There isn’t a provide on {the marketplace} that has truly been spoken about far more within the earlier 2 years than Nvidia ( NASDAQ: NVDA) The enhance of skilled system (AI) has truly made Nvidia’s graphics refining programs (GPUs) amongst one of the crucial in-demand gadgets as a consequence of their perform in coaching AI.

It has truly likewise made Nvidia among the many finest provides on {the marketplace}. From September 2022 to the start of September 2024, its provide elevated over 750%– 18 occasions better than the S&P 500‘s gains over that period. That’s not an easy activity for a enterprise whose market cap was round $300 million on the time.

Nvidia has truly likewise uploaded financial outcomes to again this buzz, enhancing earnings and working earnings by 122% and 174%, particularly. The appreciation is effectively ought to have. That claimed, there are 2 enterprise that I’d be most definitely to purchase now since there seems to be far more lasting assurance round their providers.

1. Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Company ( NYSE: TSM) (TSMC) is among the many globe’s most-important expertise enterprise regardless of not being a household identify like a couple of different massive expertise enterprise. It runs the globe’s greatest semiconductor (chip) manufacturing unit, producing chips for enterprise’ particulars necessities.

Companies pertained to TSMC with a chip format, and it generates the chip in response to the agency’s demand. It may seem straightforward ample, but producing chips with that stated diploma of accuracy and at that vary requires intricate procedures (inserting it gently) and progressed trendy expertise that nothing else agency has truly had the power to match.

One agency that relies upon vastly on TSMC isNvidia TSMC produces Nvidia’s chips for its GPUs, data-center cpus, and numerous different AI-related chips. Without TSMC’s manufacturing capacities, there’s a stable scenario that Nvidia’s gadgets will surely take a high quality hit. That’s primarily why Nvidia hasn’t accepted numerous different chip makers and suits relying on TSMC.

Nvidia’s reliance on TSMC is why I prefer it at this section. Much of Nvidia’s excessive analysis is improved assumptions of what it must come to be, and its capability to produce on that exact will definitely depend on TSMC’s manufacturing capability. The ceiling won’t be just about as excessive for TSMC, but its trajectory is comparatively far more reliable.

TSMC likewise has an eye catching reward that decreases a couple of of the spending hazard. Its reward return is presently over the S&P 500’s typical, making it simpler for financiers to remain particular person all through tough occasions and rely on its lasting capability.

2. Apple

Apple ( NASDAQ: AAPL) actually didn’t get to the issue of being the globe’s most helpful public agency by likelihood; it has truly taken years of non-complacency and self-displined implementation. With Apple’s document of self-control, it was perplexing why plenty of Wall Street financiers have been comparatively stunned as Apple continued to be fairly silent all through present AI mania.

Apple has a background of permitting numerous different enterprise develop one thing and afterwards venturing proper into that location with a greater format and making it far more straightforward to make use of. We’ve seen it with sensible gadgets (apple iphone), pill computer systems (iPad), smartwatches (Apple Watch), on-line truth (Apple Vision Pro), and handfuls of assorted different expertise tools.

Of program, Apple isn’t merely strolling round replicating others; as a substitute, the expertise titan does a terrific work of permitting others be the check topic and afterwards discovering possibly from their errors previous to launching its very personal providers and merchandise to {the marketplace}. That seems to be the exact same technique it’s taking with AI, additionally.

Apple hasn’t hurried proper into AI like the vast majority of numerous different massive expertise enterprise. In actuality, it doesn’t additionally describe its coming AI capacities as “artificial intelligence”; it’s “Apple Intelligence.” (It’s merely inventive ample to perform.) Nvidia stays in an unstable setting; equally as fast because it elevated, it will probably drop if it falls quick to meet assumptions. Apple doesn’t reasonably have that exact same hazard, although it’s not excluded from volatility.

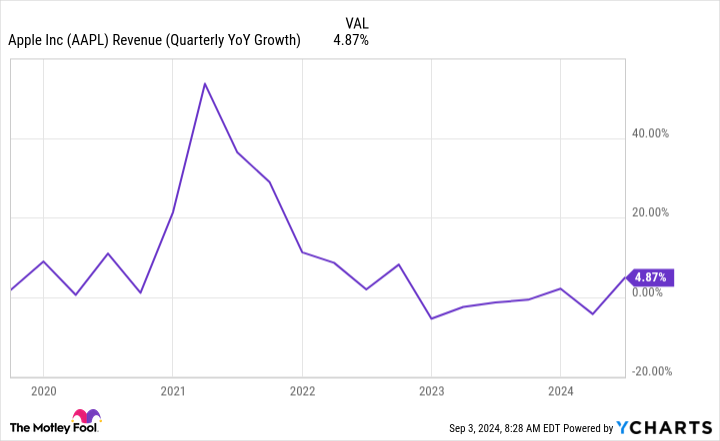

Ideally, Apple Intelligence will definitely present Apple a immediate financial enhance, with clients hurrying to amass its next-gen gadgets as a result of it’ll simply come on newer tools designs. After a despair in Apple’s sensible machine market over the last few years, I’m sure the agency wouldn’t thoughts an added raise from someplace.

Short- time period enhance aside, there aren’t method too many enterprise I depend on far more long-term thanApple The upside continually seems to exceed the potential drawback.

Should you spend $1,000 in Taiwan Semiconductor Manufacturing now?

Before you purchase provide in Taiwan Semiconductor Manufacturing, think about this:

The Motley Fool Stock Advisor skilled group merely acknowledged what they suppose are the 10 best stocks for financiers to amass at present … and Taiwan Semiconductor Manufacturing had not been amongst them. The 10 provides that made it would generate beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … for those who spent $1,000 on the time of our referral, you will surely have $656,938! *

Stock Advisor provides financiers with an easy-to-follow plan for achievement, consisting of recommendation on creating a profile, regular updates from consultants, and a pair of brand-new provide decisions month-to-month. The Stock Advisor answer has better than quadrupled the return of S&P 500 as a result of 2002 *.

*Stock Advisor returns since September 3, 2024

Stefon Walters has settings inApple The Motley Fool has settings in and suggests Apple, Nvidia, andTaiwan Semiconductor Manufacturing The Motley Fool has a disclosure policy.

There’s No Denying It; Nvidia Is on a Historic Run, but Here Are 2 Tech Stocks I’d Buy Instead was initially launched by The Motley Fool