Buying Alphabet ( NASDAQ: GOOG) ( NASDAQ: GOOGL) provide is seldom a adverse idea.

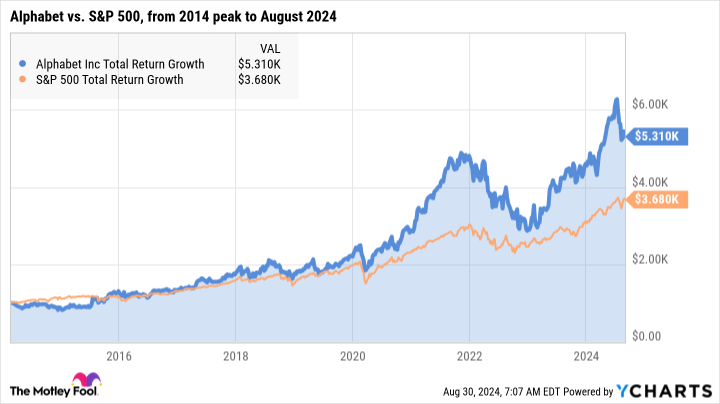

Imagine getting $1,000 of Alphabet provide onFeb 25, 2014. That ended up being essentially the most terrible day of that yr to enter into the innovation titan’s shares. The day’s optimum, with a doc fee of $30.50 per split-adjusted share, was complied with by an 18% dive over the next 10 months. The bear lure collected as European regulatory authorities thought of separating the agency, Android cellphone gross sales had a tough time, magnates left, and brand-new merchandise ideas like Google Glass and Waymo self-driving autos weren’t capturing on.

That’s okay, although. If you had really held on to that $1,000 monetary funding through thick and slim, you will surely have a market-beating $5,310 in your pocket about one decade in a while.

Alphabet’s provide has really stumbled previously– and return turning

You will surely naturally have really performed additionally a lot better in case you bought Alphabet on any type of numerous different day of that yr, but the agency conquered its issues and stomped the extra complete market additionally from essentially the most terrible possible starting issue of 2014. I anticipate future generations to say comparable elements of buying Alphabet provide in 2024– that monetary funding should defeat {the marketplace} for a number of years or maybe years to search out, no matter precisely how inadequately you might need timed the acquisition.

Time in the market beats timing the market, you acknowledge. And this company was built to last for a very long time.

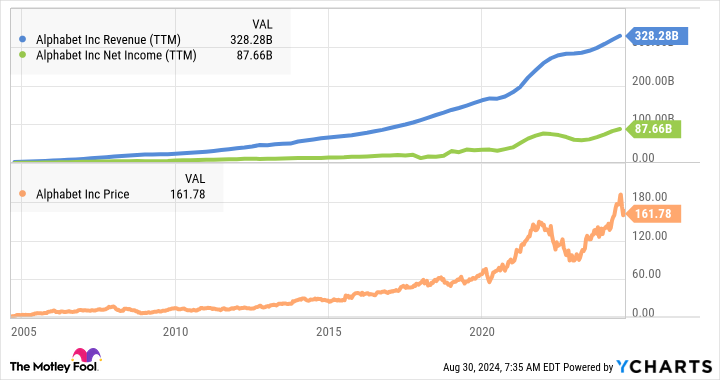

I cannot take into account any type of solitary agency extra possible than Alphabet to produce sturdy returns in 2040, 2050, and previous. That dreadful fee lower in 2014 is a hardly noticeable graph squiggle now. And Alphabet’s firm outcomes merely remained to develop:

Alphabet’s provide is a deal in the present day

Wait– it nonetheless improves. On prime of Alphabet’s tank-like remaining energy, the provision happens to be uncommonly cheap in the present day.

After getting to 1 extra all-time doc of $191.40 per share in July, Alphabet shares have really pulled again 15% to about $162 per share. As I create this, they commerce at 23.4 occasions monitoring income with a price-to-earnings-to-growth (PEG) proportion of 1.1. These are probably the most cheap earnings-based evaluation proportions amongst the “Magnificent Seven” of know-how titans.

Moreover, Alphabet has really taken a number one operate within the professional system (AI) growth. Google Cloud is a most well-liked cloud laptop system the place numerous different enterprise can educate and run their very personal AI programs. The Google Gemini chatbot contends straight with OpenAI’s ChatGPT in language understanding and era. The agency is positioned to maximise generative AI as a long-lasting improvement stimulant.

I’d happen, but you receive my issue. Alphabet’s provide was an ideal monetary funding previous to the present sell-off, and it’s an additionally a lot better purchase in the present day. Market sell-offs could be your buddy whenever you’re looking for to buy a terrific agency like Alphabet.

Should you spend $1,000 in Alphabet in the present day?

Before you purchase provide in Alphabet, take into account this:

The Motley Fool Stock Advisor professional group merely acknowledged what they assume are the 10 best stocks for capitalists to amass at present … and Alphabet had not been amongst them. The 10 provides that made it’d create beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … in case you spent $1,000 on the time of our referral, you will surely have $731,449! *

Stock Advisor provides capitalists with an easy-to-follow plan for fulfillment, consisting of help on setting up a profile, regular updates from specialists, and a pair of brand-new provide decisions month-to-month. The Stock Advisor resolution has larger than quadrupled the return of S&P 500 provided that 2002 *.

*Stock Advisor returns since August 26, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. Anders Bylund has placements in Alphabet and Vanguard S&P 500 ETF. The Motley Fool has placements in and suggests Alphabet and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The Recent Tech Sell-Off Made This Artificial Intelligence (AI) Stock an Even Better Buy was initially launched by The Motley Fool