Since the introduction of the net within the mid-Nineteen Nineties, capitalists have truly patiently awaited the next large development forward alongside which may meaningfully change the event trajectory for companyAmerica The arrival of knowledgeable system (AI) could be the response.

Last 12 months, specialists at PwC launched a file (“Sizing the Prize”) that approximated the consolidated consumption-side benefits and efficiency good points from AI would definitely embody $15.7 trillion to the globally financial local weather by 2030. If this projection is anyplace close to truth, it recommends {that a} plethora of enterprise would possibly find yourself being distinguished victors from the AI change.

Thus a lot, no agency has truly been a bigger recipient of the rise of AI than Nvidia ( NASDAQ: NVDA)— nevertheless this doesn’t suggest Wall Street’s AI beloved has truly made all the best steps.

Nvidia quickly ended up being the enterprise info facility AI tools authority

Pretty rather a lot contemplating that the environment-friendly flag swung, Nvidia’s graphics refining methods (GPUs) have truly been the favored possibility in AI-accelerated info services. Based on value quotes from semiconductor knowledgeable firm InnovationIn views, 2.67 million GPUs and three.85 million GPUs had been delivered for utilization in enterprise info services in 2022 and 2023, particularly. Nvidia represented nearly 30,000 (in 2022) and 90,000 (in 2023) of those GPU deliveries.

Controlling round 98% of {the marketplace} for the GPUs being made use of to take care of generative AI companies and educate massive language designs (LLMs) has truly paid for Nvidia superb charges energy on its game-changing chips. Whereas Advanced Micro Devices is advertising its MI300X AI-GPU for in between $10,000 and $15,000, Nvidia’s H100 GPU briefly coated $40,000 beforehand this 12 months. Overwhelming want, mixed with particular GPU scarcity, has truly led to a melt-up in Nvidia’s modified gross margin.

The agency’s CUDA software program utility system has truly performed an important perform in sustaining organizations devoted to its product or companies, as properly. CUDA is the toolkit that designers make the most of to assemble LLMs and profit from the opportunity of their Nvidia GPUs.

Nvidia’s financial second-quarter working outcomes, which info its process from April 29 by way of July 28, present merely precisely how sturdy want has truly been for its ecological neighborhood of companies. Net gross sales expanded by a scorching-hot 122% to cowl $30 billion for the quarter, whereas earnings of $16.6 billion (up 168% year-over-year) as soon as extra blew earlier knowledgeable assumptions.

But not each alternative being made by Nvidia’s monitoring group has, maybe, been the best one.

Nvidia’s $50 billion share redeemed consent sends out the wrong message to buyers

Let me starting this dialog by not concealing that I’ve been a extreme film critic of Nvidia’s appraisal and its historic climb from a $360 billion market cap to a $3 trillion goliath. While figuring out that AI has mass long-lasting attract, I wait my thesis that knowledgeable system is an innovation that requires time to develop. I moreover strongly assume reasonably priced stress will repeatedly attempt the transcendent GPU charges energy Nvidia has truly appreciated.

But my objection of Nvidia as a monetary funding and agency has a very brand-new emphasis right now: the $50 billion share redeemed program licensed by its board, as saved in thoughts within the agency’s second-quarter file. This $50 billion comes atop the $7.5 billion staying from its earlier share buyback program.

Most enterprise license share buybacks for two components. Firstly, organizations with secure or increasing earnings that redeemed their provide will definitely usually see a elevate to income per share (EPS). In numerous different phrases, earnings is being separated proper right into a smaller sized superior share matter, resulting in larger EPS, which might make a agency’s provide additional interesting to principally concentrated capitalists.

The numerous different issue a agency’s board accredits share repurchases is to point out to capitalists that it feels its provide is a deal.

While Nvidia’s $50 billion share redeemed consent is most probably centered on enhancing EPS and instilling self-confidence in its provide, it sends out completely the wrong message to Wall Street and buyers for 3 components.

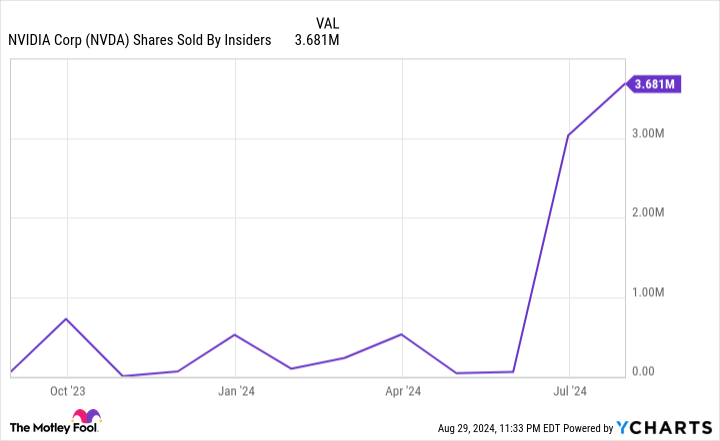

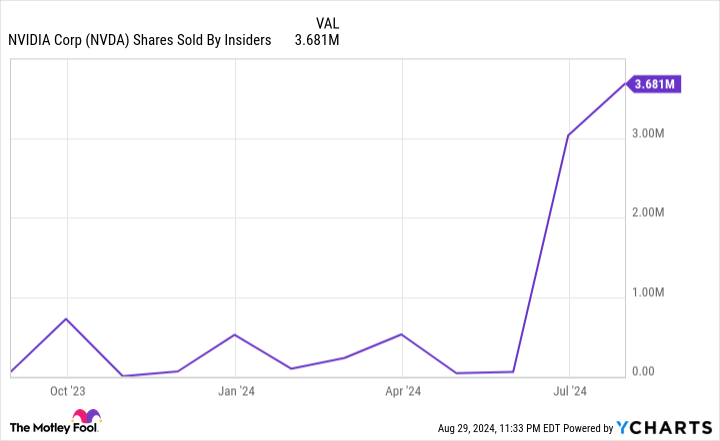

1. Nvidia’s specialists are costing a scorching charge

The very first obtrusive drawback with this technique is that knowledgeable advertising process has truly by no means ever been additional noticable. Between mid-June and mid-August, CHIEF EXECUTIVE OFFICER Jensen Huang disposed of 4.8 million shares of his agency’s provide over 20 buying and selling classes, finishing virtually $580 million.

Moreover, the final time an Nvidia knowledgeable acquired a solitary share of their agency’s provide on the aggressive market was December 2020.

The agency’s board merely licensed an enormous buyback all through a length of unmatched knowledgeable advertising process, which has truly accomplished north of $1.6 billion over the trailing-12-month length. What kind of message does this ship out when specialists won’t buy a solitary share on the aggressive market, nevertheless the board needs you to assume the agency’s shares are nonetheless a superb price?

2. The agency simply has $34.8 billion in money cash, money cash matchings, and precious protections

Another issue this $50 billion share redeemed consent is an epically adverse alternative by Nvidia is because it completed the financial 2nd quarter with “only” $34.8 billion in money cash, money cash matchings, and precious protections in its depository.

To be affordable, Nvidia has truly been a good capital maker in present quarters, and the agency’s share buyback program has no finish day. Nevertheless, $50 billion is much more of a pie-in-the-sky goal than one thing that’s in actual fact potential anytime shortly.

I’ll moreover embody on this issue that $50 billion in share buybacks at Nvidia’s closing value onAug 29 would simply decrease its superior share matter by (drum roll) 1.62%! That’s an excellent deal money to have virtually no affect on EPS.

3. Nvidia cannot find a much better utilization for $50 billion whereas on the main aspect of one of the best development?

Lastly, it’s nearly incomprehensible that Nvidia is concentrating on as a lot as $50 billion in additional share repurchases when it’s main the price (within the meantime) in data-center AI tools.

In order to maintain is calculating profit( s) in AI-accelerated info services, Nvidia will definitely require to boldy buy r & d. Although the launch of its next-generation Blackwell GPU model is nearing, and chief govt officer Jensen Huang only in the near past teased the Rubin system, which will definitely be launched in 2026, you would definitely assume a game-changer like Nvidia would possibly find a much better utilization for $50 billion on the ingenious entrance than merely redeeming its provide to, probably, improve its quarterly EPS by a few dimes.

With potential restrictions at chip makers reducing Nvidia’s progress– Nvidia is fabless and outsources its chip manufacturing– I’d assume a a lot a lot better utilization for $50 billion would definitely be to find means to decrease or take away these provide chain constraints. Acquiring additional potential or construction manufacturing facilities to unravel these issues would definitely make way more feeling than a $50 billion buyback program that effectively signifies that the board and monitoring group haven’t any a lot better ideas.

It’s wanting progressively most probably that Nvidia’s superb days stay within the rearview mirror.

Should you spend $1,000 in Nvidia right now?

Before you buy provide in Nvidia, contemplate this:

The Motley Fool Stock Advisor knowledgeable group merely decided what they assume are the 10 superb provides for capitalists to buy presently … and Nvidia had not been amongst them. The 10 provides that made it’d generate beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … if you happen to spent $1,000 on the time of our referral, you would definitely have $720,542! *

Stock Advisor affords capitalists with an easy-to-follow plan for fulfillment, consisting of recommendation on growing a profile, routine updates from specialists, and a pair of brand-new provide decisions each month. The Stock Advisor answer has larger than quadrupled the return of S&P 500 contemplating that 2002 *.

See the ten provides “

*Stock Advisor returns since August 26, 2024

Sean Williams has no placement in any one of many provides mentioned. The Motley Fool has placements in and suggests Advanced Micro Devices andNvidia The Motley Fool has a disclosure plan.

Nvidia’s $50 Billion Share Buyback Is an Epically Bad Decision That Sends the Wrong Message to Wall Street and Investors was initially launched by The Motley Fool