Following a superb start to the 12 months, Super Micro Computer‘s ( NASDAQ: SMCI) provide graph has really undertaken a plain turnaround over the earlier 6 months. It has really shed close to 60% of its price from its peak, and present growths seem to have further dinged up capitalist self-confidence within the enterprise.

First, the monetary 2024 fourth-quarter outcomes it launched onAug 6 weren’t up to Wall Street’s expectations, and monitoring’s assist was irritating. Second, short-seller Hindenburg Research launched a document affirming accountancy abnormalities atSupermicro Then, Supermicro monitoring revealed that it was suspending the declaring of its yearly document, which simply included within the unfavorable press.

Those facets make clear why Wall Street specialists have really been devaluing the availability not too long ago. But thought-about that shares of this net server and cupboard space techniques provider are presently buying and selling at an interesting 22 instances monitoring income and 13 instances onward income, opportunistic capitalists is perhaps attracted to amassSupermicro Should they be doing that due to the present growths?

Addressing the elephant within the area

Investors should remember the fact that Hindenburg is a short-seller, and it has an financial ardour in seeing Supermicro’s provide charge loss. In that context, we can’t make sure that the accusations that Hindenburg is making stand, notably occupied with that the short-seller has really been incorrect up to now. That said, Supermicro was billed by the Securities and Exchange Commission (SEC) for accounting infractions in August 2020, when it was found to have really too quickly acknowledged earnings and underrated its prices over a three-year period.

However, the enterprise has really recouped extremely ever since, clocking distinctive good points over the earlier variety of years many because of the looks of a brand-new stimulant in the kind of skilled system (AI). Its earnings in its monetary 2024 higher than elevated to $14.9 billion from $7.1 billion within the earlier 12 months. Non- GAAP income soared to $22.09 per share, from $11.81 per share in monetary 2023.

Addressing the hold-up in Supermicro’s yearly declaring, monitoring cleared up that “we don’t anticipate any material changes in our fourth quarter or fiscal year 2024 financial results.” It included that the enterprise is anticipating a “historic” 2025 with “a record number of orders, a strong and growing backlog of design wins and leading market positions across a number of areas.”

Supermicro claims that the present growths is not going to affect its manufacturing capacities, and it will get on observe to fulfill the necessity for its AI net server cures. It’s price preserving in thoughts that Supermicro is anticipating its monetary 2025 earnings to land in between $26 billion and $30 billion. That would definitely be yet one more 12 months of remarkable improvement from its $14.9 billion in monetary 2024.

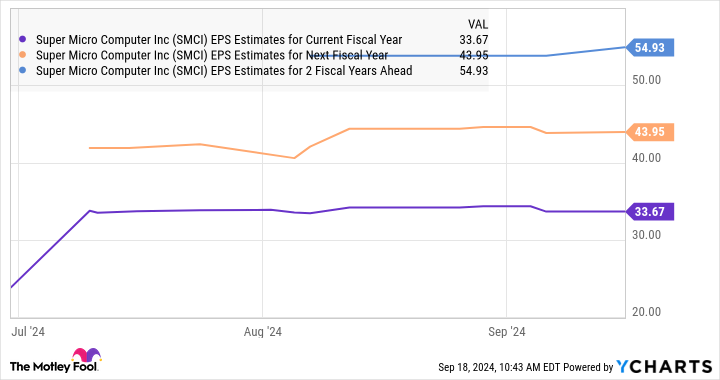

Though it’s coping with margin obstacles because of the raised monetary investments it’s making because it enhances functionality to fulfill the stable want for its liquid-cooled net server cures, monitoring is optimistic that it’ll actually return to its common margin selection previous to the finishes. Analysts’ settlement value quotes moreover present that Supermicro’s income get on observe to reinforce at a tremendous velocity within the current , complied with by wholesome and balanced enter the next variety of years too.

What ought to capitalists do?

The hold-up in Supermicro’s yearly declaring led JPMorgan to downgrade the availability from overweight to impartial and to cut back its charge goal to $500 from $950. Even Barclays lowered the availability to equal weight from overweight, stating the margin stress that Supermicro offers with together with the declaring hold-up. However, JPMorgan’s downgrade had not been an consequence of the Hindenburg document neither a illustration of its capability to finish up being licensed, but because of the near-term unpredictability that borders the enterprise and the absence of a fascinating disagreement to amass the availability.

So, risk-averse capitalists would definitely succeed to attend on much more high quality prior to buying this AI provide. However, these with higher menace cravings which are in search of to incorporate a fast-growing enterprise to their profiles can take into consideration buying Supermicro presently. It seems environment friendly in sustaining its excellent improvement over time many because of the huge prospects supplied to it within the AI net server market.

Analysts anticipate Supermicro’s income to broaden at an annualized value of 62% over the next 5 years. If the enterprise can surpass its current issues, it would find yourself being a robust monetary funding occupied with the appraisal at which it’s buying and selling now.

Should you spend $1,000 in Super Micro Computer now?

Before you purchase provide in Super Micro Computer, contemplate this:

The Motley Fool Stock Advisor skilled group merely acknowledged what they assume are the 10 best stocks for capitalists to amass presently … and Super Micro Computer had not been amongst them. The 10 provides that made it would generate beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … in case you spent $1,000 on the time of our referral, you would definitely have $710,860! *

Stock Advisor provides capitalists with an easy-to-follow plan for achievement, consisting of assist on growing a profile, routine updates from specialists, and a couple of brand-new provide decisions month-to-month. The Stock Advisor resolution has higher than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since September 16, 2024

JPMorgan Chase is a advertising companion of The Ascent, a Motley Fool enterprise. Harsh Chauhan has no placement in any one of many provides mentioned. The Motley Fool has placements in and suggests JPMorganChase The Motley Fool suggestsBarclays Plc The Motley Fool has a disclosure policy.

Is Super Micro Computer Stock a Buy Now? was initially launched by The Motley Fool