Kremlin- possessed energy titan Gazprom endured a collapse in its North Sea revenues in 2015 as permissions and the windfall tax obligation broken enterprise.

Gazprom UK, which is possessed by the Russian federal authorities, noticed pre-tax revenues drop from EUR45m (₤ 37.6 m) in 2022 to EUR4m in 2015, in response to accounts submitted at Companies House.

The enterprise paid EUR1.7 m in returns to its Russian mothers and pop utilizing a Dutch subsidiary, under EUR41m the yr prior.

Gazprom UK has really been producing fuel from the Sillimanite space, which is unfold out all through British and Dutch waters, contemplating that 2020 underneath a joint endeavor with German enterprise Wintershall.

However, it revealed methods in March to market down its danger, 2 years after Vladimir Putin’s intrusion of Ukraine triggered a wave of Western permissions which have really maimed the Kremlin’s exports.

The enterprise’s UK subsidiary had really been gaining from an increase in energy prices following the battle, which aided the enterprise, Russia’s largest taxpayer, to ship out tens of millions to the Kremlin in 2021 and 2022.

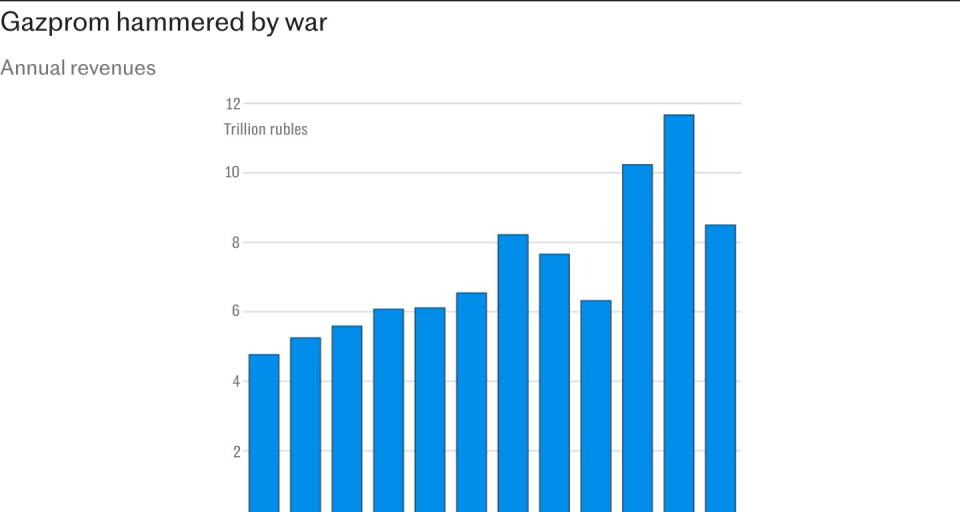

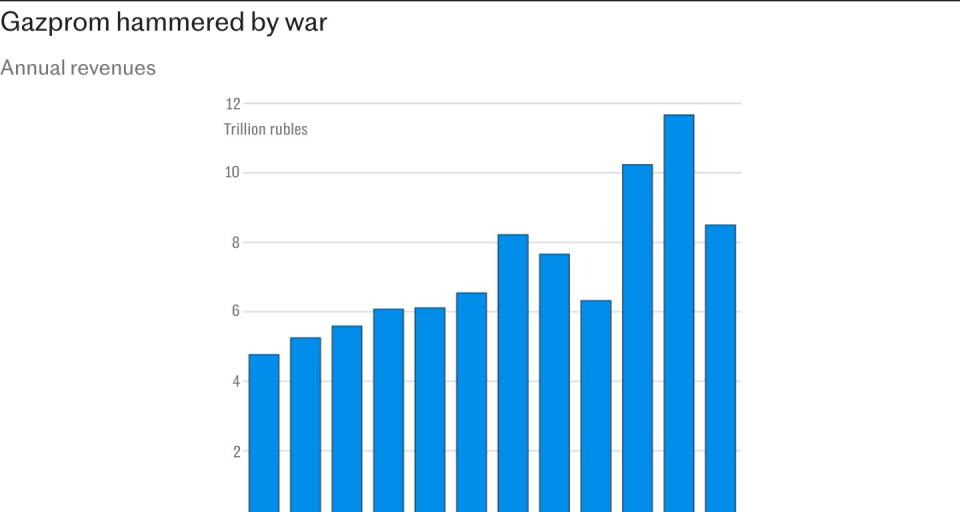

The UK accounts, which have been submitted a day late, have been launched months after its mothers and pop enterprise endured its very first yearly loss in higher than twenty years amidst diminishing fuel occupation with Europe.

“The decrease in profits is primarily due to a decrease in production volumes,” the UK enterprise said in filings.

The accounts likewise reveal that a whole lot of Gazprom’s UK revenues have been gnawed by the ability revenues impose offered by Rishi Sunak when he was chancellor, with repayments amounting to ₤ 2.9 m contemplating that the tax obligation was utilized in May 2022.

The Russian head of state has really likewise enforced an added manufacturing tax obligation on Gazprom in Russia until 2025 because it has a tough time to keep up funding the battle.

The outcomes emphasize the numerous lower of Gazprom, which has really been amongst Russia’s only companies contemplating that the collapse of the Soviet Union.

A report appointed by the enterprise’s leaders that was launched this summer time season forecasted that income weren’t more likely to exceed pre-war levels for no less than a years, with fuel exports to Europe hardly attending to a third of pre-war levels by 2035.

“The main consequences of sanctions for Gazprom and the energy industry are the contraction of export volumes, which will be restored to their 2020 level no earlier than in 2035,” the report’s writers created.