Energy Transfer ( NYSE: ET) is offering financiers an ultra-high 8% circulation return. Enterprise Products Partners ( NYSE: EPD) has a return of seven.2%. Although each come from the midstream energy subject, they aren’t appropriate monetary investments. Here’s why lower-yielding Enterprise deserves buying hand over clenched fist and most will presumably be a lot better off stopping Energy Transfer.

The situation with Energy Transfer

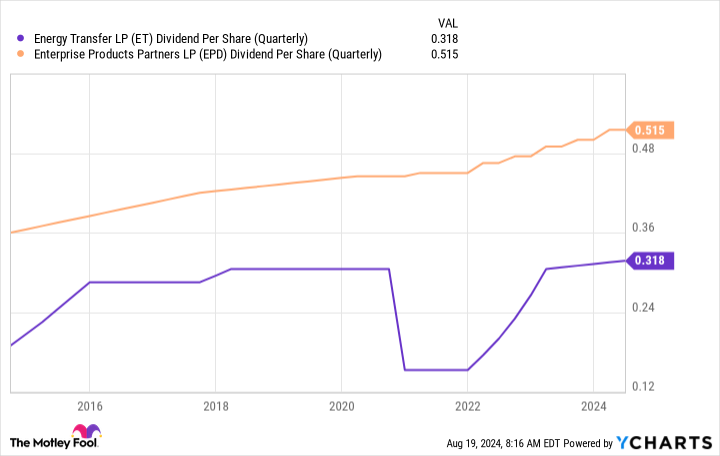

When energy charges dove early within the coronavirus pandemic, Energy Transfer decreased its circulation 50%. That 2020 circulation minimize was, presumably, warranted by the unpredictability the globe encountered on the time, but it undoubtedly was not the circulation end result the financiers had been anticipating. And whereas the master limited partnership‘s (MLP) circulation has really begun to climb as soon as once more and is de facto greater than it was previous to the minimize, financiers that respect earnings uniformity shouldn’t overlook the choice that administration made in 2020. It opens the extraordinarily real hazard that the next energy sector recession will definitely trigger the very same end result.

Still, a circulation minimize within the face of energy sector misfortune is affordable. What’s tougher to debate with Energy Transfer is the unsuccessful 2016 contract to amassWilliams Companies Energy Transfer launched the cut price, but an influence recession led to the MLP acquiring cool toes. Energy Transfer after that functioned to scuttle the cut price, declaring that consummating it could actually name for taking up as effectively a lot monetary debt, decreasing the reward, or each. The initiative to depart the contract consisted of offering exchangeable protections, which is the place the real situation might be present in.

The chief govt officer obtained an enormous part of the exchangeable protections on the time. The safety would definitely have effectively shielded the chief govt officer from the impact of a returns minimize if the cut price underwent as ready whereas leaving unitholders to essentially really feel the entire burden of a minimize. It was a complicated affair, but that’s a high-level, and upsetting, sight. That CHIEF EXECUTIVE OFFICER, Kelcy Warren, is at present “just” the chairman of the board, so there’s nonetheless wonderful issue to be bothered with what came about nearly a years again.

Overall, in case you are trying to find a reliable earnings stream, Energy Transfer is presumably not the realm to look.

Enterprise Products Partners stays to position unitholders initially

Enterprise Products Partners is an extra big North American midstream MLP. But it doesn’t have the very same circulation downsides hanging over it. For freshmen, it’s boosted its circulation yearly for 26 successive years. Secondly, it has really dealt with to make regular procurements with out turning to hostile strategies in an initiative to complete a purchase order previous to it has really been completed.

But what’s fascinating proper right here is that Enterprise isn’t unsusceptible to the impact of energy slumps. While its group is vastly fee-based, 2016 was a fairly difficult yr, due to this fact was 2020. The group saved downing alongside no matter short-term weak level, and the circulation was elevated no matter that weak level. A significant facet there may be the standard nature of Enterprise’s administration, with the circulation backed by an investment-grade annual report and a stable circulation safety proportion (presently distributable capital covers the circulation by 1.7 instances).

There’s moreover a prolonged background of unitholder-friendly selections to consider. For occasion, in 2002 Enterprise minimized its motivation circulation civil liberties by 50%, liberating much more money cash to pay unitholders on the expenditure of the fundamental companion. In 2007, administration slowed down circulation improvement so it may well spend much more vastly in group progress to lift long-lasting returns. In 2011, the MLP eliminated motivation circulations and obtained its primary companion, effectively coming to be an unbiased entity. And in 2018 Enterprise functioned to finish up being a self-funding group so it could not want to supply as quite a few dilutive programs sooner or later.

Stick to the one you possibly can depend on

It isn’t an fascinating monetary funding, but Enterprise has really plainly saved a watch out for unitholders in such a method that Energy Transfer hasn’t. If you are trying to stay off of the earnings your profile creates, trusted Enterprise, no matter a considerably decreased return, is almost certainly to be the a lot better various than Energy Transfer over the long term.

Should you spend $1,000 in Energy Transfer now?

Before you purchase provide in Energy Transfer, take into account this:

The Motley Fool Stock Advisor skilled group merely decided what they assume are the 10 best stocks for financiers to amass at present … and Energy Transfer had not been amongst them. The 10 provides that made it may well generate beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … should you spent $1,000 on the time of our referral, you would definitely have $792,725! *

Stock Advisor presents financiers with an easy-to-follow plan for fulfillment, consisting of help on growing a profile, regular updates from specialists, and a couple of brand-new provide selections each month. The Stock Advisor answer has better than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since August 26, 2024

Reuben Gregg Brewer has no setting in any one of many provides identified. The Motley Fool advisesEnterprise Products Partners The Motley Fool has a disclosure policy.

1 Ultra-High-Yield Energy Stock to Buy Hand Over Fist and 1 to Avoid was initially launched by The Motley Fool