-

Nasdaq 100 and S&P 500 decreases in September supply a buying risk, claims Ned Davis Research.

-

Weak seasonality info and excessive pessimism analyses suggest a strong fourth quarter rally is prematurely, NDR claimed.

-

NDR sees no indicators of a pointy bearish market, with favorable incomes modifications and monetary indicators.

A 6% lower within the Nasdaq 100 and 4% lower within the S&P 500 contemplating that the start of September stands for an attention-grabbing buying risk for capitalists, in accordance with Ned Davis Research.

The research firm claimed in a notice on Friday that the weak level in provides up till now this month is bigger than frequent, given weak seasonality data — nevertheless it’s likewise a big risk supplied {the marketplace} goes to its perfect three-month stretch of the 12 months.

“With the September weakness relieving the optimism and sending sentiment indicators to excessive pessimism readings, equities would be likely to launch a persistent ascent similar to the first quarter advance, supported by fourth quarter seasonal tendencies,” NDR planner Tim Hayes claimed.

He included: “Whereas a comparison of three-month declines shows that August – October has been the weakest, October – December has been the strongest.”

Hayes discovers it motivating that, primarily based upon inside NDR analyses, the inventory alternate, financial scenario, and enterprise incomes are revealing no indicators of being in danger to a pointy bearish market lower akin to what befell in 2022.

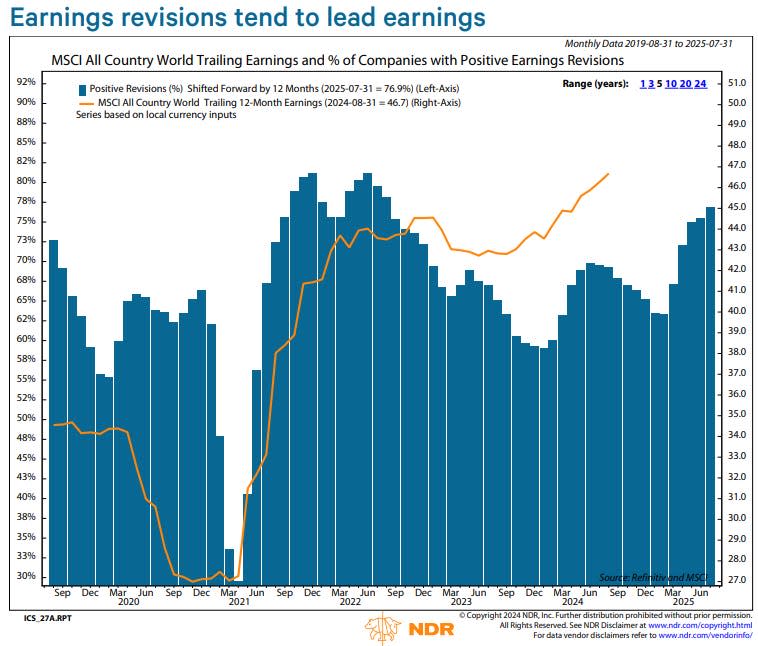

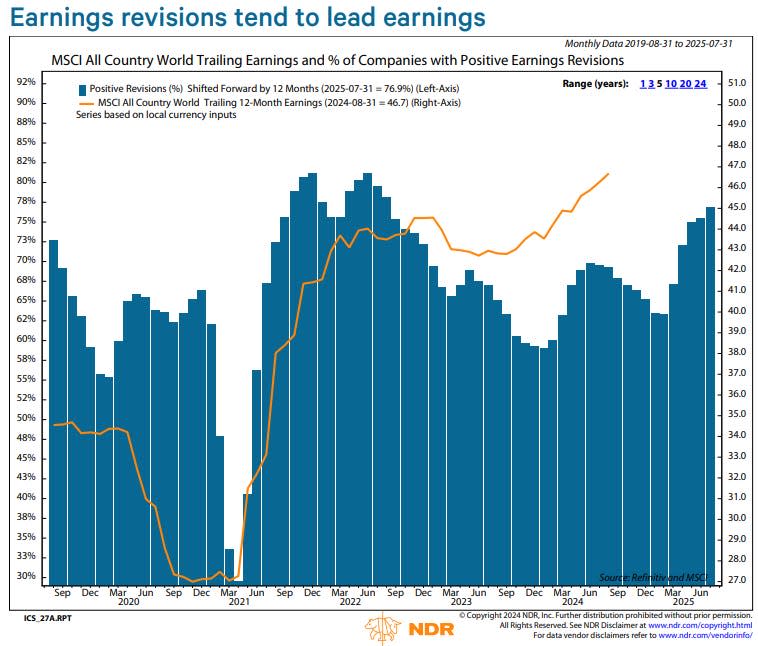

Analyst incomes modifications stay to pattern better, historically a number one signal for enterprise incomes.

“As with revisions, economic performance is a leading indicator of earnings growth, currently supporting the earnings outlook. While the recession probability has risen from its lows of May and June, it hasn’t risen out of its bullish mode for equities,” Hayes mentioned.

Altogether, that implies the current inventory alternate lower is extra possible to be an on a regular basis enchancment that ultimately verifies to be wholesome and balanced for the sustainability of the recurring bull rally that began in October 2022.

“The current choppiness will prove to be just that, not the sign of a new bear market. It should lead to a buying opportunity within the continuing bull market, ahead of renewed rallying in the fourth quarter,” Hayes claimed.

Read the preliminary brief article on Business Insider