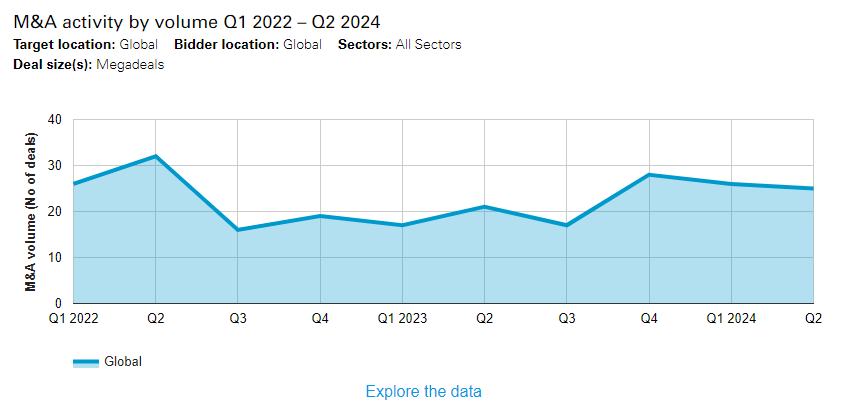

Megadeals had been securely on the schedule in H1 as much more safe rising price of residing and interesting value determinations enhanced convention room self-confidence. An general of 51 deals worth more than US$5 billion each had been revealed all through the preliminary 6 months of the yr– the best quantity on this charge brace contemplating that H1 2022.

Effective July 1, 2023, the underlying Mergermarket info sustaining the M&A Explorer was mixed with Dealogic info to generate a way more whole picture of the M&A market. M&A Explorer discourse launched previous to July 1, 2023 would possibly reference info that doesn’t mirror this mix.

For much more info on the necessities behind cut price addition, click here

Global cut price numbers mirror a think about the main finish of {the marketplace}. Deal value was up yr on yr, whereas amount stayed restrained. In full, bargains bought to US$1.65 trillion during H1— 21 % greater than in H1 2023. An general of 18,010 revealed bargains, on the identical time, was the second-lowest number since the pandemic

The United States cut price market plainly managed activity. Seventeen of the main 20 bargains of the yr up till now all focused United States corporations operating all through quite a lot of markets. Three of those bargains had been valued at higher than US$ 30 billion, signifying restored self-confidence in transformational offers regardless of regulative headwinds.

United States credit score scores mortgage suppliers enroll with pressures

The largest crucial deal noticed the United States’s 2 largest credit score scores mortgage suppliers enroll with pressures, in Capital One’s website requisition ofDiscover Financial Services The US$ 35.3 billion all-stock acquisition is among the many largest bargains to occur within the financial options market contemplating that the financial scenario. If the discount finishes, it can actually produce a monetary and financing massive environment friendly in taking over opponents JPMorgan Chase and Citigroup.

Regulatory difficulties look forward to as Washington will increase its evaluation of industry-defining offers. If the discount does proceed, it would set off a wave of mixture amongst tiny to medium-sized monetary establishments– a bit of {the marketplace} underneath boosting stress from climbing opponents and financing costs. M&A supplies an interesting alternative for these corporations to boost or defend market share.

AI search drives expertise megadeals

The drive to acquire AI talents sustained an extra website megadeal within the preliminary fifty % of 2024: United States chip model software program program enterprise Synopsys’s US$ 33.6 billion acquisition of Ansys, a producer of AI-augmented simulation software program program. The cut price, which waits for conclusion, is the most important to occur within the trendy expertise area contemplating that Broadcom’s US$ 69 billion acquisition of VMWare in late 2023.

The tie-up mirrors want for considerably intricate chip model trendy expertise utilized by market leaders reminiscent of Advanced Micro Devices, Intel and Nvidia.

The acquisition by Synopsys adheres to an extra vital expertise megadeal revealed within the preliminary fifty % of the yr: Hewlett Packard Enterprise’s US$ 14.3 billion acquisition of Juniper Networks, an extra cut price pushed by the demand to spice up efficiency with bettering AI talents.

The seek for AI is a big motorist in United States expertise M&A now. An general of 1,036 transactions worth US$166.4 billion focused United States expertise corporations all through the preliminary fifty %, standing for the best half-year cut price value contemplating that H1 2022.

United States shale race gasoline bargains

The United States energy area likewise carried out extremely all through the preliminary fifty %. Several costly offers concentrating on oil and gasoline corporations altered arms, the most important of which noticed United States oil producer Diamondback Energy settle for receive shale oil opponentEndeavor Energy Resources The cut price comes as corporations race to develop their existence within the worthwhile Permian Basin, which extends Texas and New Mexico and is the most important oilfield within the United States.

The US$ 26 billion cut price will definitely increase Texas- based mostly Diamondback to the third-largest oil producer within the container, behind supermajors ExxonMobil andChevron It adheres to ExxonMobil’s industry-defining US$ 60 billion requisition of Pioneer Natural Resources revealed final October, which provided to boost opponents for prime boring locations.

The legislation concern

United States antitrust regulatory authorities have truly made apparent of their goal to safe down on bargains they consider anti-competitive. Navigating a progressively intricate regulative ambiance will definitely in consequence be very important to urgent bargains over the road.

As a presumably industry-defining cut price, Capital One’s buy of Discover Financial appears readied to immediate excessive regulative evaluation. The cut price has truly been referred to as the preliminary big examination for President Biden’s monetary establishment merging legislation contemplating that the administration launched an exec order in 2021 that triggered the Department of Justice to consider a extra complete collection of variables when analyzing antitrust issues.

Synopsys’s buy of Ansys likewise appears almost certainly to acquire regulative evaluation because of the transformational nature of the discount. China’s antitrust guard canine, the State Administration for Market Regulation, or SAMR, is almost certainly sustaining a cautious eye on the potential tie-up, which likewise requires authorization from United States, EU and UK merging authorities.

An boosting regulative think about bargains is influencing cut price timings. The dimension in between information and conclusion is increasing, presently balancing higher than 8 months, in keeping with theLondon Stock Exchange Group Dealmakers will definitely require to accumulate a sharper understanding of myriad regulative calls for to take care of the M&A process on track.

Outlook: Will the bull run proceed?

The flurry of megadeals revealed all through the preliminary fifty % of the yr talks with a mixture of firm self-confidence, stable annual report, climbing up securities market and much more tasty charge of curiosity. Just as considerably, present megadeals will not be restricted to a few markets nevertheless mirror clear crucial inspiration all through quite a lot of markets– an extra favorable indication.

While the M&A therapeutic shouldn’t be performed down, difficulties keep when driving prematurely. The stage to which regulatory authorities would possibly or may not safe down on bargains is a big concern, and the run of pricy offers rests on precisely how the regulative panorama progresses over the approaching yr. Some clients would possibly stay on the sidelines until the picture involves be extra clear.

The upcoming United States political election would possibly likewise set off dealmakers to pump the brakes until a sense of political safety returns. A priority likewise stays concerning whether or not the numerous tie-ups revealed within the preliminary fifty % of the yr mirror a continuing monetary recuperation, or whether or not they are going to actually confirm to be standalone bargains. The reality that H1 amount stays delicate means that activity is manipulated in the direction of the main finish of {the marketplace}, with dealmaking between to lowered components but to get pace.

While unpredictability stays, the return of the megadeal within the preliminary fifty % signifies a restored constructive outlook amongst {industry} and is a positive indication for dealmakers wanting to barter within the 2nd fifty % of the yr.