Companies across the globe paid a doc $606.1 billion in returns to their traders all through the 2nd quarter– 8.2% larger than the prior-year length. Nearly 90% of dividend-paying corporations have really both held their settlements constant or elevated them over the earlier yr.

This data recommends that right this moment is a blast for returns. However, that’s not consistently the occasion. Downturns and financial downturns can considerably have an effect on the capability of some corporations to proceed making these settlements.

While some corporations could ultimately be not capable of protect their returns, Enterprise Products Partners ( NYSE: EPD), Enbridge ( NYSE: ENB), and American States Water ( NYSE: AWR) are variations of returns longevity. They’ve proceeded administering these settlements to financiers all through the years no matter what. Because of that, they appeal to consideration to a fewFool com components as incredible provides to buy for these searching for reliabledividend payments

Enterprise prepares to pay you (properly)

Reuben Gregg Brewer (Enterprise Products Partners): The simple truth is that almost all of financiers will most definitely find Enterprise Products Partners’ 7.2% circulation settle for be the piece de resistance of its provide. Given the S&P 500‘s parsimonious present return of simply 1.2%, that’s not gorgeous. But when it includes producing a simple income stream, there’s an incredible deal much more than that to equivalent to round Enterprise Products Partners.

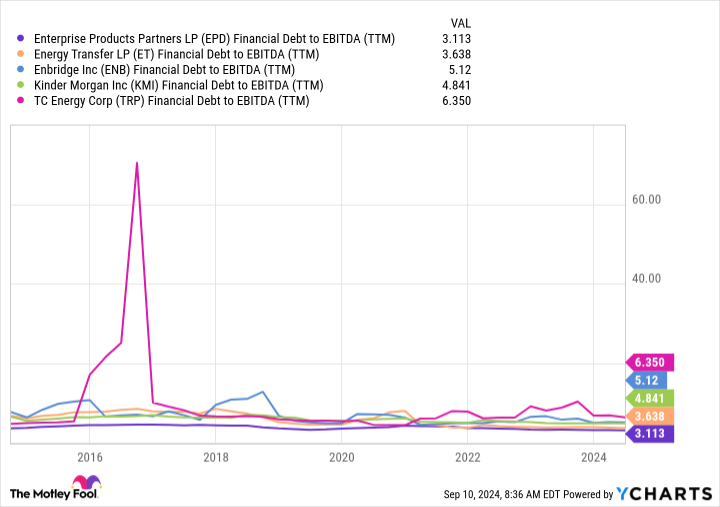

For rookies, there’s its placement as one of many greatest midstream energy organizations inNorth America It has a principally unduplicatable community of energy services properties– pipes, cupboard space facilities, refining facilities, and much more– that generates reliable cost income progressively. That is what sustains the returns, and its distributable capital covers its circulation by a safe 1.7 instances. On prime of that, Enterprise’s annual report is investment-grade ranked, so there’s little issue to emphasize over it requiring to cut back its circulation. Also vital is the truth that Enterprise is amongst one of the vital monetarily standard players in its colleagues, and has really been for a number of years. So what you see right this moment is actually what you’ll be acquiring for the long-term.

That all leads as much as the next enormous quantity on the circulation entrance, which is 26. That’s the number of successive years that the facility enterprise has really enhanced its circulation. If you’re searching for a reliable high-yield income provide, Enterprise Products Partners must get in your checklist.

Proven returns longevity

Matt DiLallo (Enbridge): Enbridge pays amongst one of the vital reliable returns within the energy market. The Canadian pipe and power enterprise has made returns settlements for larger than 69 years, and enhanced these settlements for 29 straight years. That contact must proceed regardless of {the marketplace} issues.

Driving that take a look at is the overall longevity and predictability of Enbridge’s revenues. The enterprise has really fulfilled its yearly financial assist for 18 straight years. That length consisted of two vital financial downturns and a pair of numerous different durations of oil market disturbance. Enbridge has an extremely regular revenues account, with 98% of its income originating from cost-of-service or acquired properties. It likewise obtains larger than 95% of its revenues from investment-grade ranked customers. Meanwhile, regarding 80% of its revenues originated from agreements with rising price of dwelling securities in place.

Enbridge’s goal is to pay 60% to 70% of its regular revenues in returns. That permits it to maintain a purposeful % of its capital to cash progress jobs. The enterprise likewise has a powerful investment-grade annual report. Its make the most of proportion was 4.7 on the finish of the 2nd quarter, and will get on velocity to glide in the direction of the lowered finish of its 4.5 to five.0 goal selection by following yr because the enterprise catches the entire benefit of its present fuel power purchases.

Those presents will definitely help it increase its revenues over various years. In enhancement, the enterprise has a complete stockpile of assets jobs. These help maintain monitoring’s sight that it will possibly increase its revenues at a yearly worth of round 5% over the device time period.

With a strong financial account and noticeable growth boiling down the pipe, Enbridge must have loads of fuel to proceed enhancing its returns, which generates larger than 6.5% these days Those attributes make Enbridge an excellent alternative for these searching for a returns they’ll depend on.

70 years of returns will increase and checking

Neha Chamaria (American States Water): When it includes returns, American States Water has really completed one thing nothing else overtly famous provide within the united state has– it has really enhanced its returns yearly for the earlier 70 successive years. That makes American States Water provide the Dividend King with the lengthiest energetic contact of returns rises. Yes, that is one provide that doesn’t merely pay you a returns, nonetheless likewise sends out ever-fatter checks your means yearly, no matter what.

It doesn’t take a lot to assume why American States Water has really been such a bankable returns provide. It’s a managed water power and creates regular and foreseeable capital from its options. It offers water options to larger than 1 million people all through 9 states, and likewise has {an electrical} power subsidiary. That aside, American States Water’s acquired options subsidiary offers water and wastewater options to 12 armed forces bases within the united state underneath 50-year agreements and one underneath a 15-year settlement.

What’s genuinely distinctive regarding American States Water’s returns is its velocity of growth. It has really expanded its returns at a compound yearly worth of 8.8% over the earlier 5 years, and eight% over the earlier 10. Its latest stroll, launched in August, was an 8.3% improve. That’s well-founded returns growth originating from an power. With American States Water likewise focusing on a minimal of seven% fee growth within the long-term, this 2.3%- producing dividend stock is the kind every income investor would want to own.

Should you spend $1,000 in Enterprise Products Partners right this moment?

Before you buy provide in Enterprise Products Partners, think about this:

The Motley Fool Stock Advisor knowledgeable group merely decided what they assume are the 10 best stocks for financiers to buy at present … and Enterprise Products Partners had not been amongst them. The 10 provides that made it’d create beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … if you happen to spent $1,000 on the time of our suggestion, you would definitely have $729,857! *

Stock Advisor offers financiers with an easy-to-follow plan for fulfillment, consisting of assist on creating a profile, regular updates from specialists, and a pair of brand-new provide selections each month. The Stock Advisor answer has larger than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since September 9, 2024

Matt DiLallo has settings in Enbridge andEnterprise Products Partners Neha Chamaria has no placement in any one of many provides mentioned. Reuben Gregg Brewer has settings inEnbridge The Motley Fool has settings in and suggestsEnbridge The Motley Fool suggestsEnterprise Products Partners The Motley Fool has a disclosure policy.

Rewarding Dividends: 3 Stocks That Pay Out No Matter What was initially launched by The Motley Fool