All eyes shall be on Federal Reserve Chairman Jay Powell when he proclaims what the Fed is planning on doing with rates of interest throughout its Sept. 17 and 18 assembly. It’s a foregone conclusion that there shall be no less than some charge minimize, however no person is aware of how a lot. As a end result, some customers could maintain off on purchases till after charges begin to fall, one thing that might massively profit a number of firms.

One inventory that might go parabolic if the Fed cuts charges is Upstart (NASDAQ: UPST). Upstart’s software program is a substitute for FICO scores and is used primarily in private and auto loans, two areas that haven’t seen as a lot demand since rates of interest rose.

Upstart makes use of AI to evaluate creditworthiness

Upstart’s various lending mannequin assesses debtors in a different way than a credit score rating. It makes use of various elements that aren’t usually utilized in FICO scores to higher assess a borrower’s creditworthiness. It additionally makes use of synthetic intelligence (AI) to do that, which can assist take away bias from approving loans. The outcomes are fairly stark: Upstart has 53% fewer defaults than a standard mannequin on the identical approval charges.

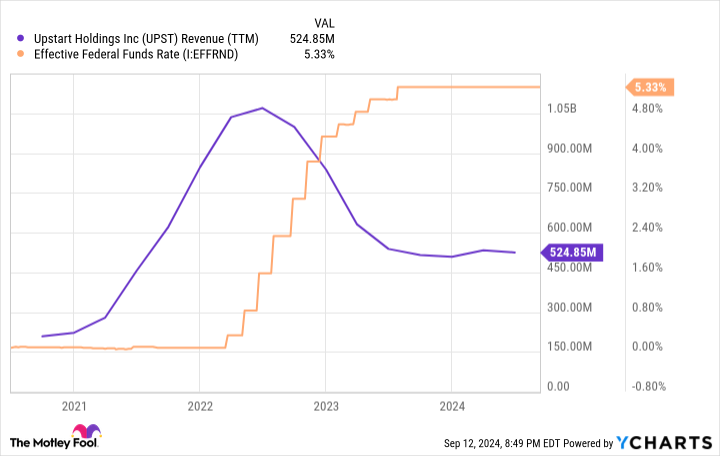

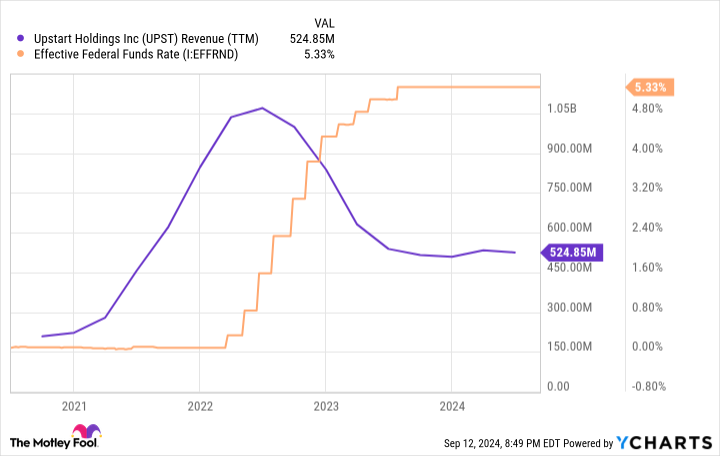

Upstart has a improbable mannequin, however the issue is that it isn’t accountable for its personal future. Because its enterprise is tethered to the rate of interest setting, it could possibly increase and bust alongside these charges. Just a number of years in the past, it had a $1 billion annual income run charge. Now, the determine sits at about half of that quantity.

But these low income quarters are just about the inverse of the efficient federal funds charge, so this raises the query: Can Upstart return to prominence if the Fed cuts charges?

Upstart’s enterprise hasn’t accomplished effectively with increased charges

The downside with Upstart is that its enterprise wants booms to outlive. As talked about above, Upstart’s lending experience is targeted on the non-public and auto mortgage house. These charges are sometimes considerably increased than the federal funds charge as a result of elevated threat of those loans that the lender takes on. As a end result, when charges are as excessive as they’re now, there’s little demand. However, if the Fed decreases charges, customers could also be extra prone to tackle some loans if they’ll get a decrease charge than beforehand.

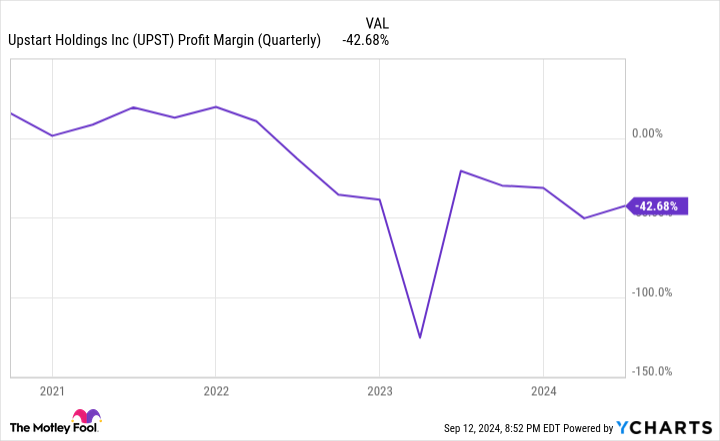

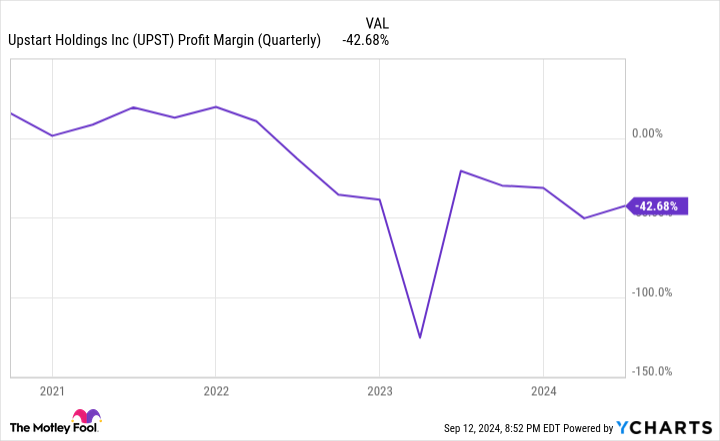

Unfortunately, Upstart has turn into deeply unprofitable since its enterprise took a nostril dive due to excessive rates of interest.

Although the corporate’s income has stayed pretty regular, it has accomplished little to turn into extra environment friendly and minimize its losses. This is an enormous warning flag for me, because it reveals that it should have these low rate of interest intervals in an effort to survive.

That is a mark of an organization that isn’t constructed for the long run. If Upstart had been marginally worthwhile in unhealthy occasions however massively worthwhile in good occasions, I’d rethink, however this isn’t the case.

Still, this doesn’t imply the inventory gained’t see vital good points because the Fed cuts charges. There is probably going pent-up demand for private and auto loans, as customers could have been avoiding taking over loans resulting from increased charges than in latest occasions. As a end result, Upstart’s enterprise will probably take off, and the inventory might observe go well with.

Unless administration makes some modifications from the previous increase, Upstart might battle once more years down the street. The inventory could possibly be purchased right here if it modifications for the higher. But if it sticks with its previous methods (which it has accomplished over the previous few quarters), it might repeat its issues a number of years from now.

Should you make investments $1,000 in Upstart proper now?

Before you purchase inventory in Upstart, think about this:

The Motley Fool Stock Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Upstart wasn’t considered one of them. The 10 shares that made the minimize might produce monster returns within the coming years.

Consider when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $729,857!*

Stock Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Stock Advisor returns as of September 16, 2024

Keithen Drury has positions in Upstart. The Motley Fool has positions in and recommends Upstart. The Motley Fool has a disclosure coverage.

1 Stock Down 91% That Could Go Parabolic if the Fed Cuts Rates was initially revealed by The Motley Fool