Markets that improve have really continuously been complied with by markets that lower. It’s the traditional bull/bear cycle that capitalists must care for.

Right at the moment, {the marketplace} is up close to historic highs, which is why I’m delighted to own some boring want provides. One of my faves is power Black Hills ( NYSE: BKH) Here’s why I possess this high-yield provide and why you would want to purchase it, as effectively.

What does Black Hills do?

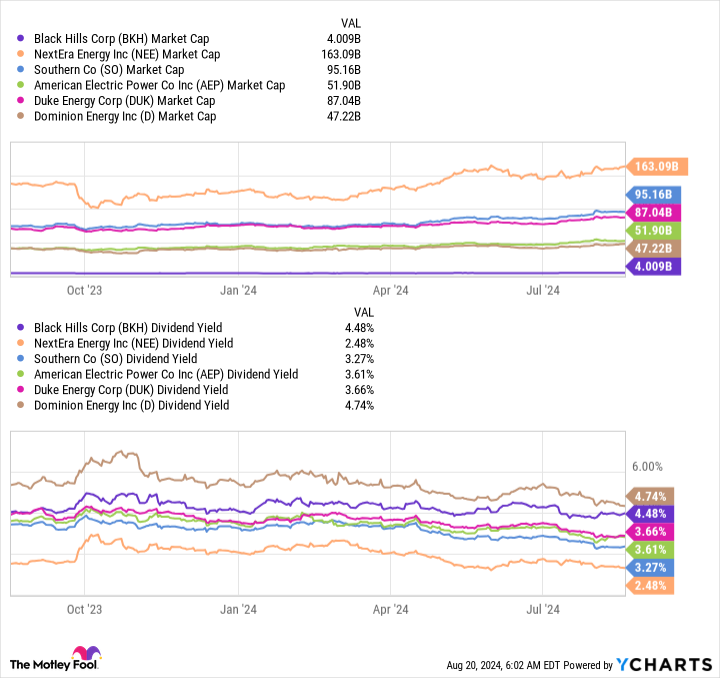

With a market cap of merely $4 billion roughly, Black Hills is just not an particularly large power. In reality, it’s towered over by market titan NextEra Energy ( NYSE: NEE), which has a market cap of $160 billion. Compared to that, Black Hills is just a rounding mistake! Yet it nonetheless affords a requirement of latest life.

The enterprise has round 1.3 million natural gas and electric shoppers all through elements of Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, andWyoming Without the facility Black Hills merchandise, these shoppers would definitely be operating within the Dark Ages.

The service is managed, so it must acquire its costs and capital expense methods accepted by the federal authorities. However, being managed moreover suggests it has a syndicate within the areas it affords. Those 1.3 million shoppers haven’t any place else to remodel for his or her energy requires.

Black Hills is a little bit little bit of a turtle, offered the service, nevertheless with {the marketplace} close to all-time highs, I’m delighted to have a few reliable turtles in my profile. Because of its tiny dimension, nonetheless, numerous capitalists have really by no means ever examineBlack Hills This is regrettable because it has really simply outmatched the market titans on one very important statistics: returns.

Black Hills is a Dividend King

NextEra Energy, which most capitalists have really come throughout, has really enhanced its reward yearly for 3 a long time. That’s a extremely wonderful contact, nevertheless it fades in distinction to the 54 successive years of yearly reward rises that Black Hills has really gathered. It is among the many lengthiest reward touches within the power discipline, making it a really unique Dividend King.

Think relating to the final 5 years: The guidelines of onerous occasions consists of the pandemic, the Great Recession, the dot.com bust/recession, Black Monday, and newest factor rising price of dwelling and oil dilemma of the Nineteen Seventies.

And that’s merely the emphasize reel. There had been smaller sized ups and downs on Wall Street and within the financial scenario, as effectively. Through all of it, Black Hills remained to compensate capitalists with yearly reward rises. That is the sort of uniformity I want to have in my income profile when {the marketplace} is floating at hovering levels.

But there’s much more to the story than merely the reward. For occasion, Black Hills’ consumer base is increasing nearly 3 occasions quicker than the broader united state populace. That must maintain sturdy growth because the power spends to supply that growing consumer base.

To positioned some numbers on that exact, the five-year capital expense technique is $4.3 billion, which administration anticipates to transform proper into income growth in between 4% and 6% a yr.

The reward will possible observe along with income growth, implying about 5% reward growth is the goal. That’s a powerful quantity for an power and easily happens to be the annualized worth of reward growth Black Hills has really attained over the earlier years. So typically, it anticipates to take care of doing what it has really offered for years: offering shoppers with reliable energy, and capitalists with reliable reward growth.

Black Hills is a boring and reliable reward provide

I’m not mosting more likely to boast to any particular person relating to proudly owning Black Hills; it isn’t that sort of provide. It is a elementary monetary funding that I can conveniently possess with nice occasions and poor understanding that its essential resolution will definitely continuously stay in want. Along the means, I can accumulate a hovering 4.5% reward return, among the many highest attainable within the power discipline, backed by an increasing reward (for referral, NextEra’s return is just about 2.6%).

If Wall Street strikes the ceiling and a bearishness comes, I’m not mosting more likely to shed any sort of relaxation proudly owningBlack Hills If you’re a conventional reward financier, that may presumably appear interesting to you, as effectively.

Should you spend $1,000 in Black Hills now?

Before you purchase provide in Black Hills, take into account this:

The Motley Fool Stock Advisor skilled group merely acknowledged what they assume are the 10 best stocks for capitalists to amass at the moment … and Black Hills had not been amongst them. The 10 provides that made it’d generate beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … for those who spent $1,000 on the time of our referral, you would definitely have $792,725! *

Stock Advisor affords capitalists with an easy-to-follow plan for fulfillment, consisting of recommendation on setting up a profile, routine updates from consultants, and a couple of brand-new provide selections month-to-month. The Stock Advisor resolution has larger than quadrupled the return of S&P 500 as a result of 2002 *.

*Stock Advisor returns since August 22, 2024

Reuben Gregg Brewer has settings in Black Hills, Dominion Energy, andSouthern Company The Motley Fool has settings in and advises NextEraEnergy The Motley Fool advises Dominion Energy andDuke Energy The Motley Fool has a disclosure policy.

Is the Stock Market Going to Crash? I Don’t Know. That’s Why I Own This High-Yield Stock. was initially launched by The Motley Fool