monsitj

Dear Investor:

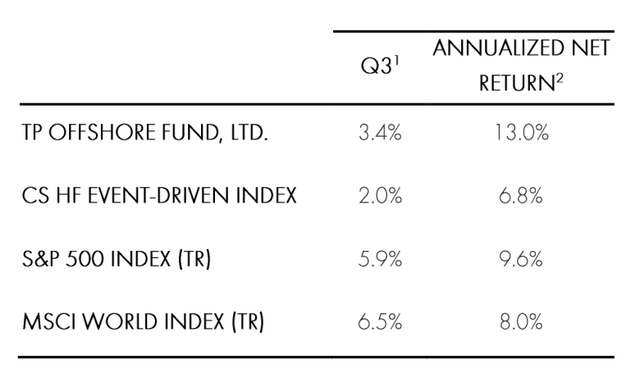

During the third quarter, Third Point (OTCPK:TPNTF) returned 3.9% within the entrance runner Offshore Fund.

OTCPK:TPNTF) returned 3.9% within the entrance runner Offshore Fund.” contenteditable=” incorrect” loading=” careless”>

|

1 Through September 30, 2024. Please word there’s a one-month lag in effectivity confirmed for the CS HF Event-Driven Index 2 Annualized Return from starting (December 1996 for TP Offshore and estimated indices). PLEASE SEE THE BRAND-NEW COLLECTION RETURNS AT THE END OF THIS PAPER. |

The main 5 champions for the quarter had been a private setting in R2 Semiconductor, Pacific Gas andElectric Co (PCG),Vistra Corp (VST), KB Home (KBH), andDanaher Corp (DHR)

The main 5 losers for the quarter, omitting bushes, had been Bath & &Body Works Inc (BBWI),Amazon comInc (AMZN),Advance Auto Parts Inc (AAP),Alphabet Inc(GOOG,GOOGL )and Microsoft Corp.(MSFT)

EVALUATION AND OVERVIEW 1

During the third quarter,Third Point Offshore created beneficial properties of just about 4%, bringing yr -to-date return to 13%, internet of expenses and expenditures. Global fairness markets proceeded their strong effectivity, but returns had been pushed by considerably much more market breadth than over the earlier yr and a fifty p.c. The “Magnificent Seven” routed the broader market (albeit decently) for the very first time contemplating that This autumn 2022. Rate delicate provides and cyclicals dramatically exceeded as {the marketplace} moved its emphasis to the Fed’s long-awaited assuaging cycle. As we highlighted in our Second Quarter letter, our profile has all kinds of economic funding motifs past big cap know-how. These kinds of economic investments in industrials, energies, merchandise, and numerous different housing-sensitive provides led the profile for Q3.

For a number of the just about thirty years I’ve really run Third Point, {the marketplace} has really been essentially climbing up a wall floor of concern. At occasions, the priority transforms to distress, most only recently initially of August, when the Nikkei (NKY:IND) inexplicably tanked roughly 20% in a few days and volatility within the United States took off to just about 70 from 16, all whereas United States markets went down 6%. Many consultants noticed this as a warning that {the marketplace} had much more space to go down which, in the easiest state of affairs, provides had really ended up being “un-investable” by way of the political election. While we took our swellings for a few days, we remained devoted to our placements, took the sight that {the marketplace} turning would definitely proceed, and enhanced our monetary investments in event-driven and value-oriented provides.

Considering political growths over the last few weeks, our staff consider that the potential for a Republican triumph within the White House has really enhanced, which would definitely have a positive affect on specific fields and {the marketplace} typically. We assume the urged “America First” plan’s tolls will definitely increase residential manufacturing, framework prices, and charges of specific merchandise and property. We likewise assume {that a} lower in guideline usually and notably within the lobbyist antitrust place of the Biden-Harris administration will definitely launch efficiency and a wave of firm process. Accordingly, now we have really enhanced specific placements that may achieve from such a state of affairs via each provide and selection acquisitions and stay to alter our profile removed from enterprise that may definitely not. Whatever the tip results of the Presidential political election, now we have really very rigorously researched the Senate races and assume that the Republicans will definitely develop a bulk, limiting the monetary disadvantage of a “Blue Sweep” which could in concept introduce squashing tax obligations, suppressing legal guidelines, and a headwind to growth.

In the financial local weather, we see no proof of financial disaster, slowing down rising value of residing, and an precise charges of curiosity that also requires forward down. We assume wholesome and balanced buyer prices and energetic levels of particular investing should give a liquidity background to take care of market levels. We consider this association is a particularly nice one for event-driven investing, particularly contemplating that a number of our rivals round have really retired or carried on. The risk for menace arbitrage offers and firm process may introduce a golden period for the strategy. At this issue, our gross direct exposures are diminished, now we have average webs, are nicely positioned in our current profile, and may launch contemporary sources as possibilities happen.

Equity Updates

DSV (OTCPK:DSDVF)

During the Third Quarter, we launched a brand-new setting within the Danish merchandise forwarder DSV. DSV has really come a prolonged methodology from its beginnings as a Nordic road-hauler to finish up being the globe’s third largest merchandise forwarder, with a robust efficiency historical past of mixing the fragmented worldwide merchandise forwarding market. We assume the agency has a superb society that’s systems-driven and returns-focused. DSV has really created a roughly 20% EPS CAGR over the earlier ten years and is often recognized because the best-in-class driver, with market- main growth and earnings margins.

DSV turned the main potential purchaser within the public public sale of DB Schenker, a subsidiary of German state-owned Deutsche Bahn AG, and amongst its largest rivals. DB Schenker is comparable in dimension to DSV but simply fifty p.c as profitable. We assume the assimilation and concord seize anticipated from this combine will definitely adjust to a tried and examined playbook and drive incomes improve over of 30%. We have really assessed DSV’s quite a few purchases and noticed that they adjust to a sample of promptly shifting the goal onto DSV’s IT system, selecting low-margin group, and rightsizing the expense framework, resulting in the goal’s margins attending to DSV’s best-in- course margins inside 2 years.

The DB Schenker buy is going on at an intriguing time. Following a period of post-COVID incomes normalization and a chief government officer adjustment, DSV’s provide was buying and selling at an approximate 20% low cost price to each its lower-growth friends and its historic quite a few. Following the cut price, DSV will definitely be the largest gamer in a sector during which vary brings substantial expense and community benefits. An occasion of this blessed inexpensive positioning is that DSV was picked because the particular logistics provider for Saudi Arabia’s NEOM process. We assume the joint endeavor in between DSV and Saudi Arabia will definitely give end-to-end provide chain monitoring, set up transportation and logistic properties, and increase the agency’s incomes energy by round 15% by 2028.

We have really hung round with Jens Lund, DSV’s lengthy time frame COO/CFO that ended up being chief government officer beforehand this yr and have really found him to be laser-focused on producing investor value.Mr Lund made an enticing state of affairs that rising intricacy in worldwide provide chains will definitely revenue DSV, because it monetizes its particular community that ensures functionality and on-time shipments. In the merchandise forwarding market, simple tons, A-to-B transport is hardly profitable. The real money is created from value-added options equivalent to custom-mades clearance, tons mixture and therapy when troubles occur, a core proficiency of DSV. We assume DSV can achieve higher than 100 DKK per share in 2027 and see substantial profit for amongst Europe’s supreme enterprise.

Cinemark (CNK)

Earlier this yr we took a danger in Cinemark, the third largest cinema chain within the united state We assume Cinemark is positioned for underappreciated growth over the next couple of years as the provision of theatrical launches recoils from pandemic- and strike-related headwinds. In enhancement, our staff consider Cinemark will definitely receive share from undercapitalized rivals.

There is not any shortage of doubters in regards to the relocation cinema group. In 2020 the overview for residential film theaters appeared grim: the quick improve of streaming, included with habits changes from the pandemic, referred to as into query whether or not people would definitely ever earlier than most probably to film theaters as soon as once more. Regal Cinemas utilized for private chapter. AMC ended up being a meme provide.

Against this unpromising background, Cinemark has really proven sturdy financial effectivity. Consider that in 2023, counterintuitively, Cinemark reported higher cost-free capital than they carried out in each years earlier than the pandemic. Yet, Cinemark provide went into 2024 buying and selling 70% listed under pre-pandemic levels (a mid-single quantity quite a few on routing 12-month cost-free capital), recommending market people was afraid cost-free capital would definitely go down precipitously and by no means ever recoup. We differ with this sight and assume the multi-year overview for Cinemark has really by no means ever been much more sturdy.

Despite the present success of films equivalent to “Inside Out 2”, 2024 market income are anticipated to finish up at roughly $8.5 billion, over 20% listed under pre-pandemic levels. While quite a few on the market characteristic this to reworking buyer selections, the knowledge exhibits film theaters are a supply-driven market (much more films quantity to much more foot internet visitors), and our staff consider the important automobile driver of weak ticket workplace income has really been a 20% decline in widescreen theatrical launches contemplating that 2019. Importantly, our staff consider that that is pushed by intermittent variables, particularly labor interruptions from the pandemic and consequently the strikes, as an alternative of nonreligious variables. Over the earlier 3 years, ventures proper into particular streaming and day-and-date launches have really confirmed as nicely unlucrative, and the “event” ingredient of a staged launch has really confirmed necessary to safeguarding main ability and producing franchise enterprise IP that may drive future incomes. As an end result, all 6 vital Hollywood workshops have really devoted to ramp amount again as much as pre-COVID levels, and in addition pureplay banners like Amazon and Apple (AAPL) have really began launching films particularly in film theaters. We anticipate provide to rebound following yr and get to the pre-COVID diploma by 2026, which we anticipate to drive a whole therapeutic in ticket workplace income as decently diminished per-film participation is balanced out by value rises and growth in giving in income. In our sight, short-term headwinds from the 2023 Hollywood strikes had been concealing this important nonreligious change in film provide, which supplied us the possibility to launch the monetary funding at a dislocated appraisal.

Cinemark’s incomes outperformance versus its friends by way of the pandemic has really not been a crash; whereas AMC and Regal have really been shutting shows and underinvesting to take care of liquidity, Cinemark utilized what we view as a strong annual report and unrelenting focus on expense effectiveness to obtain repairs capex of their film theaters whatever the examined working background. As an end result, the agency has really taken management of 100 bps of market share, a fad we view as lasting as friends stay to justify their affect no matter a boosting market.

Given the substantial therapeutic in ticket workplace, risk for ongoing share achieve and excessive working make the most of of enterprise, we consider Cinemark can produce over $4 of FCF/share in 2026, which is meaningfully higher than pre-pandemic levels and should increase within the adhering to years. The agency revealed it can definitely set out its long-lasting sources allowance methodology in very early 2025, consisting of a re-introduction of a returns, which should be useful of an ongoing re-rating within the shares.

Credit Updates

Corporate Credit

Third Point’s firm debt publication created a 3.5% gross return (3.4% internet) all through the quarter, including 50 foundation point out effectivity. That locations year-to-date effectivity at +8.3% gross (8.2% internet), in accordance with the excessive return index. The summertime verified something but horrible for top return, with {the marketplace} returning 5.3% all through the quarter, in accordance with the strong effectivity of the S&P 500. Spreads tightened up partially with a number of the return pushed by the lower in price of curiosity.

While some monetary process has really been revealing indicators of slowing down, the protecting make-up of the current excessive return market with a excessive combine of higher debt and temporary interval has permit the costs tailwind bewilder such worries. The least costly top quality fields of {the marketplace} have really executed finest, sustained by each mushy/no landing assumptions, along with 2 favorable events within the beleaguered telecommunications space. Telecom/ wire have really been dangerous entertainers yr to day because of overhang from the event of FWA (often known as “wireless cable”) and enhanced fiber construction, however the trade re-rated materially on 2 gives. First, Lumen Technologies (LUMN) revealed that its Level 3 (LVLT) subsidiary was doing a fiber framework assemble to maintain AI growth. Our hostility to nonreligious lower (a number of LUMN is melting copper framework) maintained us out of the circumstance but the AI fairy dust triggered an infinite rerating of LUMN monetary debt and fairness. These higher security charges consequently promoted a variety of switch to re-finance components of the sources framework and increase the trail.

Second, Verizon (VZ) revealed a proposal to acquire Frontier Communications (FYBR), a purchase order which the fund took benefit of by way of its monetary funding in FYBR monetary debt. This buy, focused at elevating’s VZ fiber affect, has really triggered vast revaluation of fiber retail networks that we consider is correct. While we stay to anticipate to see FWA swiftly deteriorate non-upgraded wire and notably copper’s share of the low-end broadband market, the VZ cut price emphasizes the price of the higher finish affect.

Much has really been mentioned “creditor on creditor violence”– duty monitoring gives the place suppliers have the power to lower their expense of sources or increase liquidity paths through the use of part of lenders a possibility to go up the sources pile on the expenditure of their brethren. These are sometimes a lot much less than completely no quantity gives for lenders and largely benefit financial enrollers, and a a fantastic deal wind up reorganizing anyhow after paying substantial expenses to attorneys and consultants. As an end result, we’re seeing an rising number of monetary establishment “co-op agreements”, which supply to keep away from enrollers from controling lenders. While now we have really usually been extraordinarily cautious to position ourselves on the profitable facet of those altercations, we enjoyment of to see the rise of those co-op contracts. Co- ops could make buying extraordinarily apprehensive circumstances much more eye-catching as a result of the truth that you possibly can depend on that an aged duty doesn’t receive leapfrogged by a jr duty. Additionally, it guarantees that these co-ops will definitely pace up the speed of restructurings, contemplating that enrollers will definitely have restricted selections to get time to remain away from fairness write-offs.

While the excessive return market has really rallied, now we have really remained to find likelihood in a few places. We have really bought proper into a variety of credit score scores which have really skilled duty monitoring gives. These firms had been enhancing, and recapitalization was thorough satisfactory to “fix” the annual report. We are likewise discovering value in a variety of loan-only frameworks which have really delayed the rally within the excessive return market.

Structured Credit

The Structured Credit profile added 20 foundation elements within the quarter, pushed by Treasuries and debt spreads rallying. While the Treasury market has most probably overstated the scale of attainable Fed value cuts for this yr, we capitalized on that market house window and exercised our telephone name civil liberties on 8 reperforming house mortgage gives this quarter. We valued a brand-new house mortgage securitization in August with AAA’s costs inside 5%, nearer to monetary funding high quality returns we noticed in 2019 and really early 2020. As insurance coverage supplier and unique credit score scores funds proactively search monetary funding high quality menace, now we have really had the power to accessibility, in our sight, eye-catching expense of funds all through organized debt funds. Given the lower in brand-new house mortgage sources and freshly launched mortgage-backed protections, now we have really seen a renovation within the technological background for present protections and funds. We assume this vibrant gives us a profit as we stay to market and maximize our present house mortgage profile.

On the stomach muscle entrance, returns have really remained to press all through all possession programs. Spreads have really continued to be enormously the identical on our rental automobile stomach muscle profile, which we bought beforehand this yr at twin quantity returns. This has really been a positive occupation for the profile as we perceive substantial carry month-to-month. We have really been monetizing our stomach muscle placements proper into this debt unfold tightening up and are investing much more time on CLOs and CMBS as debt events start to play out.

As we encounter geopolitical unpredictability and an unpredictable charges of curiosity environment, we put together for intriguing monetary funding possibilities within the Fourth Quarter as financiers search to safeguard a robust 2024 effectivity.

Private Position Update: R2 Semiconductor

In March, we revealed that we had been sustaining R2 Semiconductor, a private agency in our Third Point endeavors profile that we bought over 15 years beforehand, because it appeared for to use its trademarked innovation versusIntel The innovation, established by R2’s Founder David Fisher, connects to included voltage guideline, which performs an necessary half in reducing energy utilization by built-in circuits whereas retaining merchandise integrity.

At completion of August, Intel revealed that its disagreement with R2 had really been completely resolved in all territories. The phrases are private, but we’re happy with the tip outcome, which triggered a substantial achieve within the setting for the quarter.

Business Updates

Matthew Ressler signed up with Third Point’s unique debt group in Q3. Prior to signing up with Third Point,Mr Ressler invested 4 years at Apollo Global Management as a financier within the Private Equity Group, with an emphasis within the innovation, industrials and buyer fields.Mr Ressler likewise previously operated at Moelis & & Company as an Associate within the firm’sInvestment Banking division after beginning his job at JPMorganChase Mr. Ressler holds an MBA from Harvard Business School and a B.A from Dartmouth College.

Ted Smith-Windsor signed up with Third Point in Q3, concentrating on debt monetary funding possibilities. Prior to signing up with Third Point,Mr Smith-Windsor operated at Silver Point Capital the place he focused on monetary investments in troubled debt and distinctive circumstances. He began his job at CPPIB the place he focused on monetary investments secretive fairness and debt.Mr Smith-Windsor is a grad of the University of Toronto, the place he made a B.Comm in Finance and Economics.

Maureen Hart signed up with Third Point in Q3 as Head ofConsultant Relations Prior to signing up with Third Point,Ms Hart was a Partner atAlbourne America Over her 12 years at Albourne, she supervised many of the firm’s North American clients, dealt with a world 50-person group, and led the corporate’s cross-selling marketing campaign.Ms Hart began her job in Investor Relations at ForePoint Partners, overlaying fairness lengthy/brief funds. She completed from the University of Connecticut with a B.A. in English.

Thomas Anglin signed up with Third Point in Q3 as Head of Marketing and Business Development for the Asia-Pacific space. Prior to signing up with Third Point,Mr Anglin was a Managing Director at Goldman Sachs in Hong Kong the place he supervised safety of hedge fund supervisors in Asia and was answerable for Goldman Sachs’ Australian Prime Brokerage group. Previously, he held aged administration placements at Goldman Sachs in New York, UBS Investment Bank in New York and Sydney, and was an equities and property investor atOspraie Management Mr. Anglin started his job in fairness by-products gross sales and buying and selling at Macquarie Bank in Australia and transferred to New York with Macquarie in 2000. He obtained a B.Com from Monash University in Melbourne and is a CFA charterholder.

Sincerely,

Daniel S. Loeb CHIEF EXECUTIVE OFFICER

Editor’s Note: The recap bullets for this write-up had been picked by Seeking Alpha editors.

Editor’s Note: This write-up critiques a number of protections that don’t commerce on a big united state trade. Please acknowledge the threats linked with these provides.