RHJ

Overview

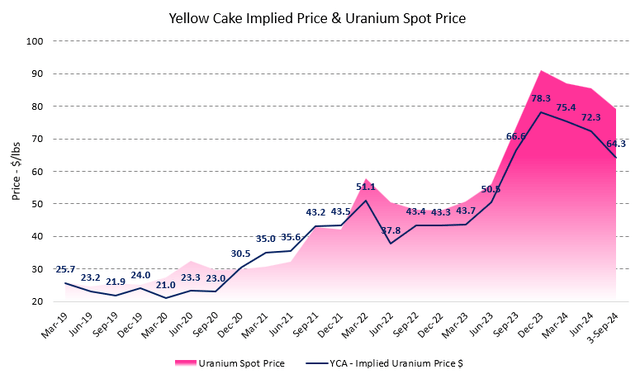

Yellow Cake (OTCQX:YLLXF) is a uranium funding agency with its fundamental itemizing in London, UK. I’ve really lined Yellow Cake recurrently returning to late 2019, these write-ups may be found here, and it has really been a core holding of my uranium profile for a lot of this period.

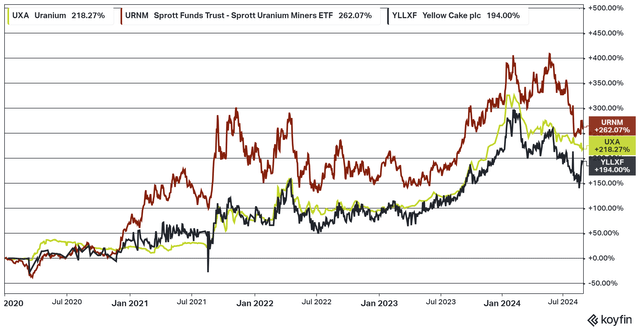

Yellow Cake’s provide value effectivity within the 2020s years has really been merely timid of 200%, which is an excellent return in a lot lower than 5 years, it does monitor the place value of uranium fairly rigorously, but it has really delayed some in time.

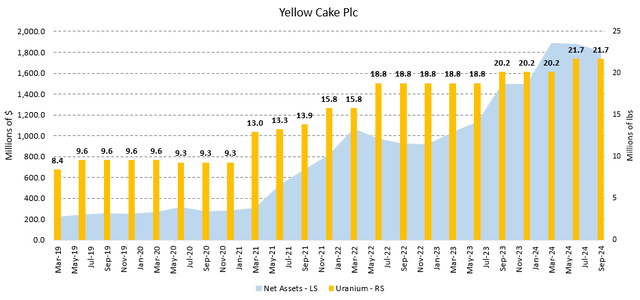

This is partially because of the working expense of operating the enterprise, but the working expense are at the moment listed under 1% of internet property value, because the possessions have really expanded significantly all through the years. The growth in possessions has really originated from a better uranium value and by elevating fairness assets to get further uranium.

Figure 2 – Source: Quarterly Reports & & TradingView(* )varied different issue that describes why

The has really underperformed the place value of uranium on this years, is because of the truth that the low cost price to internet property value has really raised. Yellow Cake low cost price to internet property value is round 19% at present, whereas it was simply 4% firstly of this years.The recently in 2024,

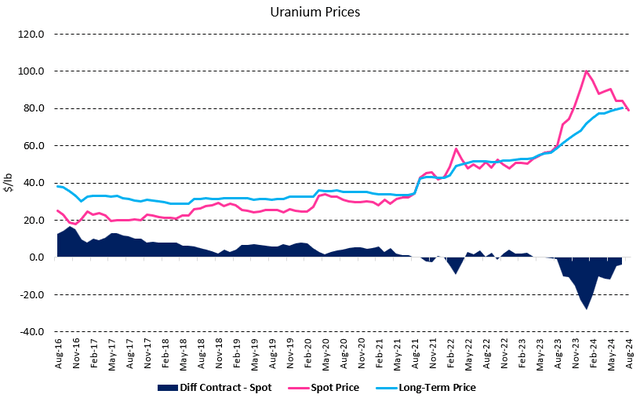

More has really decreased along with many uranium equities, the place the place value has really decreased to at the moment merely listed under $80/lb and the view for a lot of uranium equities has really degraded significantly complying with a strong 2023.Yellow Cake, the long-lasting settlement value stays to look actually strong.

However value has really reached merely over $80/lb on the finish of That, which is a 16-year-high. July finish of The quantity is anticipated to be supplied all through at present, and August (Cameco) will definitely launch the numbers CCJ.here 3 –

Figure: Source & & TradingView Cameco 12 months in

Recent Industry Developments

Every, the August releases theWorld Nuclear Association with knowledge of operable atomic energy crops and atomic energy crops in constructing all around the world.Nuclear Performance Report 4 –

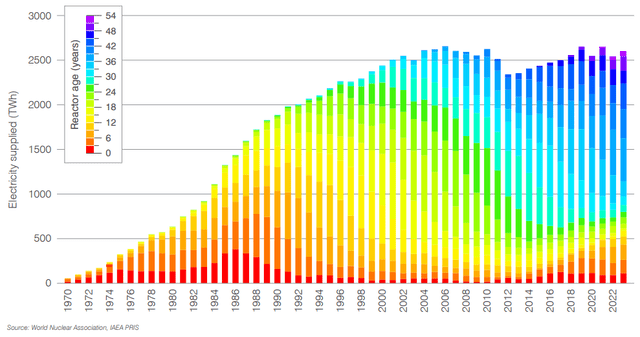

Figure: Source 2024Nuclear Performance Report activators world wide produced an general of

Nuclear, up 2.3% from 2022 but nonetheless a bit of listed under the levels seen in 2021. 2,602 TWh of electricity in 2023 can see by the pink location within the graph above, which highlights recently constructed atomic energy crops, that the market is experiencing a renewal.We of the present growth is originating from

Most, additionally if a lot of western nations have really dedicated to tripling their nuclear capability by 2050. Asia can uncover an additional in-depth malfunction of the present nuclear effectivity file in You that was launched a few days again.this blog post latest market-moving event for the uranium market, was the prolonged waited for

The, that was launched on the Kazatomprom H1 2024 result 23. August had not been loads the half-year final result of the globe’s greatest uranium producer that the monetary funding neighborhood had an curiosity in, but a lot of financiers have been largely focused on the 2025 recommendation numbers and any type of varied different attainable information regarding an increase in future uranium provide.It 5 –

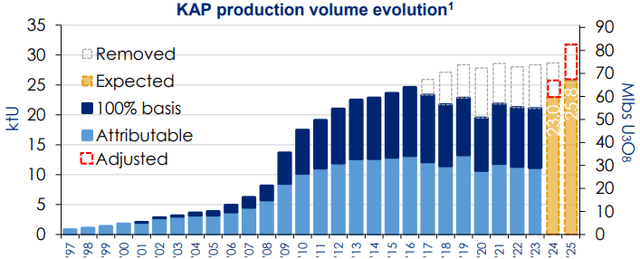

Figure: Source did as anticipated lowered its 2025 manufacturing recommendation by round Kazatomprom Corporate Presentation

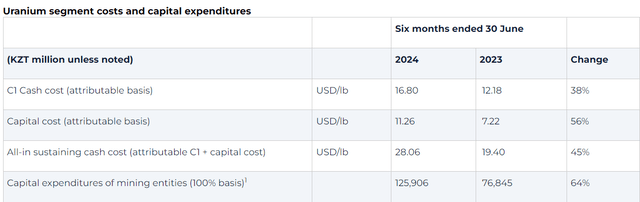

Kazatomprom, which is a substantial discount in regard to a worldwide fundamental mine provide of round 130-140 13-14Mlbs of uranium every year. Mlbs high of that, the enterprise moreover urged the target to renegotiate some subsoil utilization preparations lowered, which positively doesn’t look like a agency desirous to develop manufacturing significantly. On on Based background of lowering recommendation, it might actually not be a shock to see the 2025 recommendation be decreased moreover all through following 12 months.Kazatomprom’s half-year final result moreover revealed significantly better bills for the enterprise, with money cash increase 38% and AISC enhancing 45% year-over-year.

The in the summertime season, it was Earlier that the mineral elimination tax obligation will definitely increase considerably from 2025. announced, all this positively components in direction of a change within the uranium worth contour better.So 6 –

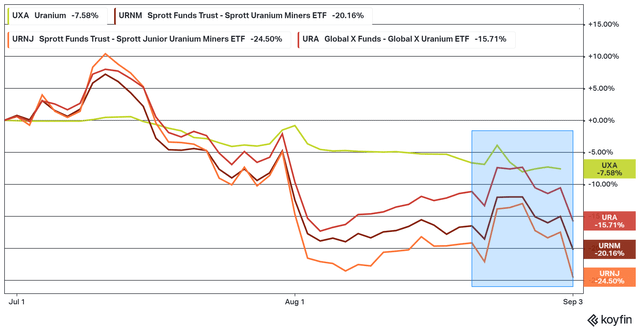

Figure: Source H1 2024 Kazatomprom favorable collections of knowledge created a small bump in uranium equities, but now we have not seen a lot of a comply with up, because the bearish view desires to have really remained to regulate within the uranium market.Result

These 7 –

Figure: Source & &(* )goes to the second of this creating buying and selling at ₤ 5.00 on the Koyfin

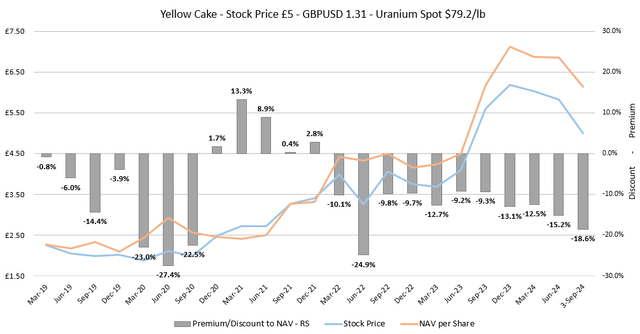

Valuation, and the present uranium place value was $79.20/ pound. Conclusion

Yellow Cake one of the vital present FX worth, we’re contemplating an 18.6% low cost price to internet property value for London Stock Exchange, which fits to the highest finish of what we usually see, additionally the low cost price has really exceeded 20% on unusual celebrations.With 8 – Yellow Cake:

Figure & & TradingView(* )equates to an indicated uranium value of $64.30/ pound, which stays in my sight a extremely interesting value for a uranium provide with marginal useful and administrative menace, every time when probably the most inexpensive worth producer merely noticed its all-in struggling increase by 45% YoY.Source isn’t more likely to have the very best attainable benefit from as soon as the view enhances for uranium equities, but I nonetheless take into account it an essential a part of my profile and with the low cost price to NAV going to the better finish of what we usually see, I assume this is a wonderful chance to get or embrace in Quarterly Updates.

This 9 –

Yellow Cake: Yellow Cake & & TradingView

Figure: Source write-up opinions a number of safeties that don’t commerce on a major united state trade. Quarterly Updates know the threats associated to those provides.

Editor’s Note