Normally, capitalists looking for returns improvement wouldn’t anticipate to find it within the property funding firm (REIT) trade. But in some circumstances there are treasures that receive ignored since they don’t fulfill the requirements. Rexford Industrial Realty ( NYSE: REXR) is just such a genre-defying provide. Here are 3 causes that that is one spectacular high-yield returns improvement provide you’ll want to consider getting and holding for all times.

1. Rexford’s return is interesting

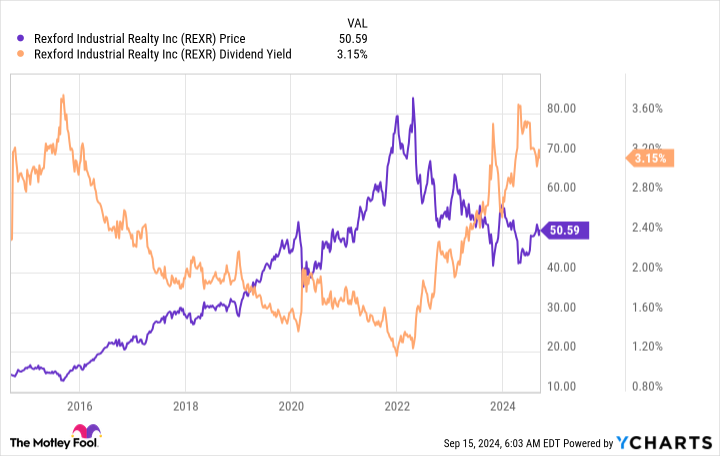

To receive the issue out initially, Rexford Industrial’s return is a bit under par for a REIT. Rexford’s dividend yield is 3.3% whereas the everyday REIT has a return of roughly 3.7%. However, while you distinction Rexford to the extra complete market, it seems to be quite a bit much better. That 3.3% return is nearly 3 occasions greater than the S&P 500 index’s modest 1.2% return.

And, many because of a outstanding pullback in Rexford’s provide charge, the returns return is moreover close to its highest diploma of the years. So you may find higher-yielding REITs, but Rexford’s return nonetheless seems to be reasonably interesting on each an outright foundation and about its very personal background.

2. Rexford’s returns improvement is extraordinarily interesting

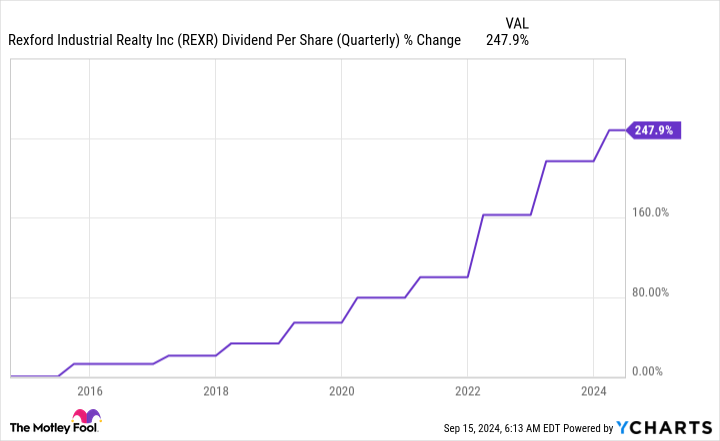

You can’t merely try Rexford Industrial’s return and cease. The REIT’s most excellent returns truth is the worth of returns improvement it has truly achieved over the earlier years. REITs are often known as slow-moving and fixed farmers; a mid-single-digit returns improvement worth is usually considered reasonably wonderful. Rexford’s returns broadened at an annualized worth of 13% over the earlier years. That would definitely be an enormous quantity for any sort of enterprise but is downright outstanding for a REIT.

When you embody the returns improvement to the return, it finally ends up being clear that Rexford is an especially interesting improvement and income provide. In reality, over roughly the earlier ten years the returns has truly expanded from $0.12 per share per quarter (in 2013) to $0.4175 per share (in 2024). That’s a nearly 250% bounce, one thing that nearly any sort of returns financier would definitely worth.

3. Rexford’s firm design is ready aside

Rexford is a business REIT, which isn’t particularly distinctive in any respect. However, it has a particular geographical emphasis that establishes it along with its friends. Unlike most business REITs, which consider variety, Rexford has truly gone accomplished in on the Southern California market. That’s proper– it simply buys one space of theUnited States There is a transparent hazard on this technique, but supplied the enterprise’s stable returns background, the wager monitoring has truly made is settling.

That’s actually not additionally stunning should you return and analyze the Southern California market. It is the largest business market within the United States and charges as theNo 4 market world wide. Notably, it’s an important portal for merchandise regarding North America fromAsia Being an vital gear within the worldwide provide chain has truly led to excessive want, with the Southern California space having a considerably diminished job worth than the rest of the nation. Add in provide restrictions, and Rexford has truly had the flexibility to spice up costs on working out leases in present quarters considerably.

Add that tailwind to the REIT’s development methods and procurements, and also you receive a REIT that appears most definitely to proceed fulfilling capitalists fairly presumably for a number of years to seek out.

Dividend improvement capitalists can buy Rexford whereas they’ll

So why is Rexford’s provide down 40% or two from its perpetuity highs? The response actually comes right down to financier perception, which obtained a bit bit overheated all through the coronavirus pandemic as want for stockroom room boosted along with on the web shopping for. Although the enjoyment has truly worn away, Rexford’s firm stays to hold out nicely. If you’re a reward improvement financier, it’s good to take into consideration getting Rexford and hanging on to it for a very long time.

Should you spend $1,000 in Rexford Industrial Realty now?

Before you buy provide in Rexford Industrial Realty, contemplate this:

The Motley Fool Stock Advisor knowledgeable group merely acknowledged what they suppose are the 10 best stocks for capitalists to buy at present … and Rexford Industrial Realty had not been amongst them. The 10 provides that made it could create beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … should you spent $1,000 on the time of our suggestion, you would definitely have $710,860! *

Stock Advisor provides capitalists with an easy-to-follow plan for fulfillment, consisting of assist on creating a profile, regular updates from specialists, and a couple of brand-new provide decisions month-to-month. The Stock Advisor answer has better than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since September 16, 2024

Reuben Gregg Brewer has no setting in any one of many provides identified. The Motley Fool has placements in and advises Rexford Industrial Realty and Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.

1 Magnificent High-Yield Dividend Growth Stock Down 40% to Buy and Hold Forever was initially launched by The Motley Fool