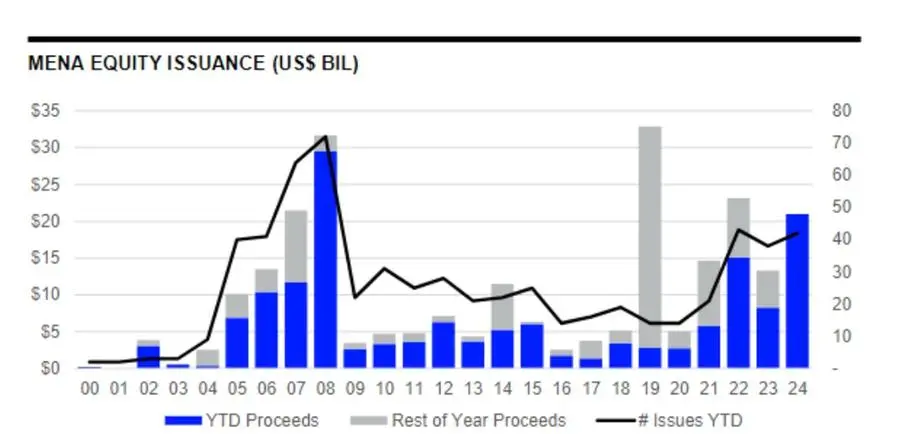

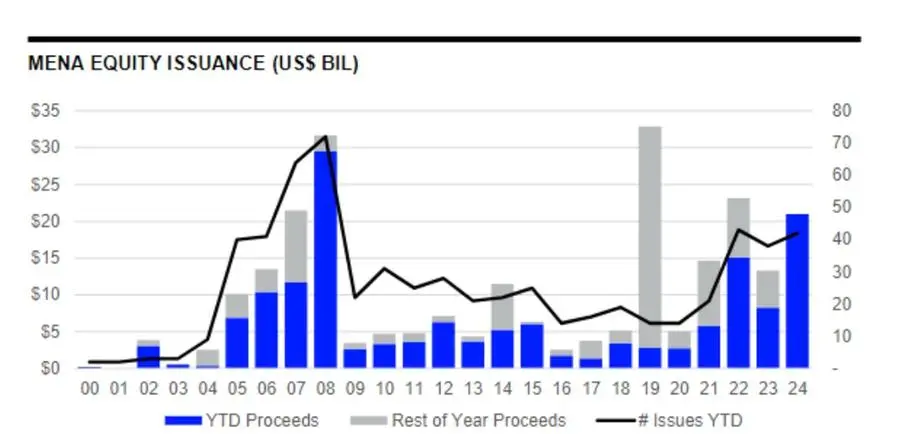

MENA fairness funding markets (ECM) elevated $21 billion in fairness and equity-related issuances within the preliminary 9 months of 2024, improved by a $12.3 billion provide sale by Saudi Arabia’s Aramco.

This notes a 154% rise from 12 months in the past levels and the best preliminary nine-month total within the space on condition that 2008, info from the London Stock Exchange Group (LSEG) revealed.

The number of issues enhanced 11% from in 2015.

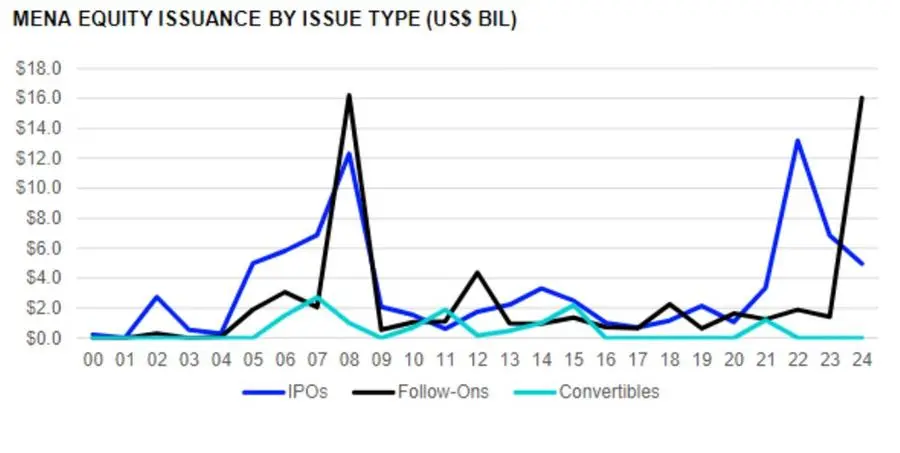

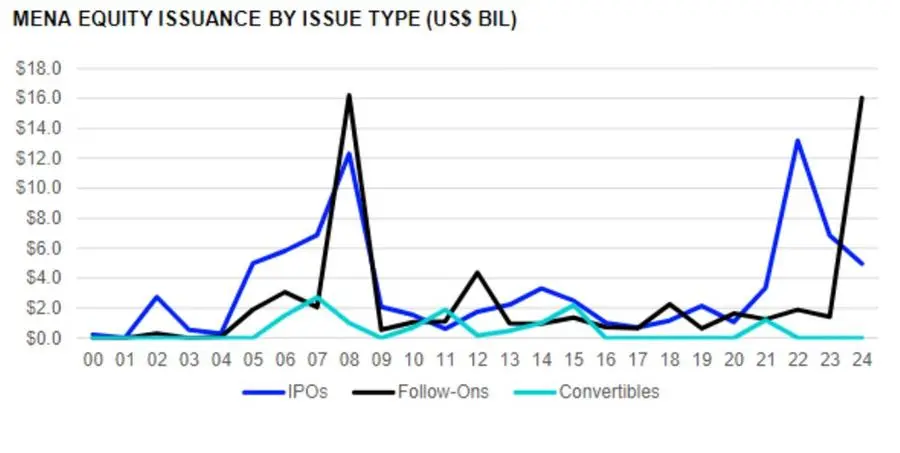

Initial public choices (IPOs) made up 24% of process, whereas follow-on issuance made up 76%.

There was a complete quantity of 30 IPOs all through the preliminary 9 months of 2024, on the identical degree with in 2015’s diploma, and a whole not gone past all through any sort of January to September length on condition that 2008.

They elevated a blended $5.0 billion, 28% a lot lower than in 2015.

The UAE’s NMDC Energy, elevated $876.7 million in its inventory alternate launching on Abu Dhabi Securities Exchange in September, the most important Stock Launch within the space all through the preliminary 9 months of 2024.

Proceeds elevated from follow-on choices received to a 16-year excessive of $16 billion, principally improved by a $12.3 billion provide sale by Saudi Arabia’s Aramco in June.

The energy & & energy trade was most energetic with firms rising a blended $14.3 billion, making up 68% of total fairness funding raisings within the space within the preliminary 9 months of 2024.

Retail adhered to, making up 12%.

Saudi Arabia led the desk with the Aramco cut price. Savola Group moreover had a follow-on sale for $1.75 billion.Dr Soliman Abdel Kader Fakeeh Hospital Company completed an Stock Launch netting $763.5 million.

The UAE had one follow-on issuance by ADNOC Drilling that elevated $934 million. IPOs consisted of these of Alef Education Consultancy LLC,Parkin Co PJSC and Spinneys 1961Holding Co Plc.

EFG Hermes took high place within the MENA ECM underwriting group desk all through the preliminary 9 months of 2024, with a 9% market present total earnings masking $1.88 billion from 8 issuances.

Riyadh Bank adhered to with 8% market share and total earnings of $1.7 billion from 2 issuances.

(Writing by Brinda Darasha; modifying by Seban Scaria)

brinda.darasha@lseg.com