I’m an Indian workers member in an MNC detailed in London inventory market. My enterprise expanded workers member provide selection technique in 2019 to day and I signed up for it. Kindly permit me acknowledge simply the best way to decide the tax obligation positive aspects or loss from the sale of such shares detailed in worldwide alternate. They have truly subtracted alternate deal tax obligations whereas buying shares as nicely. For the profit shares they put aside, my organisation has truly subtracted TDS based mostly on piece costs appropriate in India revealing it as income.

Arun

Shares which aren’t detailed in an recognized inventory market in India are handled as “unlisted shares” for the operate of calculation of assets positive aspects underneath the Income- tax obligation Act, 1961. Accordingly, in case you are holding the shares for a length of 24 months or much more, after that the ensuing assets achieve (if any sort of) from sale of such shares would definitely be pertained to lasting assets positive aspects. This would definitely be taxed at 12.5 p.c if supplied on or after July 23, 2024.

Section 48 of the Income- tax obligation Act, 1961, allows discount of prices which had been sustained “wholly and exclusively” for the operate of switch whereas calculating the lasting assets positive aspects. Hence, the alternate deal tax obligations billed on the market of shares may be subtracted whereas coming to taxed assets positive aspects.

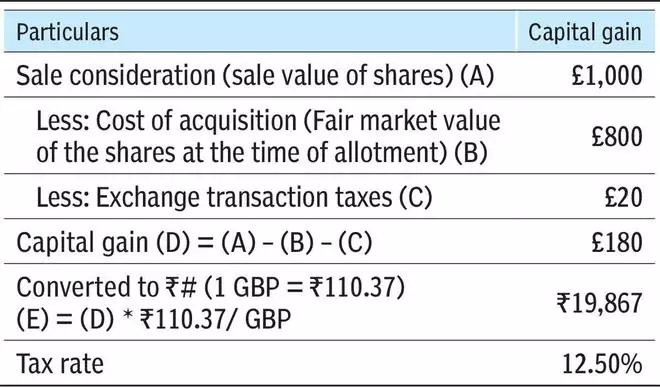

Since these offers stay in worldwide cash, the assets achieve/loss would definitely require to be remodeled to INR as given in Rule 115 for the targets of assets achieve calculations. Capital achieve/loss is calculated as complies with (proven making use of instance worths):

#For the operate of image, State Bank of India telegraphic switch buying value as on September 30, 2024, has truly been utilized in accordance with Rule 115 of the Income- tax obligation Rules, 1962, on the presumption that the shares are supplied in October 2024.