth projection for the next components in direction of an enhancement in its growth worth.

However, if Apple no doubt determines to extend the manufacturing of its upcoming apples iphone and Cirrus winds up offering way more materials to the expertise titan, there’s a probability of Cirrus’ income conveniently surpassing specialists’ assumptions transferring ahead.

That’s why at the moment will surely be a good time for capitalists to accumulate this semiconductor provide. It’s buying and selling at merely 26 occasions routing income, a worth reduce to the Nasdaq -100 index’s income a number of of 31. And the AI-driven growth within the good gadget market and Cirrus’ restricted reference to among the many greatest players on this room could cause better-than-expected growth transferring ahead.

Should you spend $1,000 in Cirrus Logic at the moment?

Before you purchase provide in Cirrus Logic, take into account this:

The Motley Fool Stock Advisor knowledgeable group merely decided what they suppose are the 10 best stocks for capitalists to accumulate at the moment … and Cirrus Logic had not been amongst them. The 10 provides that made it could actually generate beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … in the event you spent $1,000 on the time of our referral, you will surely have $792,725! *

Stock Advisor affords capitalists with an easy-to-follow plan for fulfillment, consisting of recommendation on developing a profile, routine updates from specialists, and a pair of brand-new provide decisions month-to-month. The Stock Advisor resolution has better than quadrupled the return of S&P 500 on condition that 2002 *.

*Stock Advisor returns since August 22, 2024

JPMorgan Chase is a advertising companion of The Ascent, a Motley Fool agency. Harsh Chauhan has no placement in any one of many provides acknowledged. The Motley Fool has placements in and suggests Apple and JPMorganChase The Motley Fool suggestsCirrus Logic The Motley Fool has a disclosure policy.

Up 69% in 2024, This Red-Hot Artificial Intelligence (AI) Growth Stock Could Keep Soaring was initially launched by The Motley Fool