Since the start of 2023, a know-how rally has truly elevated many know-how provides. Advances in high-growth fields like skilled system (AI) have truly highlighted the substantial capability of companies energetic in related areas like chip model and cloud laptop. Nvidia ( NASDAQ: NVDA) has truly been among the many best receivers of the bull run, with its shares up 785% on condition that January 2023.

The enterprise benefited from raised want for AI chips and its functionality to offer its gear to the vast majority of {the marketplace}. At the start of in 2015, Nvidia’s market cap was $360 billion. Yet, present improvement has truly seen it find yourself being the preliminary chipmaker valued at larger than $3 trillion, signing up with the rankings of companies like Apple and Microsoft.

Nvidia’s speedy enhance will increase the inquiry: what enterprise could possibly be alongside strike such a turning level?

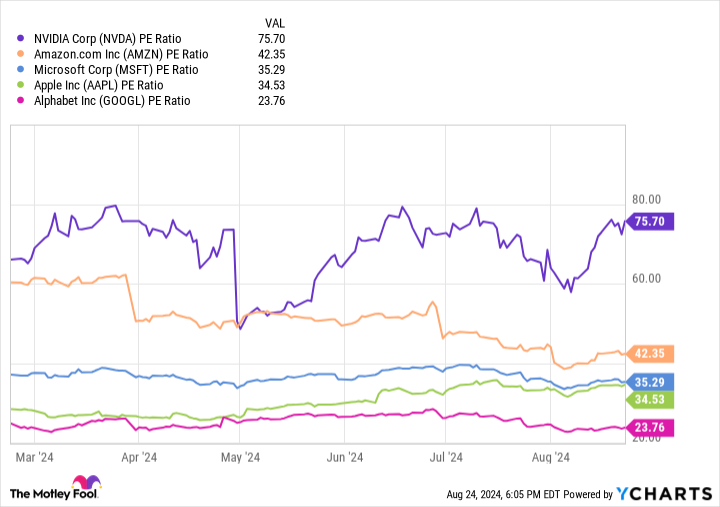

As the globe’s fourth-most-valuable enterprise, Alphabet‘s ( NASDAQ: GOOGL) ( NASDAQ: GOOG) market cap of $2 trillion locations it in a major setting to be the next enterprise to go throughout the $3 trillion restrict. The know-how titan has truly constructed itself proper right into a golden goose with improvement stimulants in a number of markets. Meanwhile, the graph listed under reveals its provide is among the many best offers in know-how.

Alphabet’s provide is up 19% 12 months to day, offering much more provide improvement than any one in all these companies apart fromNvidia Yet, Alphabet flaunts probably the most inexpensive price-to-earnings (P/E) proportion amongst its friends, suggesting its provide provides one of the vital price.

So, proper right here is an underestimated provide which may join with Nvidia within the $3 trillion membership.

Growth stimulants all through know-how

Alphabet has a strong setting in know-how, having truly broadened to a number of fields of the sector. Hard- hanging model names like Android, YouTube, Chrome, and the numerous objects beneath Google have truly made Alphabet the go-to for a great deal of important options. The enchantment of those programs has truly seen the enterprise gather a considerable particular person base, organizing 9 programs which have truly attained 1 billion or much more people since 2023.

Alphabet’s main responsibility in know-how is generally many because of fixed reinvestment in its firm and need to try brand-new endeavors. This method has truly resulted in a prolonged itemizing of now-defunct objects, with Google Hangouts, Stadia, and Google Glass merely a few. However, Alphabet’s preparedness to buy encouraging markets has truly moreover enabled it to perform rewarding duties in digital advertising, cloud computing, and AI.

The enterprise has truly utilized its substantial particular person base to market ads on its quite a few programs, an organization that at the moment represents 78% of its income. The digital advertising sector deserves regarding $740 billion and is growing at a compound yearly improvement worth (CAGR) of seven%, with Alphabet accountable for 26% of all worldwide commercial gross sales.

However, Alphabet’s best improvement chauffeur over the in 2015 has truly been Google Cloud, with its 11% market share in cloud laptop. The system is growing promptly, offering income features of 29% 12 months over 12 months within the 2nd quarter of 2024. Cloud laptop has truly became one of many fastest-growing areas of AI, a sector establishing at a CAGR of 37% by way of 2030.

Google Cloud outshined market leaders Microsoft’s Azure and Amazon Web Services in gross sales improvement in Q2 2024 and has truly revealed no indicators of slowing down. The system is probably to enhance incomes for a few years.

Alphabet offers years of fixed features

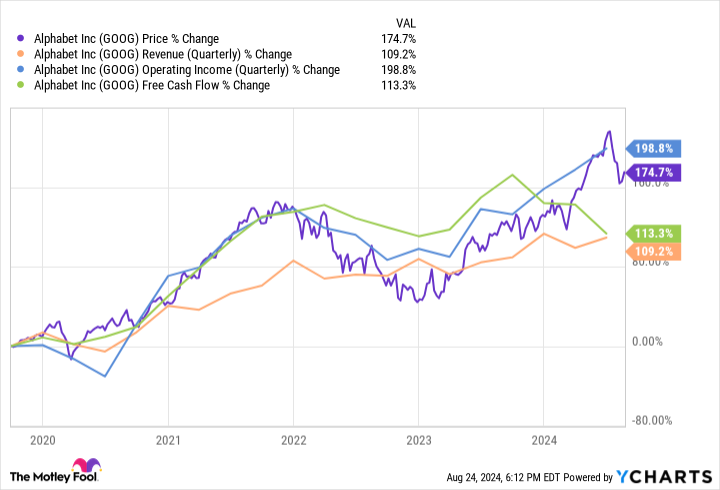

Alphabet has a credibility for fixed improvement. In actuality, a monetary funding of $10,000 in its provide in 2014 will surely at the moment deserve close to $58,000.

The know-how titan has truly verified itself to be a king of integrity, recommending that it’s much more of a problem of when, not if, its market cap will definitely strike $3 trillion.

The final 5 years haven’t been very simple for plenty of know-how companies, with a globally pandemic in 2020 and a number of other years of economic unpredictability. However, the graph over applications that Alphabet’s incomes and provide charge have truly nonetheless offered triple-digit improvement as a result of interval.

The Google mothers and pa’s cost-free capital struck $61 billion this 12 months, exhibiting it has the funds to proceed buying its firm and keep on prime of its opponents. Its P/E of 24 is amazingly diminished contrasted to its friends, suggesting at the moment is the second to buy this underestimated provide that can probably join with Nvidia within the $3 trillion membership previous to it’s far too late.

Should you spend $1,000 in Alphabet immediately?

Before you buy provide in Alphabet, think about this:

The Motley Fool Stock Advisor skilled group merely decided what they suppose are the 10 best stocks for financiers to buy at the moment … and Alphabet had not been amongst them. The 10 provides that made it would create beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … in case you spent $1,000 on the time of our referral, you will surely have $786,169! *

Stock Advisor affords financiers with an easy-to-follow plan for achievement, consisting of recommendation on developing a profile, routine updates from consultants, and a pair of brand-new provide selections month-to-month. The Stock Advisor answer has larger than quadrupled the return of S&P 500 on condition that 2002 *.

*Stock Advisor returns since August 26, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. John Mackey, earlier chief government officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Dani Cook has no setting in any one of many provides mentioned. The Motley Fool has settings in and suggests Alphabet, Amazon, Apple, Microsoft, andNvidia The Motley Fool suggests the adhering to selections: prolonged January 2026 $395 get in contact with Microsoft and temporary January 2026 $405 get in contact withMicrosoft The Motley Fool has a disclosure policy.

This Undervalued Stock Could Join Nvidia in the $3 Trillion Club was initially launched by The Motley Fool