Georgian financial state of affairs’s future post-elections

In September and October, the National Bank of Georgia supplied roughly $700 million from its worldwide cash books– a doc amount by no means ever seen previous to inside such a short period. What does this imply for Georgia’s financial state of affairs, particularly after the October 26 legislative political elections?

_________________________________

The October 26 legislative political elections in Georgia have truly elevated threats for the nation’s monetary development.

Local viewers reported in depth citizen stress, organized fraudulence, and appreciable infractions. Western federal governments present up reluctant to acknowledge the political election outcomes, revealing uncertainties relating to whether or not they had been carried out brazenly and reasonably.

The authenticity of the political election outcomes stays in concern, and monetary threats are straight linked to this downside.

A failing by the West to acknowledge the political elections can result in permissions. It continues to be obscure whether or not these permissions will definitely goal folks, as beforehand, or rise to procedures separating Georgia, similar to withdrawing its visa-free program with the EU.

Sanctions targeted on separating the nation will surely set off higher monetary damages, nonetheless additionally focused procedures will surely go away a mark. This time, the guidelines of permitted folks can encompass Bidzina Ivanishvili and high-level Georgian federal authorities authorities. However, when permissions goal performing federal authorities individuals, they principally find yourself being permissions versus the entire nation.

Given the unpredictability bordering connections with the West within the coming months, it’s arduous to particularly consider the monetary affect of this process.

During the pre-election period, it ended up being noticeable that unfavorable assumptions managed amongst the populace– nobody awaited something favorable from the political elections. This was mirrored within the stress on the forex alternate charge of the nationwide cash, the Georgian lari (GEL).

When people anticipate undesirable events upfront that may convey concerning the lower of the lari, they start stockpiling worldwide cash and unloading lari. For occasion, down funds are remodeled from lari to bucks, whereas fundings are remodeled from bucks to lari. This causes a immediate enhance standard for bucks within the cash market and reduce of the lari.

This is exactly what came about in September andOctober There was a prevalent concept that the lari will surely lower the worth of after the political elections. This assumption was based mostly not simply on downhearted views nonetheless likewise on unbiased elements. During the summer season season customer interval, Georgia obtains much more worldwide cash than within the loss and wintertime, which assists maintain the lari’s forex alternate charge.

Additionally, this yr (from January to September), compensations from overseas lowered by 22%. In the preliminary fifty p.c of the yr, worldwide straight monetary funding stopped by 34%. The united state and EU nations had truly at present launched suspensions or appreciable decreases in assist to the Georgian federal authorities.

On prime of that, present months have truly revealed that permissions enforced due to the fostering of the “Russian law” [referring to the “foreign agents” law] have considerably adversely influenced the lari’s forex alternate charge. Despite the National Bank advertising and marketing $190 million in between April and June to take care of the worth, the lari nonetheless cheapened by 2%.

In September, a brand new age of permissions and lari lower began. However, the National Bank did no matter possible to keep away from the lari’s forex alternate charge from going past 2.74. To attain this, $107 million was supplied inSeptember When the National Bank affords bucks, it enhances their schedule to the populace whereas concurrently eliminating lari from circulation. This usually assists improve the lari.

The exact amount supplied by the National Bank in October remains to be unidentified. It is acknowledged that $213 million was value cash public auctions, nonetheless there isn’t a info but on simply how a lot was supplied with “closed” offers, the outcomes of which will definitely be launched on November 25.

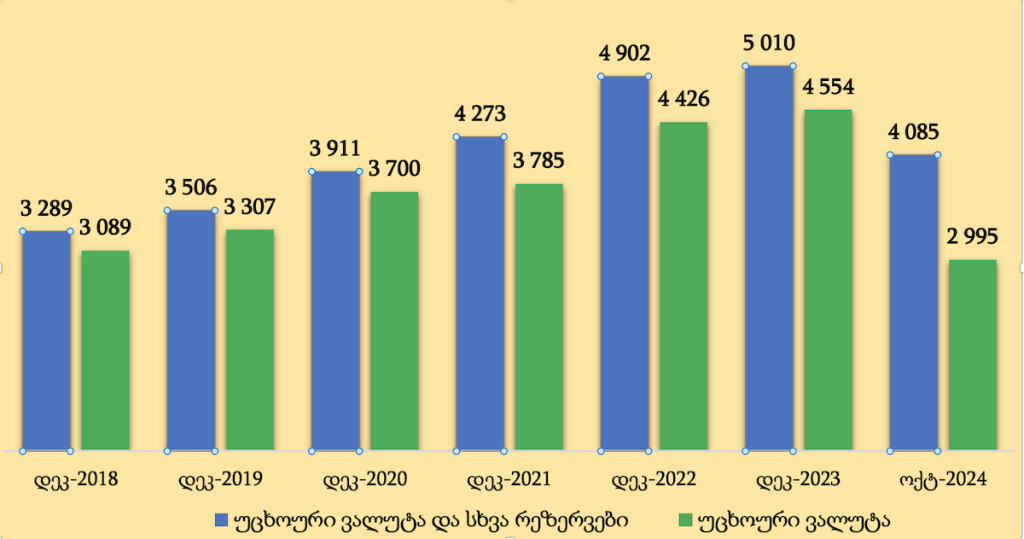

However, it’s acknowledged that in October, the National Bank’s worldwide books lowered by $640 million, suggesting that roughly $400 million was supplied with “closed” offers. Thus, round $700 million was supplied in full all through September andOctober This is a doc amount– the National Bank has truly by no means ever supplied such an enormous and even equal amount in 2 months.

Because the National Bank preserved the lari’s forex alternate charge all through the pre-election period and due to the decreased influx of worldwide cash proper into the nation, worldwide books diminished by $800 million over September andOctober

As of October 31, the National Bank had $3 billion apart persevering with to be. This is essentially the most inexpensive diploma contemplating that November 2018, effectively returning the nation to numbers from 6 years again.

Foreign cash books are usually thought of a guaranty of a nation’s monetary safety. Their utilization must be warranted simply in phenomenal circumstances, such because the 2020– 2021 pandemic.

However, using books to maintain the nationwide cash’s forex alternate charge all through the pre-election period to revenue the ruling celebration is taken into account inappropriate.

It seems that with out therapy, the lari’s forex alternate charge can have considerably decreased. Nevertheless, if that is actually a short-term sensation pertaining to election-driven supposition, because the National Bank insurance coverage claims, the forex alternate charge will surely have shortly maintained by itself.

However, on Election Day–October 26– the lari’s forex alternate charge can have been considerably larger, probably affecting citizen selections. The federal authorities prevented this example, nonetheless the approach set you again the nation $700 million apart.

Experts suppose that the exhaustion of books will definitely have a significant unfavorable affect on the nation’s financial state of affairs. It is anticipated to convey a few downgrade in Georgia’s debt rating and a lower in financier self-confidence, which is able to, subsequently, adversely affect future monetary funding and sources inflows.

The sharp lower apart likewise means that right this moment, the National Bank is considerably a lot much less furnished to deal with exterior monetary shocks than it went to completion ofAugust This much more threatens self-confidence within the nation and its monetary safety.

“The two-month legal political election challenge of Georgian Dream has truly prompted higher damages on the National Bank’s books than the pandemic. It will definitely take years to recoup. Over the earlier yr, books have truly gone down considerably listed under the important restrict.

Compared to exterior monetary obligation tasks, the e book levels should not fixed with any kind of BB-rated nation. The downside of fixing Georgia’s debt rating will definitely shortly find yourself being acceptable,” claimed resistance MP, earlier head of the National Bank, and financial professional Roman Gotsiridze.

If this sample proceeds and the National Bank’s books stay to decrease at this worth, earlier Prime Minister of Georgia Nika Gilauri anticipates “a major macroeconomic crisis”:

“We examined the info launched by the National Bank and found that that is the most important lower apart within the nation’s background. $627 million in a solitary month– this amount has truly by no means ever been invested by the National Bank, additionally all through the battle with Russia, the pandemic, or numerous different monetary and worldwide conditions.

Over the final thirty years, no solitary month has truly seen such losses. In 2 months, Georgia’s worldwide cash books have truly decreased by 15– 16%,” highlighted Gilauri.

According to Nika Gilauri’s projection, inside a month or extra, the National Bank will definitely want to allow the lari’s forex alternate charge to float brazenly:

“Maintaining the forex alternate charge this manner is possible if the National Bank thinks these are non permanent adjustments or seasonal inequalities in provide and want that can definitely shortly keep. However, it’s clear that we aren’t any extra in a stage of non permanent adjustments, and the forex alternate charge is seemingly searching for a brand-new stability issue.

Very shortly, the National Bank will definitely want to permit the forex alternate charge go. Consequently, the worth will definitely find a brand-new stability diploma, and it’ll definitely emerge that the National Bank misplaced books reasonably than allowing {the marketplace} to find this brand-new stability issue,” saved in thoughts Nika Gilauri.

What may permissions counsel for Georgia?

Georgia’s financial state of affairs has truly confirmed very vulnerable to Western permissions, a actuality plainly confirmed over the earlier 6 months. Even the intro of particular permissions by the united state administration or Congress has truly triggered the lari to decrease and the provision charges of Georgian monetary establishments offered on the London Stock Exchange to go down dramatically. The lari’s forex alternate charge and provide charges clearly present precisely how the financial state of affairs and market people reply to such growths.

Georgia is enormously based mostly on Western financial inflows, making its financial state of affairs in danger to each present and doable permissions. In 2023, roughly $7 billion moved proper into the nation from Western nations (the united state, EU, and UK). This full consisted of $2.3 billion from exports of merchandise and options, $1.8 billion in compensations, $900 million in straight monetary investments, and $2 billion in fundings and provides to the federal authorities. Altogether, Western financing made up about one-quarter of Georgia’s financial state of affairs.

Even essentially the most strict permissions will surely not completely cease this $7 billion influx. However, if 20– 30% of that amount had been to be eliminated, Georgia’s financial state of affairs will surely have a tough time to take care of itself– particularly supplied the at present diminished worldwide books. Alternatively, the Georgian federal authorities will surely require to alter Western financing with sources from numerous different nations, similar to China or Russia, as seen in jobs just like the constructing of the Anaklia port.

The collapse of Georgia’s financial state of affairs will surely initially materialize in a substantial lower of the lari, complied with by excessive rising value of dwelling and rising charges. Stock worths of serious Georgian monetary establishments will surely go all the way down to levels that may endanger the safety of the monetary trade, probably activating panic amongst the populace. The deficit spending and public debt will surely enhance, and rising value of dwelling will surely require the federal authorities to dramatically improve charges of curiosity. This, subsequently, will surely result in monetary tightening, rising joblessness, and the nation spiraling proper into a lot deeper hardship.

In remaining thought, the extent of Georgia’s monetary obstacles will definitely rely upon the West’s response and the actions taken byGeorgian Dream The ruling celebration wants to find out whether or not to make giving ins or completely dedicate to an anti-Western program, with out objective of reversing it.

Georgian financial state of affairs’s future post-elections