- Disruptive development develops a companies or product that adjustments markets and sectors or considerably enhances one thing that at present existed.

- Cathie Wood is amongst its main backers by providing market quite a few ETFs which can be common.

- The provides we will definitely take a look at are Lilium, Origin Materials, and Aeva Technologies.

- Looking for workable career ideas to browse the present market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Disruptive development improves sectors by using modern fashionable expertise to revamp current markets or produce completely brand-new ones. As an final result, it modifies market traits and market frameworks, generally entailing a excessive diploma of risk and the expedition of brand-new improvements.

Cathie Wood attracts consideration as a number one quantity on this location, largely together with her assortment of ETFs known as the ARKs, which consider shopping for turbulent companies. These ETFs have truly obtained super attraction, with some flaunting excellent returns all through specific durations.

They are as complies with:

- ETF ARK Innovation (NYSE:-RRB-

- ETF Genomic Revolution (NYSE:-RRB-

- ETF Fintech Innovation (NYSE:-RRB-

- ETF Next Generation Internet (NYSE:-RRB-

- ETF Autonomous Technology & & Robotics (NYSE:-RRB-

These ETFs have truly additionally extended their attain to Europe and are famous on common exchanges, consisting of Germany’s Deutsche Bӧrse Xetra, the London Stock Exchange, Amsterdam’s CBOE, Italy’s Borsa, and Switzerland’s 6 Swiss Exchange, with a compensation worth of 0.75%.

Some exceptional turbulent companies include Tesla (NASDAQ:-RRB-, Nvidia (NASDAQ:-RRB-, Roku (NASDAQ:-RRB-, Baidu (NASDAQ:-RRB-, Zillow (NASDAQ:-RRB-, Teladoc Health (NYSE:-RRB-, and so forth.

Now, permit’s research a few turbulent provides that use appreciable upside potential on the market, albeit with substantial risk. It is a area supreme only for hostile financiers with a well-diversified profile.

1. Lilium

Lilium (NASDAQ:-RRB- is a German aerospace agency famous on Nasdaq that establishes the Lilium Jet, an electric-powered airborne automotive with the power of journey.

The agency is altering the town flexibility area with its concept {of electrical} air taxicabs by offering fast, zero-emission transport whereas aiding cities stay with out blockage.

It only in the near past elevated $114 million to maintain its procedures and preliminary journey examinations. It has truly moreover completed the very first stage of mixture screening for the Lilium Jet’s electrical energy system– a necessary motion in direction of journey drawback authorization.

With further money cash than monetary obligation on its annual report, Lilium delights in financial versatility because it capabilities to accredit its merchandise. This money cash placement may be important, supplied the capital-intensive nature of the aerospace market and the recurring development stage.

Lilium will definitely report its outcomes for the quarter on November 19.

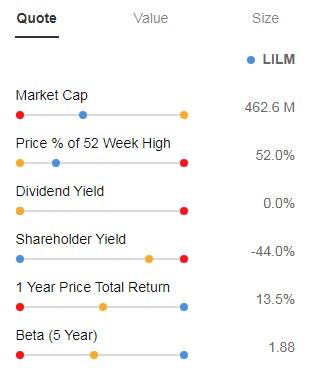

Its Beta of 1.88 mirrors its shares relocating the exact same directions as {the marketplace} nonetheless with considerably much more volatility.

Source: InvestingPro

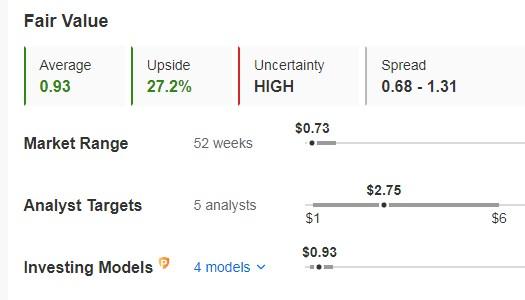

Lilium’s shares are underestimated on a fundamental foundation. Specifically, its cheap value is, in the beginning of the week, 27.2% over the share value, particularly at $0.93.

The market approximates an peculiar risk of round $2.75 for these shares.

Source: InvestingPro

2. Origin Materials

Origin Materials (NASDAQ:-RRB- functions to advertise the worldwide change in direction of lasting merchandise by altering petroleum-based merchandise with decarbonized decisions. The agency is devoted to reducing carbon exhausts and producing merchandise with lowered ecological impact.

A 12 months after it launched its growth in establishing a process for 100% recyclable plastic container parts, the agency has truly safeguarded a Memorandum of Understanding (MOU) for two years of producing and anticipates this association to create $100 million in earnings starting in very early 2025.

The agency’s chief government officer, Rich Riley, confirmed his self-confidence within the agency’s risk by buying an additional 300,000 shares.

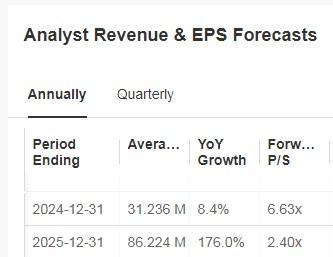

On November 7, it supplies its quarterly accounts. Earnings are anticipated to reinforce by 8.4% this 12 months and 176% by 2025.

Source: InvestingPro

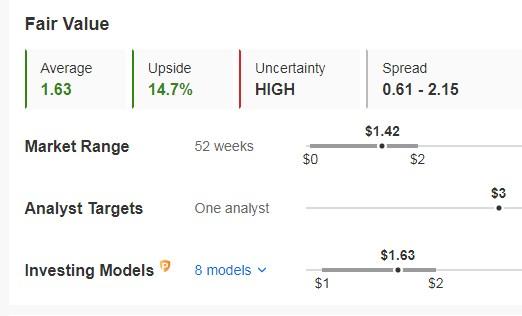

Origin’s shares are principally underestimated, with an affordable value 15% over the present share value of $1.63 on the week’s start.

The market approximates an peculiar risk of round $3 for its shares.

Source: InvestingPro

3. Aeva Technologies

Aeva Technologies (NYSE:-RRB- is a US-based agency that develops, makes, and markets LiDAR selecting up techniques and selecting up software program software companies.

The agency supplies companies which can be further dependable and reasonably priced than decisions, which may promote mass fostering, inserting itself to drive turbulent modification.

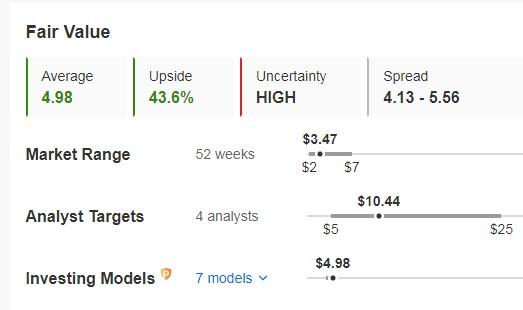

Aeva only in the near past launched that its fashionable expertise will definitely be made use of by a big European automotive producer to verify its automated automotive techniques. It anticipates its fashionable expertise to make it doable for quick distinction in between mounted and vibrant objects, like pedestrians or vehicles. Furthermore, its fashionable expertise has truly been picked by a number one united state nationwide safety security firm and for Germany’s automated practice program.

Source: InvestingPro

It will definitely launch its revenues document for the quarter on November 7. The agency preserved a robust money cash placement, with a complete quantity of $285.2 million on the finish of the quarter.

Its shares are buying and selling 43.6% (in the beginning of the week) listed beneath its cheap value or value to rules, which will surely go to $4.98.

The potential designated by the market will surely go to $10.44.

Source: InvestingPro

***

Disclaimer: This write-up consists for informative targets simply; it doesn’t make up a solicitation, deal, steerage, advise or referral to spend due to this it isn’t meant to incentivize the acquisition of possessions by any means. I want to advise you that any kind of form of property, is assessed from quite a few viewpoints and is extraordinarily harmful and consequently, any kind of monetary funding selection and the linked risk stays with the financier.