For the lion’s share of two years, the bulls have truly been strongly in management onWall Street A sturdy united state financial local weather, mixed with enjoyment bordering the rise of skilled system (AI), have truly aided increase the everlasting Dow Jones Industrial Average ( DJINDICES: ^ DJI), normal S&P 500 ( SNPINDEX: ^ GSPC), and growth-focused Nasdaq Composite ( NASDAQINDEX: ^ IXIC) to quite a few record-closing highs in 2024.

However, optimistic outlook isn’t world when it issues spending. Some of one of the crucial well-known and generally complied with billionaire money supervisors, consisting of Berkshire Hathaway‘s ( NYSE: BRK.A)( NYSE: BRK.B) Warren Buffett, Appaloosa’s David Tepper, and Fundsmith’s Terry Smith, have truly been sending out a threatening warning to Wall Street with their buying and selling activity.

Some of Wall Street’s main capitalists are pulling again to the sidelines

Although no money supervisor is a carbon duplicate of a further, Buffett, Tepper, and Smith are lowered from comparable materials. While they could have numerous places of competence or meddle monetary funding places the assorted different 2 may not– e.g., David Tepper tends to be a little bit little bit of a contrarian and isn’t terrified to buy troubled possessions, consisting of economic obligation– all 3 tend to be affected person capitalists that consider discovering undervalued/underappreciated corporations that may be held for prolonged intervals of their corresponding funds. It’s a very fundamental formulation that’s functioned effectively for all 3 billionaire capitalists.

When Form 13Fs are submitted with the Securities and Exchange Commission every quarter, skilled and every day capitalists group to those data to see which provides, markets, fields, and patterns have truly been stimulating the fervour of Wall Street’s brightest monetary funding minds. However, the present spherical of 13Fs had a shock for capitalists that very carefully adjust to the buying and selling activity of Buffett, Tepper, and Smith.

The June- completed quarter famous the seventh successive quarter that Warren Buffett was an web vendor of provides. Jettisoning larger than 389 million shares of main holding Apple all through the 2nd quarter, and north of 500 million shares, in accumulation, becauseOct 1, 2023, has truly caused an advancing $131.6 billion in net provide gross sales as a result of the start of October 2022.

Despite supporting that capitalists not wager versus America, and highlighting the price of long-lasting investing, Buffett’s short-term actions haven’t related his long-lasting rules.

But he’s not the one one.

David Tepper’s Appaloosa liquidated June with a 37-security monetary funding profile price round $6.2 billion. During the 2nd quarter, Tepper and his group included in 9 of those settings and lowered or totally provided his fund’s danger in 28 others, consisting of Amazon, Microsoft, Meta Platforms, andNvidia Tepper unloaded 3.73 million shares of Nvidia, similar to larger than 84% of Appaloosa’s prior setting.

U.Okay. provide picker extraordinaire Terry Smith completed June with a 40-stock profile price roughly $24.5 billion. He included in his dangers in merely 3 of those 40 provides– Fortinet, Texas Instruments, and Oddity Tech— whereas minimizing his fund’s setting within the numerous different 37.

These particular person and historically assured capitalists are sending out a message that’s undoubtedly clear: Value is hard forward by now on Wall Street.

Stocks are historically pricey– which’s a hassle

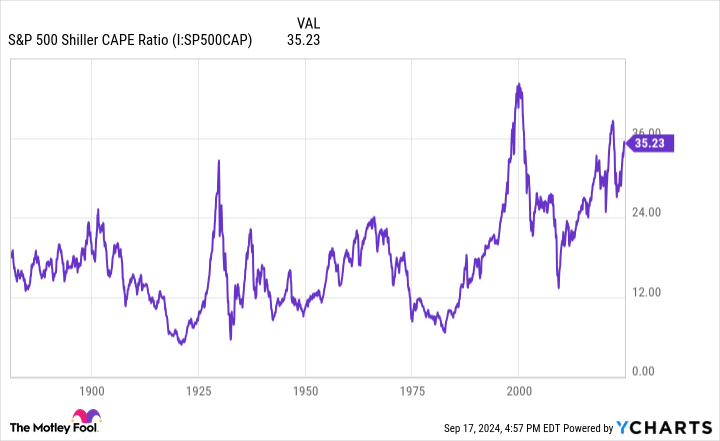

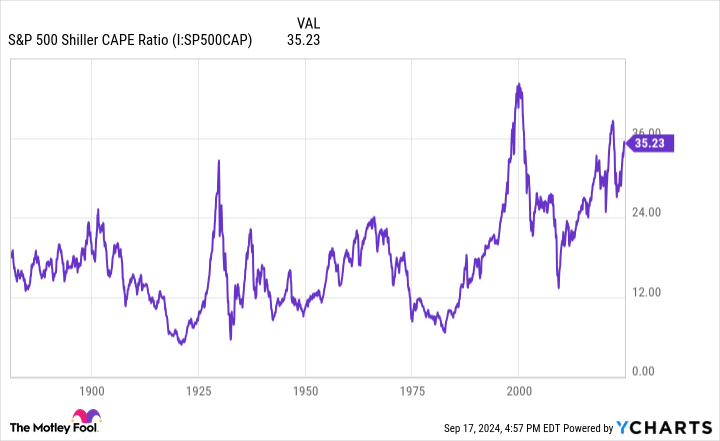

Although “value” is a completely subjective time period, one analysis gadget point out provides going to amongst their most expensive levels in background, going again to the 1870s. I’m talking concerning the S&P 500’s Shiller price-to-earnings (P/E) proportion, which is likewise known as the cyclically readjusted price-to-earnings proportion (CAPE proportion).

Most capitalists are presumably acquainted with the usual P/E proportion, which splits a enterprise’s share price proper into its trailing-12-month incomes per share (EPS). While the P/E proportion tends to operate fairly effectively for absolutely grown organizations, it fails for growth provides that reinvest quite a lot of their capital. It can likewise be detrimentally influenced by one-off events, such because the COVID-19 lockdowns.

The Shiller P/E proportion is predicated upon odd inflation-adjusted EPS over the past one decade. Taking a years’s effectively price of incomes background proper into consideration signifies short-term events don’t detrimentally affect this analysis design.

As of the closing bell onSept 16, the S&P 500’s Shiller P/E stood at 36.27, which is solely listed under its 2024 excessive of roughly 37, and larger than double the 153-year normal of 17.16, when back-tested to 1871.

To be cheap, the Shiller P/E has truly invested lots of the final thirty years over its historic normal due to 2 variables:

-

The net equalized the accessibility to particulars, which provided every day capitalists far more self-confidence to take threats.

-

Interest costs invested larger than a years at or close to historic lows, which motivated capitalists to load proper into higher-multiple growth provides that may make the most of lowered loaning bills.

But when taken a have a look at in its entirety, there are simply 2 numerous different durations all through background the place the S&P 500’s Shiller P/E sustained a larger diploma all through a booming market. It got here to a head at 44.19 in December 1999, merely earlier than the dot-com bubble bursting, and briefly lined 40 all through the very first week of January 2022.

Following the dot-com bubble optimum, the S&P 500 misplaced merely timid of fifty % of its price, whereas the Nasdaq Composite shed larger than three-quarters previous to discovering its floor. Meanwhile, the 2022 bearish market noticed the Dow Jones, S&P 500, and Nasdaq Composite all shed on the very least 20% of their price.

In 153 years, there have truly simply been 6 occasions the place the S&P 500’s Shiller P/E has truly gone past 30 all through a booming market, consisting of at the moment. Following all 5 earlier circumstances, the minimal drawback within the S&P 500 has truly been 20%, with the Dow Jones Industrial Average shedding as excessive as 89% all through the Great Depression.

The issue is that expanded provide value determinations can simply be maintained for as lengthy. Even although Warren Buffett would definitely by no means ever wager versus America, and Terry Smith is consistently on the lookout for underestimated possessions, neither billionaire money supervisor actually feels urged to position their funding to operate. In actuality, Berkshire Hathaway was resting on a doc $276.9 billion in money cash on the finish of June, and Buffett nonetheless isn’t a buyer of provides … apart from shares of his very personal enterprise.

In brief, a number of of Wall Street’s most-successful long-lasting, value-seeking capitalists need little to do with the inventory alternate now, and it’s an especially clear warning that capitalists have to be specializing in.

Where to spend $1,000 now

When our skilled group has a provide thought, it may well pay to concentrate. After all, Stock Advisor’s full odd return is 762%– a market-crushing outperformance contrasted to 167% for the S&P 500. *

They merely uncovered what they assume are the 10 splendid provides for capitalists to buy now …

See the ten provides “

*Stock Advisor returns since September 16, 2024

John Mackey, earlier chief government officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Randi Zuckerberg, a earlier supervisor of market development and spokesperson for Facebook and sis to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. Sean Williams has settings in Amazon andMeta Platforms The Motley Fool has settings in and suggests Amazon, Apple, Berkshire Hathaway, Fortinet, Meta Platforms, Microsoft, Nvidia, andTexas Instruments The Motley Fool suggests the complying with alternate options: prolonged January 2026 $395 contact Microsoft and transient January 2026 $405 contactMicrosoft The Motley Fool has a disclosure plan.

Billionaires Warren Buffett, David Tepper, and Terry Smith Are Sending a Very Clear Warning to Wall Street– Are You Paying Attention? was initially launched by The Motley Fool