Most financiers fascinated about Energy Transfer ( NYSE: ET) are introduced in to its excessive yield, which presently kicks again 7.9%. The enterprise presently pays a $0.32 quarterly circulation and is wanting to spice up that by in between 3% to five% a 12 months shifting on.

That is eye-catching per se, nevertheless I moreover consider the pipe driver’s provide can nearly fold the next 5 years.

This would definitely happen with a mixture of growth jobs, along with small quite a few growth, which is when financiers designate a better analysis statistics to a provide.

Let’s take a look at why I consider Energy Transfer’s provide can better than twin within the following 5 years.

Growth prospects

Energy Transfer is simply one of many largest midstream enterprise within the united state, with an in depth integrated system that goes throughout the nation. It’s related to nearly all components of the midstream area, carrying, saving, and dealing with completely different hydrocarbons all through its techniques. The dimension and breadth of its techniques supply it a lot of growth process prospects.

This 12 months, the enterprise intends to put money into between $3 billion to $3.2 billion in growth capital expenditures (capex) on brand-new jobs. Moving onward, prices in between $2.5 billion to $3.5 billion in growth capex a 12 months would definitely allow it to pay its circulation whereas having money left over from its capital to pay for monetary debt and/or redeem provide.

Given this, and the very early prospects that Energy Transfer is seeing in energy era due to boosted energy necessities from info amenities originating from the surge in skilled system (AI), it’s probably risk-free to say that the enterprise can make investments regarding $3 billion in growth capex a 12 months over the next 5 years.

Most enterprise within the midstream space are searching for a minimal of 8x develop multiples on brand-new jobs. This signifies that the roles would definitely spend for themselves in regarding 8 years. For occasion, a $100 million process with an 8x a number of would definitely produce an unusual return of $12.5 million in EBITDA (incomes previous to price of curiosity, tax obligations, devaluation, and amortization) a 12 months.

Based on that specific form of return on growth jobs, Energy Transfer have to should do with in a position to see its modified EBITDA surge from $15.5 billion in 2024 to round $17.4 billion in 2029 if it stays to take a position $3 billion a 12 months on growth jobs.

Multiple growth prospects

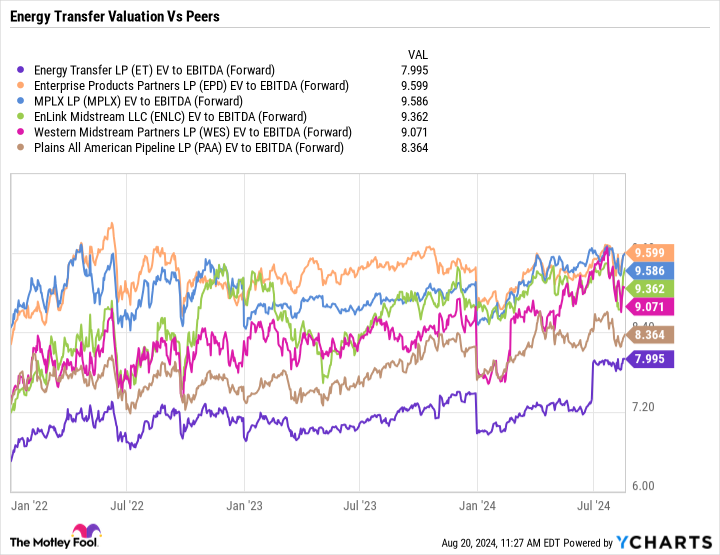

From an evaluation perspective, Energy Transfer is the least costly provide amongst its grasp minimal collaboration (MLP) midstream friends, buying and selling at 8x on an onward enterprise value-to-adjusted EBITDA foundation. This statistics takes into consideration a enterprise’s web monetary debt whereas securing non-cash merchandise and is among the most utilized means to price midstream enterprise. At the very same time, it trades at a a lot diminished analysis than it has historically.

MLP midstream provides balanced a 13.7 x EV/EBITDA quite a few in between 2011 and 2016, so the market in its entirety has really seen its quite a few boiled down. However, with want for gasoline rising due to AI and electrical automotive want subsiding, the shift to renewables resembles it’d take rather a lot longer than anticipated. If this holds true, these provides have to have the flexibility to control a better quite a few than they presently do, as this lowers the anxiousness that hydrocarbon want will definitely start to materially lower within the years upfront.

How Energy Transfer provide nearly will increase

If Energy Transfer expands its EBITDA as anticipated, the provision can get to $30 in 2029 if it will possibly regulate a 10x EV/EBITDA quite a few. That is up from the 8x onward and eight.7 x routing quite a few it presently regulates, nevertheless it’s nonetheless effectively listed beneath the place the MLP midstream space has really offered the previous.

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

|

|---|---|---|---|---|---|---|

|

Adjusted EBITDA |

$ 15.5 billion |

$ 15.88 billion |

$ 16.25 billion |

$ 16.63 billion |

$ 17.0 billion |

$ 17.38 billion |

|

Price at 8x quite a few |

$ 17 |

$ 18 |

$ 19 |

$ 20 |

$ 21 |

|

|

Price at 9x quite a few |

$ 21.50 |

$ 22.50 |

$ 23.50 |

$ 24.50 |

$ 25.50 |

|

|

Price at 10x quite a few |

$ 26 |

$ 27 |

$ 28 |

$ 29 |

$ 30 |

* Enterprise price relies upon 3.42 billion shares distinctive, $57.6 billion within the pink, $3.9 billion in beneficial fairness, $3.9 billion in monetary investments in unconsolidated associates and cash, and $11.6 billion in minority price of curiosity.

However, Energy Transfer and quite a few numerous different midstream enterprise appear fairly probably positioned to be stealth AI victors due to boosting gasoline energy want. Power enterprise and knowledge amenities have really presently been coming near Energy Transfer regarding gasoline transmission jobs, and there could be a gasoline amount growth coming. Given this growth chance, together with the enterprise’s strengthened annual report and common circulation growth, I can see Energy Transfer’s quite a few improve decently over the next 5 years and the provision nearly rising.

However, additionally if its quite a few doesn’t improve, financiers can nonetheless receive a particularly sturdy return on their monetary funding with a mixture of circulations (presently $0.32 every 1 / 4) and way more small price gratitude. With no quite a few growth and over $7 in circulations in between presently and completion of 2029 (pondering a 4% rise a 12 months), the provision would definitely nonetheless produce an over 75% return all through that stretch.

Should you spend $1,000 in Energy Transfer now?

Before you buy provide in Energy Transfer, think about this:

The Motley Fool Stock Advisor skilled group merely decided what they assume are the 10 best stocks for financiers to buy presently … and Energy Transfer had not been amongst them. The 10 provides that made it will possibly create beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … if you happen to spent $1,000 on the time of our suggestion, you would definitely have $792,725! *

Stock Advisor provides financiers with an easy-to-follow plan for achievement, consisting of recommendation on establishing a profile, regular updates from specialists, and a pair of brand-new provide decisions month-to-month. The Stock Advisor resolution has better than quadrupled the return of S&P 500 on condition that 2002 *.

*Stock Advisor returns since August 22, 2024

Geoffrey Seiler has settings in Energy Transfer, Enterprise Products Partners, andWestern Midstream Partners The Motley Fool advisesEnterprise Products Partners The Motley Fool has a disclosure policy.

Prediction: Energy Transfer Stock Will Nearly Double in 5 Years was initially launched by The Motley Fool