One of the easiest means to make sturdy monetary funding selections is to pay attention toWarren Buffett’s portfolio Many of his largest holdings have really outshined {the marketplace} for a few years and even years every time.

One of his long-lasting placements, Visa ( NYSE: V), captured my eye after a present adjustment. Buffett has really saved this provide as a result of 2011. There are 2 superb causes you will need to take into consideration Visa to your profile now.

This is the kind of provide that each capitalist intends to have

In amongst his much more fashionable quotes, Buffett tried to explain a lesson he’s came upon again and again: Trust terrific providers, not administration teams. “When a management with a reputation for brilliance tackles a business with a reputation for bad economics,” Buffett when recommended, “it is the reputation of the business that remains intact.”

The lesson proper right here is simple: Buy top of the range providers that additionally a half-competent administration group would possibly run. In this respect, Visa is the best occasion. A few months earlier, I speculated that Visa would possibly find yourself being the next trillion-dollar provide. It had not been the sensible administration group that I loved, nonetheless enterprise fundamentals that additionally an insufficient administration group would definitely uncover powerful to mess up. Visa’s main profit, I recommended, was the long-lasting tailwind of community impacts.

What are community impacts? This service tutorial 12 months mainly explains a service or product that obtains higher the far more that people put it to use. Social media is an archetype. Even the easiest social networks system won’t receive anyplace with out putting an emergency of people. In by doing this, a social media websites community’s greatest profit is its buyer base, not its fashionable know-how. People want to enroll with networks that belong of, which means that the larger methods normally generally tend to increase additionally bigger in time.

Payment networks like Visa run in comparable means. No one intends to make the most of a credit standing or debit card that distributors won’t approve. And distributors don’t want to approve sorts of settlement that clients don’t make the most of. The all-natural consequence is sector mortgage consolidation. According to info put collectively by Statista, Visa has a considerable 61% market share for general-purpose settlement playing cards within the united state Mastercard is out there in 2nd with a market share of 25%, whereas merely 2 enterprise end off the rest of the sector. This isn’t a brand-new dynamic, both. Mastercard and Visa have really delighted in industry-duopoly placements for better than a years, with Visa regulating a hefty lead the entire time.

Great provides seldom receive this cheap

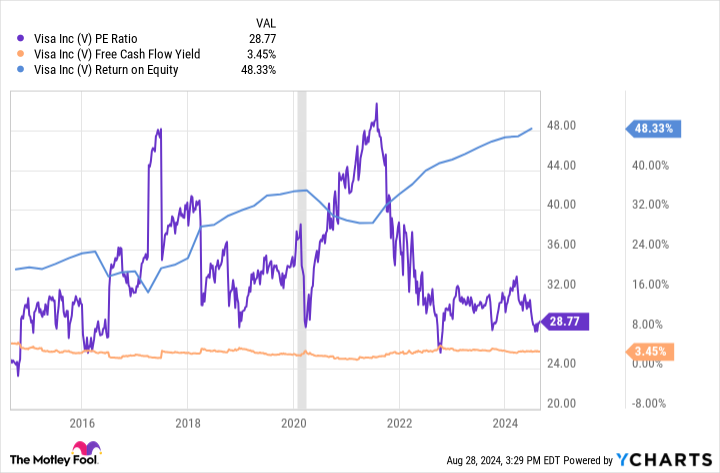

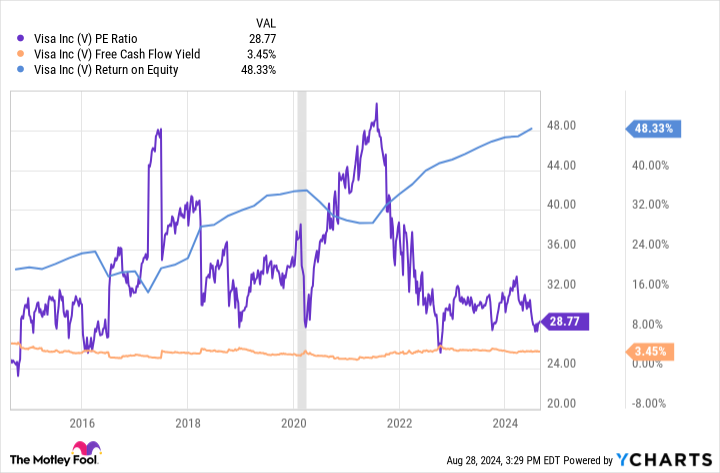

Massive- sector mortgage consolidation included with an asset-light service design has really prompted huge and constant earnings forVisa Its returns on fairness are extraordinarily glorious enthusiastic about the agency makes use of a traditional amount of benefit from. Free- cash-flow technology has really just about continuously declared. And after a tiny adjustment, shares at the moment commerce at just about their most inexpensive levels in years on a price-to-earnings foundation.

Right at the moment, the S&P 500 suddenly professions at a price-to-earnings proportion of 29.2. That suggests Visa provide professions at a value lower to {the marketplace} typical no matter operating an exceptionally respected and rewarding service design that takes benefit of community impacts that should stand up to for years forward. According to present filings, it doesn’t seem like if Warren Buffett has really been providing any considered one of his Visa placement. It’s powerful to examine him doing so at these prices.

Is Visa provide an purchase now? The response appears a strong “yes.” At these levels, the agency is a superb swimsuit for value and growth financiers alike.

Should you spend $1,000 in Visa now?

Before you purchase provide in Visa, think about this:

The Motley Fool Stock Advisor skilled group merely acknowledged what they assume are the 10 best stocks for financiers to accumulate at the moment … and Visa had not been amongst them. The 10 provides that made it’d create beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … if you happen to spent $1,000 on the time of our referral, you would definitely have $731,449! *

Stock Advisor provides financiers with an easy-to-follow plan for fulfillment, consisting of recommendation on growing a profile, regular updates from specialists, and a pair of brand-new provide selections each month. The Stock Advisor answer has better than quadrupled the return of S&P 500 as a result of 2002 *.

*Stock Advisor returns since August 26, 2024

Ryan Vanzo has no placement in any one of many provides acknowledged. The Motley Fool has placements in and suggests Mastercard andVisa The Motley Fool suggests the complying with alternate options: prolonged January 2025 $370 get in contact with Mastercard and temporary January 2025 $380 get in contact withMastercard The Motley Fool has a disclosure policy.

Is Visa Stock a Buy? was initially launched by The Motley Fool