It’s been a further fantastic 12 months for the securities market. As of this writing, the benchmark index, the S&P 500, is up nearly 18%.

Yet, if you happen to perceive the place to look, there are additionally significantly better lasting buy-and-hold probabilities round. Let’s cowl 2 know-how provides which are every up larger than 50% 12 months to day.

Spotify Technologies

Spotify Technologies ( NYSE: PLACE) covers the itemizing of know-how provides you should buy and maintain for the next years. The agency, which runs the globe’s l argest audio streaming system, stays to excite.

Since the start of 2023, shares of Spotify are up 339%, making it among the many top-performing provides over that length. The secret to its securities market success? Spotify has truly built-in earnings improvement with cost-cutting. When achieved proper, that’s an efficient combine.

Spotify’s trailing-12-month earnings has truly raised to $15.7 billion, up from $13.6 billion one 12 months again. Similarly, 12-month net income has raised to $500 million versus an nearly $800 million loss a 12 months beforehand.

In regards to earnings, the agency depends upon its prices people to produce about 90% of its gross sales. Those people pay a membership cost for accessibility to ad-free songs, podcasts, and audiobooks. Meanwhile, the agency acquires regarding 10% of its general earnings from ad-based listening.

Regarding its expenditures, Spotify has truly began a set of cost-cutting steps over the past couple of years, consisting of minimizing personnel levels, reducing its promoting spending plan, and terminating some materials jobs.

In flip, the agency is taking pictures on all cyndrical tubes. Granted, Spotify runs in an inexpensive space, with Apple, Amazon, and Alphabet all utilizing their very personal sort of audio streaming

However, Spotify has larger than held its very personal. With over 600 million audiences and virtually 250 million purchasers, Spotify has truly developed itself inside the audio streaming market. Investors in search of a improvement provide with legs ought to consider Spotify.

Meta Platforms

Next is Meta Platforms ( NASDAQ: META), the motive force of Facebook and Instagram.

Granted, I’ve had my fear about Meta, particularly across the 10s of billions of greenbacks the agency picked to spend money on theMetaverse However, one fact is apparent: Meta creates money cash at a virtually superb diploma. This agency will pay for to take some expensive risks. And I’m sure that’s among the many components Meta CHIEF EXECUTIVE OFFICER Mark Zuckerberg actually felt cozy placing $46 billion proper into the agency’s Reality Labs sector — money that heretofore has not produced any sort of return.

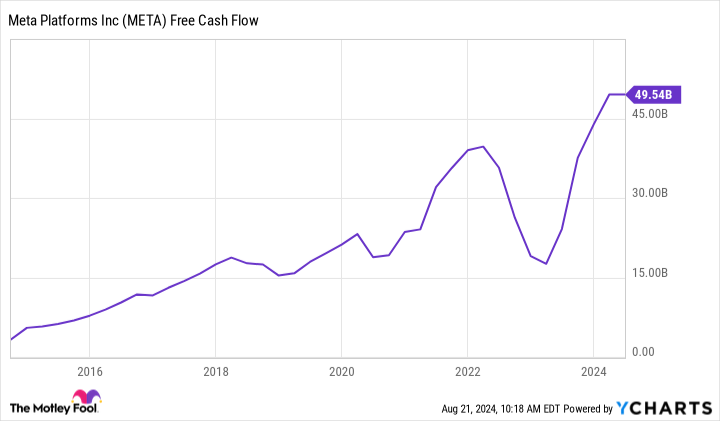

At any sort of value, permit’s take a better check out Meta’s capital. In the final one 12 months, the agency has truly produced $ 50 billion in cost-free capital.

META Free Cash Flow data by YCharts

It’s an astonishing quantity, and it locations Meta proper into rarified air. Its $50 billion in free cash flow, for example, approaches the general cost-free capital from energy titans ExxonMobil and Chevron— built-in

No query the agency began its first-ever routine reward reimbursement this 12 months. After all, discovering the money cash to spend for these returns is not any fear. The brand-new fee plan reveals that Facebook has plenty of extra money cash earnings helpful, looking for a shareholder-friendly money cash administration plan.

What’s much more, so long as Meta Platforms stays regimented in its investing, there’s heaps much more capital en route Analysts anticipate the agency to increase its gross sales by 20% this 12 months and a further 13% in 2025. Those rising earnings numbers must maintain rather more cost-free capital and most likely additionally larger reward funds at a while All of this must make financiers happy to own Meta Platforms for the next years.

Should you spend $1,000 in Meta Platforms at the moment?

Before you buy provide in Meta Platforms, contemplate this:

The Motley Fool Stock Advisor skilled group merely decided what they suppose are the 10 best stocks for financiers to buy presently … and Meta Platforms had not been amongst them. The 10 provides that made it may well generate beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … if you happen to spent $1,000 on the time of our referral, you would definitely have $792,725! *

Stock Advisor provides financiers with an easy-to-follow plan for achievement, consisting of recommendation on growing a profile, routine updates from consultants, and a pair of brand-new provide selections each month. The Stock Advisor answer has larger than quadrupled the return of S&P 500 as a result of 2002 *.

*Stock Advisor returns since August 22, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. Randi Zuckerberg, a earlier supervisor of market progress and spokesperson for Facebook and sis to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. John Mackey, earlier chief govt officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Jake Lerch has settings in Alphabet, Amazon, ExxonMobil, andSpotify Technology The Motley Fool has settings in and suggests Alphabet, Amazon, Apple, Chevron, Meta Platforms, andSpotify Technology The Motley Fool has a disclosure policy.

2 Tech Stocks You Can Buy and Hold for the Next Decade was initially launched by The Motley Fool