The long-awaited minute has truly gotten right here. The Federal Reserve is fulfilling in the present day, and monetary specialists are anticipating policymakers will definitely introduce the preliminary charges of curiosity decreased in 4 years. The Fed began elevating costs again in 2022 to tranquil surging rising price of dwelling and contemplating that has truly raised the benchmark worth 11 instances, leaving it at 5.5% in the present day. That’s the best diploma in higher than twenty years.

These steps have truly performed their work, with rising price of dwelling taking place over this length. Right presently, it goes to 2.5% and nearing the Fed’s goal of two%. Why that diploma? Because it “is most consistent with the Federal Reserve’s mandate for maximum employment and price stability,” based on the Federal Open Markets Committee.

So monetary specialists and traders have truly been hypothesizing that on Wednesday the Fed will definitely lower the benchmark worth by on the very least 25 foundation components, and a few additionally forecast a 50 foundation issue minimize. As a financier within the inventory alternate, you may be questioning what {the marketplace} will definitely do adhering to the Fed’s motion. Let’s need to background for some hints.

Why is a worth decreased such an enormous discount for provides?

First, permit’s take into consideration why a worth minimize is such an enormous discount for the inventory alternate typically and for capitalists significantly. Higher costs can hurt firm incomes and financier cravings for provides on account of numerous facets. As the fed funds worth rises, so do numerous different loaning bills for folks and enterprise.

For occasion, high-growth enterprise relying on fundings to assemble their providers will definitely see these prices climb. As an end result, potential capitalists may fret about their capability to cash improvement and may steer clear of these sort of provides. As for folks, higher loaning bills eat proper into their price range plans, which signifies they probably won’t have as a lot optionally available income to speculate.

Investors, seeing this unravel, regularly shed self-confidence in provides most inclined in this sort of environment. They might imagine twice to accumulate shares of these younger improvement enterprise– regularly innovation players– and so they may steer clear of enterprise, similar to these in house leisure or touring, that depend upon optionally available prices.

Investors may management their monetary investments within the inventory alternate and choose monetary investments that usually are inclined to thrive in a higher-rate environment, similar to bonds.

Of program, as charges of curiosity drop, the circumstance modifications, with loaning coming to be easier and more cost effective for enterprise and other people, whereas prospects find themselves with much more money to put money into non-essentials. All of this paints a brighter photograph for firm incomes, which, subsequently, makes capitalists additional sure concerning putting their bucks proper into the inventory alternate.

The S&P 500’s effectivity after earlier worth cuts

Now, as we look forward to the Fed’s following motion, permit’s take into consideration simply how the inventory alternate responded up to now to cost cuts. In the earlier 2 cycles of cuts, from the preliminary worth decline, the S&P 500 index ( SNPINDEX: ^ GSPC) climbed within the twin figures within the twelve month adhering to that motion. Those worth cuts received on March 3, 2020 andAug 1, 2019, and the S&P 500 climbed 27% and 10%, particularly, for a few years to stick to.

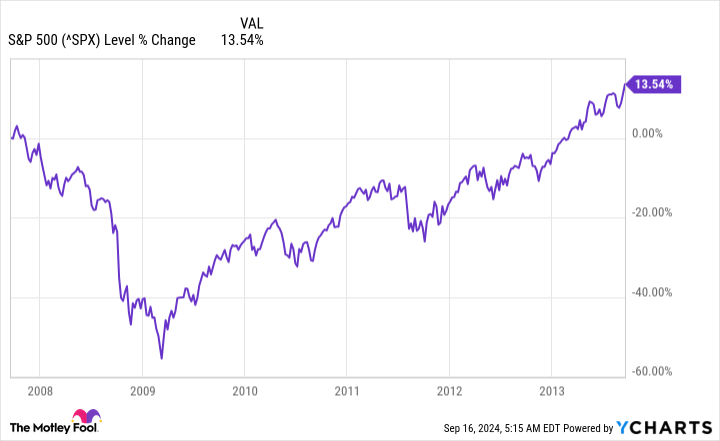

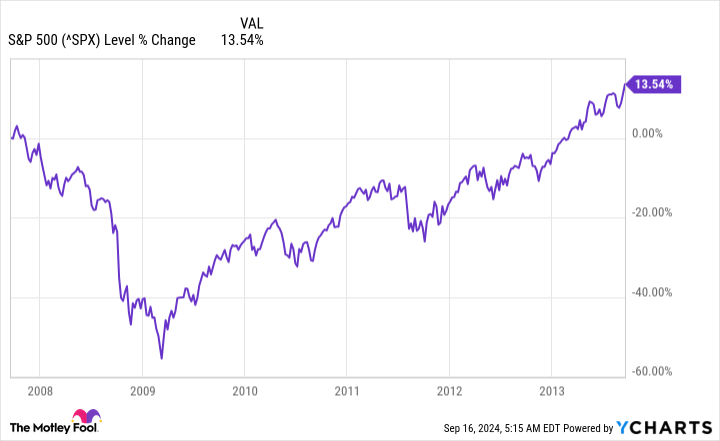

Prior to that, worth cuts occurred all through the Great Recession and an accident in the actual property market over the 2007 and 2008 length. The preliminary worth decreased after that occurred in September of 2007, and this second it took loads longer for the S&P 500 to climb up again to earlier levels.

^ SPX data by YChart s.

It’s essential to bear in mind, nonetheless, that the Great Recession was an particularly robust time worldwide, so it doesn’t stand for an asset of distinction for the S&P 500 in the present day.

What does each one among this imply for the inventory alternate progressing? It’s troublesome to forecast what the index will definitely do subsequent off, nonetheless present background reveals us a useful sample. That acknowledged, if the Fed decreases costs as anticipated or makes a way more hostile minimize in the present day, this won’t alleviate the loaning circumstance for enterprise and other people in a single day. It will definitely take a set of cuts to generate concrete outcomes.

But happily is {that a} potential worth cut back in the present day will definitely receive factors relocating the perfect directions– which could help the S&P 500 adhere to the present historic sample and improve within the coming yr.

Should you spend $1,000 in S&P 500 Index now?

Before you purchase provide in S&P 500 Index, take into account this:

The Motley Fool Stock Advisor professional group merely acknowledged what they assume are the 10 superb provides for capitalists to accumulate presently … and S&P 500 Index had not been amongst them. The 10 provides that made it’d generate beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … should you spent $1,000 on the time of our suggestion, you will surely have $729,857! *

Stock Advisor provides capitalists with an easy-to-follow plan for fulfillment, consisting of help on developing a profile, regular updates from specialists, and a couple of brand-new provide decisions month-to-month. The Stock Advisor resolution has higher than quadrupled the return of S&P 500 contemplating that 2002 *.

See the ten provides “

*Stock Advisor returns since September 16, 2024

Adria Cimino has no setting in any one of many provides identified. The Motley Fool has no setting in any one of many provides identified. The Motley Fool has a disclosure plan.

The Fed May Cut Interest Rates This WeekHistory Says Stocks Will Do This Next was initially launched by The Motley Fool