Despite a tough starting in August, capitalist perception has truly stayed sturdy, with the S&P 500 rallying nearly 9% contemplating that its August fifth lowered.

This upwards vitality has truly been pushed by a set of favorable monetary data launches, consisting of better-than-expected preliminary unemployed insurance coverage claims and stable retail gross sales numbers.

Wall Street moreover responded positively to Federal Reserve Chair Jerome Powell’s talk about Friday, signaling that the Fed is ready to cut back charges of curiosity because the labor market softens and rising value of dwelling comes near the Fed’s 2% yearly goal.

With this favorable rise in play, the very important inquiry is: simply how are you going to discover the next heat provide on this setting? One environment friendly strategy is to focus on high-upside provides advisable by specialists from top-tier monetary funding monetary establishments likeMorgan Stanley These specialists deliver essential expertise and thorough experience to the desk.

In actuality, the specialists at Morgan Stanley have truly highlighted 2 provides they assume are positioned for substantial good points within the coming 12 months– with doable profit as excessive as 220% in a single occasion. If that’s not tempting ample, based on the TipRanks database, each provides are moreover ranked as Strong Buys by the skilled settlement. Let’s see what’s driving the consentaneous appreciation from specialists.

COMPASS Pathways ( CMPS)

The initially Morgan Stanley alternative we’ll take a look at is COMPASS Pathways, a biopharma firm creating ingenious therapies for hard-to-treat psychological wellness situations by leveraging the psychedelic affect of psilocybin. As the energetic substance in ‘magic mushrooms,’ psilocybin has truly amassed curiosity in psychological circles for its doable to effectively cope with a wide range of psychological wellness issues.

COMPASS has truly created a man-made psilocybin answer, known as COMP360, made to be made use of together with psychological help and remedy. The remedy process entails a preliminary assortment of periods the place the person and specialist develop connection, adhered to by regulated treatment administration periods the place the person obtains psilocybin. During these periods, the person is fastidiously checked, and post-session conversations with the specialist support refine the expertise.

Currently, COMPASS’s most subtle take a look at program concentrates on making use of psilocybin to cope with shoppers with treatment-resistant nervousness (TRD), a critical psychological wellness downside that dramatically reduces way of life. The enterprise is analyzing the COMP360 remedy in 2 Phase 3 medical checks (COMP005 and COMP006); COMP005 is analyzing the outcomes of a single-dose monotherapy in 255 people, with top-line data anticipated by This fall 2024 or very early 2025. Meanwhile, COMP006 is concentrating on set repeat dosage monotherapy in a much bigger pal of 568 people, with top-line outcomes anticipated by mid-2025.

In enhancement to this late-stage analysis on TRD, the enterprise’s COMP360 remedy has truly moreover been the subject of an open-label Phase 2 analysis within the remedy of PTSD. The analysis included 22 shoppers, focused on security and safety and tolerability, and favorable outcomes had been revealed all through the 2nd quarter of this 12 months. Building on these outcomes, the enterprise is presently analyzing the best methodology to progressing its PTSD remedy.

Morgan Stanley skilled Vikram Purohit, that covers the availability, sees CMPS as providing an enticing risk-reward likelihood. He highlights the enterprise’s main medical program, mentioning, “Progress continues with the PhIII program for COMP360 in TRD, where the next fundamental milestone is top-line data from the PhIII COMP005 trial in 4Q24… The PhII data for COMP360 in TRD is competitive, KOL feedback on the data and uptake potential for COMP360 is positive, and the commercial opportunity in TRD is well-defined.”

“Based on the data generated & stage of development for COMP360, CMPS appears significantly undervalued and we find the risk/reward skewed positive into data catalysts in 2024/2025 that we believe could drive significant appreciation in shares,” the skilled included.

To this finish, Purohit costs CMPS shares an Overweight (i.e. Buy), and his $23 value goal elements in the direction of a sturdy 1 12 months profit risk of ~ 220%. (To watch Purohit’s report, click here)

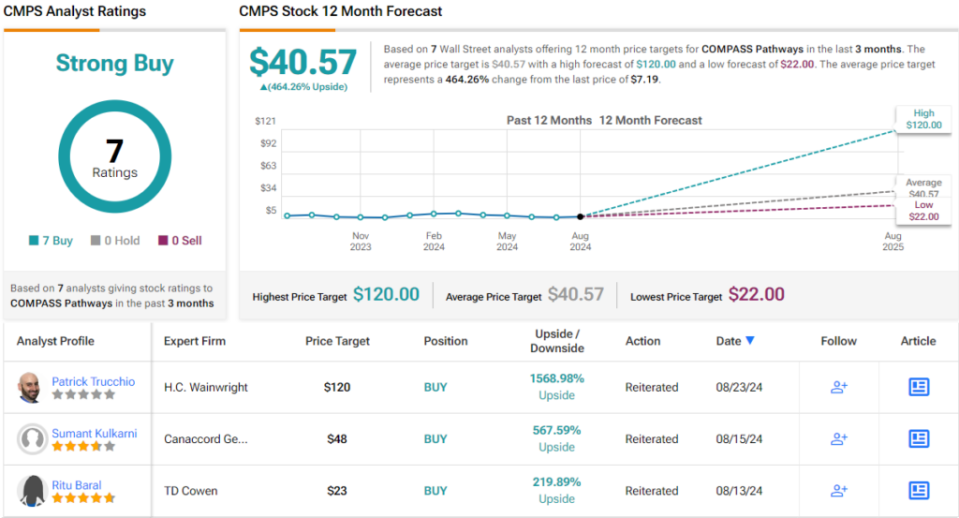

The extra complete skilled space shares Purohit’s constructive outlook. Based solely on Buy options– 7 in full– specialists collectively worth CMPS as aStrong Buy With the availability presently buying and selling at $7.19, the extraordinary value goal of $40.57 suggests a wonderful profit risk of 464% over the next 12 months. (See CMPS stock forecast)

Rocket Pharmaceuticals ( RCKT)

Next up on Morgan Stanley’s itemizing is Rocket Pharmaceuticals, a biotech enterprise on the middle of genetics remedy. Rocket makes use of adeno-associated (AAV) and lentiviral (LVV) vectors to chief therapies for classy, uncommon hematologic and cardio issues, areas with substantial unmet scientific calls for and restricted remedy decisions.

Rocket’s most subtle applications consider hematology. The enterprise is progressing LV RP-L102, a drugs prospect made to cope with Fanconi anemia, and Kresladi, a potential remedy for LAD-1.

On the Fanconi observe, Rocket only recently launched favorable data from its Phase 1/2 analysis and validated that regulative filings proceed to be on time.

Conversely, the enterprise encountered an impediment in June when the FDA launched a Complete Response Letter for the Biologics License Application for Kresladi, asking for added CMC particulars to complete its testimonial. Rocket’s monitoring has truly assured that the testimonial process is steady which they’re proactively teaming up with aged leaders and prospects on the FDA’s Center for Biologics Evaluation and Research to settle the priority.

On the cardio entrance, Rocket’s analysis examine applications are continuing effectively. Among probably the most well-liked prospects are PR-A501 and RP-A601. PR-A501, a potential remedy for Danon sickness, is presently in a Phase 2 crucial analysis, whereas RP-A601, focusing on PKP2 arrhythmogenic cardiomyopathy, is signing up shoppers for a Phase 1 analysis.

Rocket’s large and completely different pipe has truly captured the curiosity of Morgan Stanley skilled Michael Ulz, that’s particularly excited by the cardio enhancements.

“Our Overweight rating is based on Rocket’s position as a leader in the gene therapy field combined with a robust pipeline and experienced management team. We view RP-A501 (AAV) in Danon disease as a key driver with blockbuster potential and see broader potential from the cardiovascular pipeline (PKP2 and BAG3). While we expect focus on the cardiovascular pipeline, we believe the more advanced hematology (LV) franchise provides near term opportunity,” Ulz stated.

Ulz enhances his Overweight (i.e. Buy) rating on RCKT with a $45 value goal, suggesting a 142% achieve for the availability within the coming twelve month. (To watch Ulz’s report, click here)

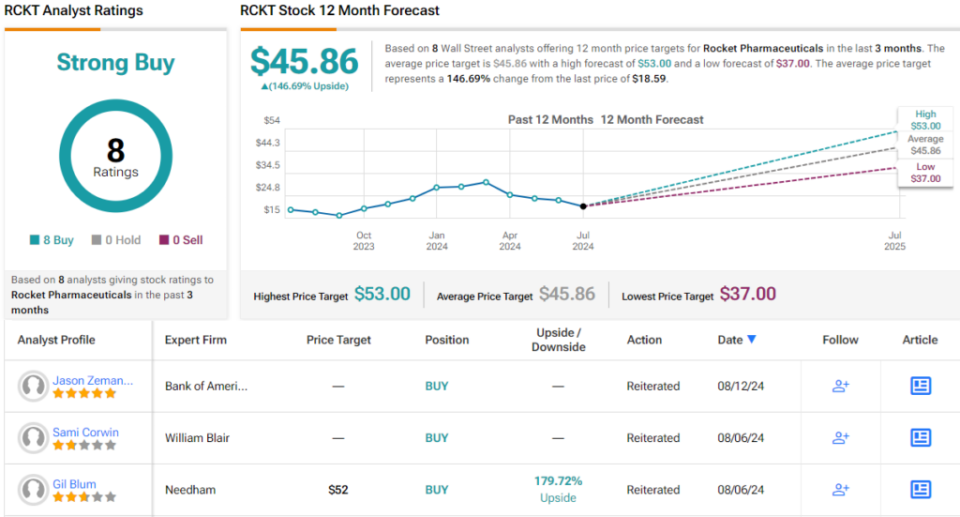

No one is suggesting with that stated deal withWall Street The provide’s Strong Buy settlement rating relies upon Buy options simply– 8, in whole quantity. The projection requires 1 12 months good points of ~ 147%, interested by the extraordinary value goal stands at $45.86. (See RCKT stock forecast)

To find wonderful ideas for provides buying and selling at interesting value determinations, go to TipRanks’ Best Stocks to Buy, a tool that joins each one in all TipRanks’ fairness understandings.

Disclaimer: The level of views shared on this put up are solely these of the included specialists. The materials is deliberate to be made use of for informative targets simply. It is extraordinarily essential to do your very personal analysis prior to creating any kind of monetary funding.