Keep our data with out commercials and paywalls by making a contribution to maintain our job!

Notes from Poland is run by a small editorial team and is launched by an unbiased, charitable construction that’s moneyed by way of contributions from our viewers. We can chorus what we do with out your help.

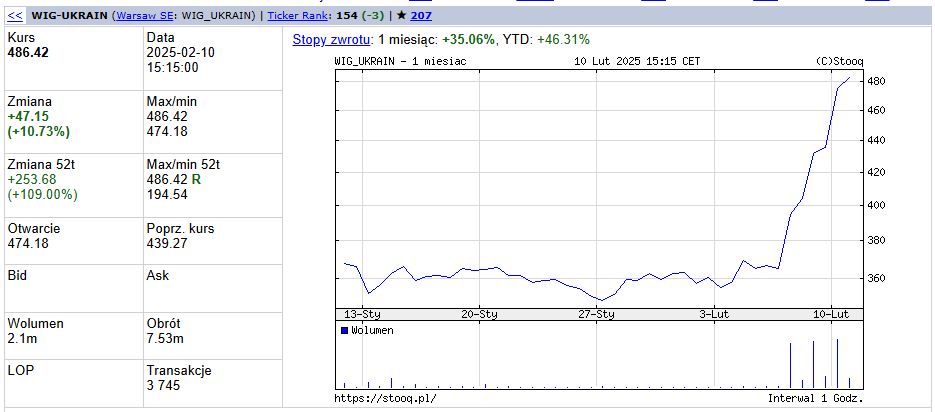

The share charges of Ukrainian enterprise offered on the Warsaw Stock Exchange (GPW) have really risen by nearly 35% over the earlier week, attending to levels final seen previous to Russia’s 2022 intrusion, with specialists recommending that financiers are banking on a potential US-brokered tranquility technique.

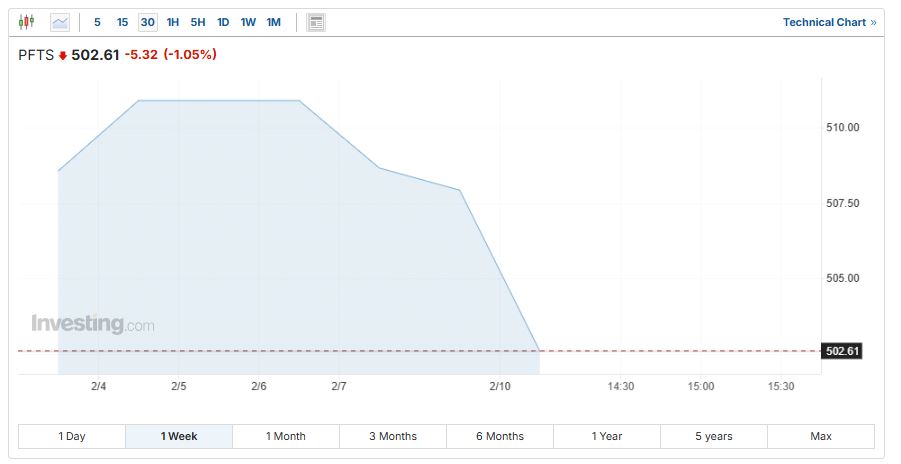

However, the features of the 6 Ukrainian enterprise offered on the GPW’s WIG-Ukraine index have really not been matched by the first index on Ukraine’s very personal inventory market, the PFTS, which has really decreased by 1.6% contemplating that just lately.

According to Polish firm paper Puls Biznesu, financiers within the GPW are considerably contemplating a postwar restore initiative in Ukrainian- managed areas, along with possible settlements on Ukraine’s inauguration to the European Union.

Sentiment has really boosted after Trump asserted his group has really made development in settlements and has really touched withRussian President Vladimir Putin Since taking office in January, he has really vowed to guard a tranquility provide inside his very first 100 days.

On Wednesday just lately, Bloomberg reported that Donald Trump’s distinctive rep for Ukraine and Russia, Keith Kellogg, will definitely provide the technique to allies, but not overtly, all through a gathering in Munich on 14-16 February.

Kellogg, in a gathering with Newsmax, rejected information that he would definitely provide a tranquility technique all through the seminar but urged that he deliberate to carry numerous talks with European leaders in Munich and file again to Trump on his return.

Despite this, Ukrainian shares on the GPW started to climb on Thursday early morning just lately, getting 34.79% by Tuesday early morning. Since the beginning of the 12 months, the WIG-Ukraine has really enhanced by 46.31%, in line with data from financial particulars answer Stooq.

The WIG-Ukraine index is included GPW-listed enterprise whose licensed office or head office lies in Ukraine or whose procedures are carried out to one of the best diploma as a result of nation.

It consists of 5 farming enterprise– IMC, Agroton and KSG Agro, Astra Holding and Milkland– along with mining firm Coal Energy.

The postwar restore of Ukraine will definitely deliver Poland roughly 190 billion zloty (EUR38.9 bn), corresponding to about 3.8% of its GDP, discovers a file

Poland’s present expertise of economic mixture with the EU makes it properly positioned to help, take note the specialists

— Notes from Poland (@notesfrompoland) October 7, 2022

Ukrainian enterprise offered on numerous different worldwide inventory market have really likewise seen their share charges climb. MHP, the most important Ukrainian producer and service provider of fowl and crops, which is offered on the London Stock Exchange (LSE), has really elevated by merely over 13% contemplating that final Thursday.

Meanwhile, IT agency EPAM Systems, offered on the New York Stock Exchange (NYSE), climbed by 5% from Wednesday close to to Friday night time, data fromInvesting com program. The agency has really shed a number of of its features at the moment, but remains to be 2.4% over Wednesday night time’s levels.

This pleasure, nonetheless, didn’t convert proper into features on Ukraine’s very personal securities market, the place the factors PFTS index has really dropped by 1.57% contemplating that Thursday, data fromInvesting com program.

Enthusiasm over a potential tranquility technique, nonetheless, did present as much as enhance Polish enterprise on the GPW, as specialists see this as an important risk for not simply Ukrainian firms but likewise Polish enterprise with a strong existence within the Ukrainian market.

“This is especially true for construction companies and manufacturers of building materials with experience in Ukraine,” Jakub Szkopek, an professional at Erste Securities, knowledgeable Puls Biznesu

He identified Grupa Kęty, a producer of aluminium parts, and constructing and development agency Budimex as firms that stand to realize from Ukraine’s restore. Since Thursday, each enterprise taped surges of their provide charges, with Grupa Kęty up by 5.9% and Budimex by 10.45%,

The WIG20, an index made up of the 20 largest Polish enterprise on the GPW, has really likewise been rising contemplating that Thursday, getting over 5%. Since the begining of the 12 months, the WIG20 has really elevated by over 15%.

It received an additional improve on Monday from Prime Minister Donald Tusk’s assertion– all through a speech on the GWP– of a brand-new monetary development put together forPoland This assisted the Polish main index exceed its earlier all-time excessive.

The technique concentrates on 6 important areas: monetary funding in scientific analysis and analysis research, energy change, up to date improvements, port development and prepare modernisation, a vibrant sources market, and firm participation.

However, doubters stored in thoughts that Tusk’s assertion consisted of an absence of sure brand-new plans that his federal authorities plans to hunt in these areas.

Prime Minister @donaldtusk has really detailed a monetary technique that he claims will definitely help Poland motion from “dreaming of catching up with the most developed countries” to moderately figuring out it’s “possible to overtake those who until recently looked down on us”

— Notes from Poland (@notesfrompoland) February 10, 2025

Notes from Poland is run by a small editorial team and launched by an unbiased, charitable construction that’s moneyed by way of contributions from our viewers. We can chorus what we do with out your help.

Main image credit score scores: Freepik

Alicja Ptak is aged editor at Notes from Poland and a multimedia reporter. She previously helped Reuters.