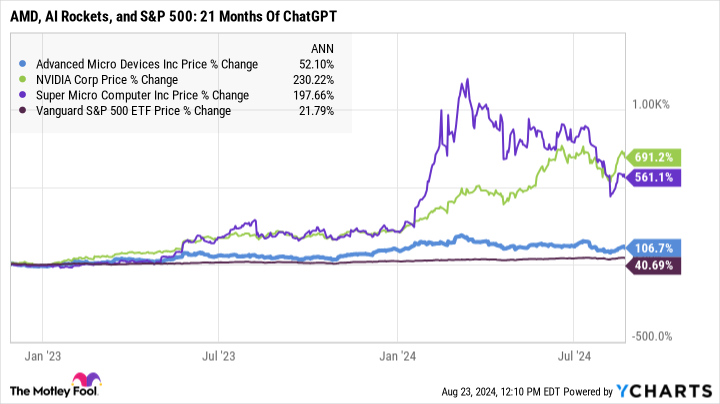

Advanced Micro Devices ( NASDAQ: AMD) has really been a big champion in skilled system (AI) growth. The chip developer’s provide has really acquired 107% contemplating that OpenAI launchedthe game-changing ChatGPT platform While that value climb cannot distinction to AI market beloveds Nvidia ( NASDAQ: NVDA) and Super Micro Computers ( NASDAQ: SMCI), it’s a market-stomping effectivity.

Less than 30 provides amongst the 503 contributors of the S&P 500 ( SNPINDEX: ^ GSPC) index have really accomplished significantly better on this period, and the index itself “only” received 41%. The index acquire workouts to a compound yearly growth worth (CAGR) of 21.8%. If I would match that skyrocketing price over an entire years, I’d rework a $1,000 monetary funding proper right into a $7,200 return. And AMD is smoking that wealth-building S&P 500 return now.

But that’s at present previous data. Past outcomes are not any assurance of future success. The melting inquiry current and potential AMD capitalists must ask right this moment is whether or not the provision has house to run any form of higher from this hovering perch.

How AMD’s Instinct AI accelerator chip compares to Nvidia

AMD isn’t any uninitiate within the high-performance laptop market. The AMD Instinct MI250X accelerator chip Is situated in 10 techniques on the freshest guidelines of the globe’s 500 greatest and simplest supercomputers.

Nvidia controls that system guidelines, led by on the very least 48 techniques using the V100 accelerator and higher than 80 relying upon some variation of the A100 chip. But once you try the effectivity numbers, the main AMD chip with a 2% share of system counts provides an astonishing 21.4% of the entire guidelines’s number-crunching effectivity.

The Instinct MI250X actually didn’t do it through unequalled effectivity per chip. This success was improved substantial setup numbers. The AMD Instinct techniques have 12.7 million cpu cores on the office in these 10 substantial supercomputers, led by 8.7 million Instinct cores in the perfect entertainer of all of them– the Frontier system at theOak Ridge National Laboratory The greatest Nvidia- based mostly techniques give up about 2 million cpu cores.

I apologize if that obtained a bit bit unpopular with cpu data and big numbers. In quick, an excessive amount of more cost effective chips can do the very same work as a few expensive, state-of-the-art cpus. I’m trying to make a fundamental issue, although:

AMD’s AI accelerators are extraordinarily reasonably priced, particularly for those who encompass system charges. Throwing nice offers of lower-priced gear at AI points can offset any form of aspect Nvidia’s chips could have with reference to easy effectivity.

In varied different phrases, AMD would possibly ought to have a bigger piece of the AI market than it obtains credit score rating for right this moment. CFO Jean Hu and CHIEF EXECUTIVE OFFICER Lisa Su like to focus on the entire expense of possession (TCO) when contrasting AMD’s gadgets to Nvidia’s, and the agency is at present successful system bargains from that angle. This concept consists of chip charges, energy consumption, help for much more reminiscence per chip, and varied different full system parts that may exceed Nvidia’s lead in pure effectivity per chip.

Is AMD’s value prices warranted?

So AMD must get in your guidelines of AI gear service suppliers to take pleasure in. Should it’s your following purchase within the AI room?

As it finally ends up, AMD’s provide could at present have {the marketplace} regard it’s entitled to. As saved in thoughts earlier, AMD’s provide graph makes the broader market look stagnant and delayed. Moreover, these shares are much more extremely valued than Nvidia’s in a lot of means:

|

Valuation Metric |

AMD |

Nvidia |

|---|---|---|

|

Price to revenues (P/E) |

183 |

72 |

|

Price to completely free capital (P/FCF) |

183 |

80 |

|

Enterprise value to revenues previous to ardour and tax obligations (EV/EBIT) |

275 |

63 |

Data from Finviz and Morningstar, current since 8/23/2024.

AMD’s shares are much more economical with reference to value to gross sales or the fee to revenues to growth proportion, so it’s not a bang dunk in both directions. Still, it’s robust to name AMD’s provide “affordable” in any respect, kind, or kind.

Can AMD take a rewarding AI particular area of interest?

Longtime AMD capitalists must be made use of to annoyingly excessive analysis proportions. This provide has a prolonged background of skyrocketing to hovering analysis proportions.

Due to AMD’s propensity in the direction of diminished income margins, the arithmetic obtains a bit ridiculous sometimes. P/FCF and P/E proportions had been gauged within the hundreds in 2004, because the K2 line of laptop cpus put in a perky battle versus Intel‘s ( NASDAQ: INTC) Celeron and Pentium 4 schedules. AMD supply was likewise a lot more expensive than Nvidia’s from 2018 to 2021, when each enterprise had unanticipated manufacturing advantages over a having a tough time Intel.

So the real inquiry is, will AMD have the flexibility to take a rewarding particular area of interest for itself on this age of hefty AI ardour?

I’m assuming that it may well. Nothing seems troublesome beneath the administration of Lisa Su, that likewise seems to have a terrific handle on simply the right way to maximize this game-changing minute. AMD isn’t trying to be Nvidia 2.0, but choosing a varied course with significantly varied methods and layouts.

So the provision is dear, but after that it form of always is. And I assume there’s numerous house for a varied approach to AI laptop from a enterprise (or quite a few) not known asNvidia Check your risk tolerance previous to going any form of higher, but AMD may be an intriguing buy for growth capitalists that worth Lisa Su’s administration.

Should you spend $1,000 in Advanced Micro Devices now?

Before you purchase provide in Advanced Micro Devices, contemplate this:

The Motley Fool Stock Advisor skilled group merely decided what they suppose are the 10 best stocks for capitalists to amass at present … and Advanced Micro Devices had not been amongst them. The 10 provides that made it would generate beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … for those who spent $1,000 on the time of our referral, you will surely have $792,725! *

Stock Advisor provides capitalists with an easy-to-follow plan for fulfillment, consisting of help on establishing a profile, routine updates from specialists, and a pair of brand-new provide decisions each month. The Stock Advisor resolution has higher than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since August 22, 2024

Anders Bylund has settings in Intel andNvidia The Motley Fool has settings in and suggests Advanced Micro Devices andNvidia The Motley Fool suggests Intel and suggests the adhering to decisions: temporary August 2024 $35 get in contact withIntel The Motley Fool has a disclosure policy.

Is It Too Late to Buy AMD Stock? was initially launched by The Motley Fool