“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us.”– Charles Dickens, A Tale of Two Cities

Travel retail in Hainan and South Korea, together with a tender Mainland China residential market, remained to tug out L’Or éal’s North Asia space, the French magnificence group disclosed on Friday all through a post-annual outcomes incomes cellphone name.

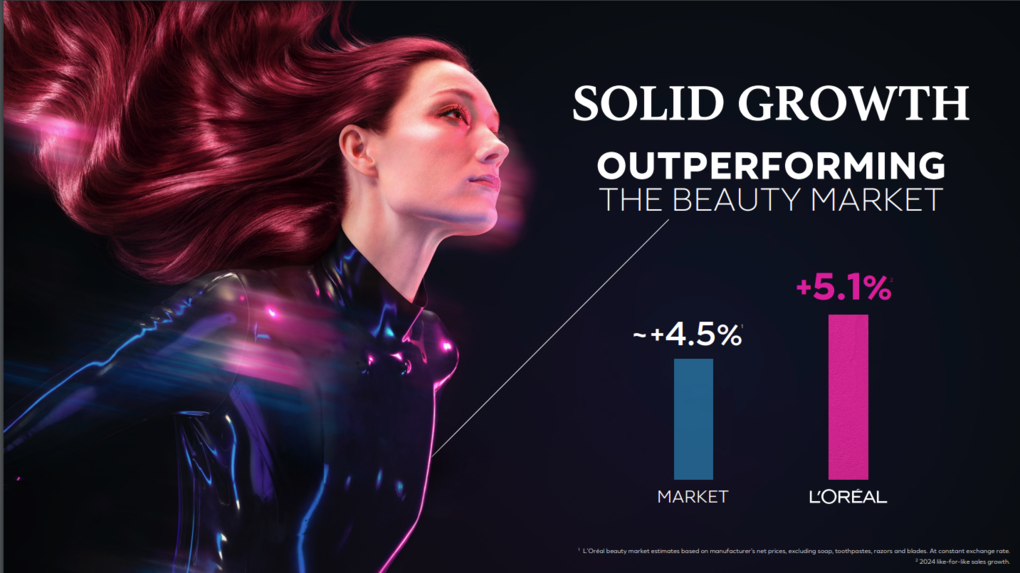

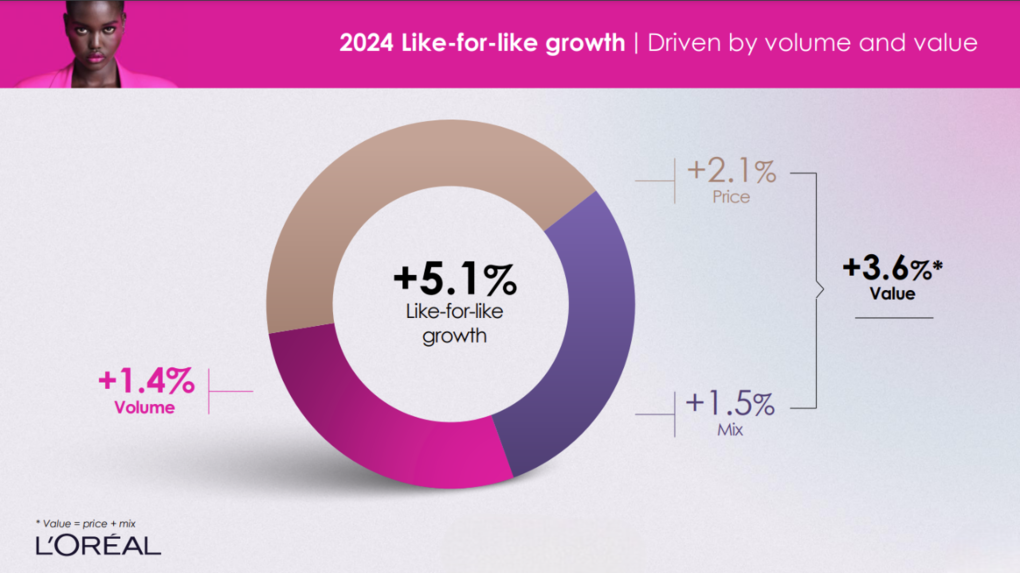

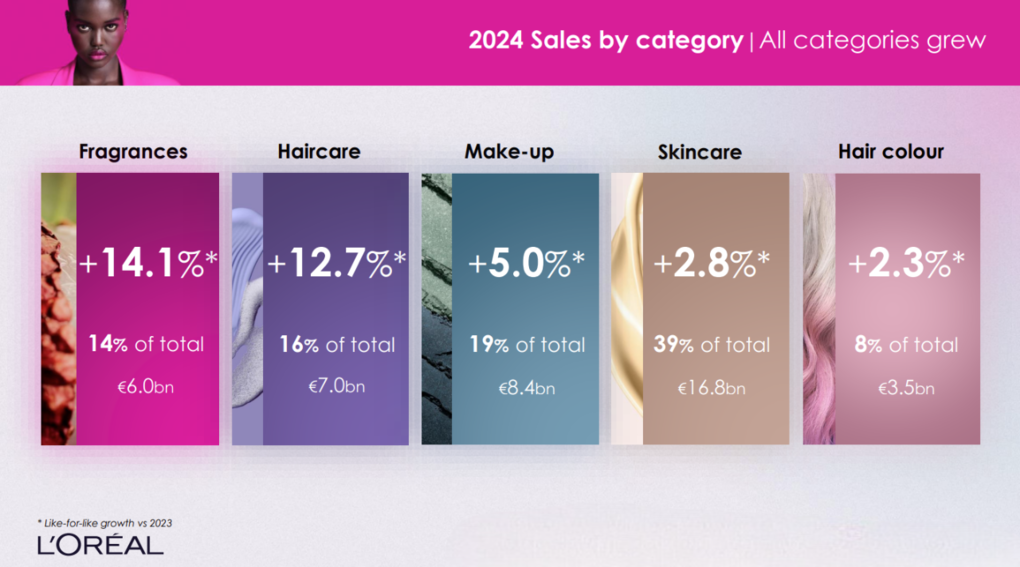

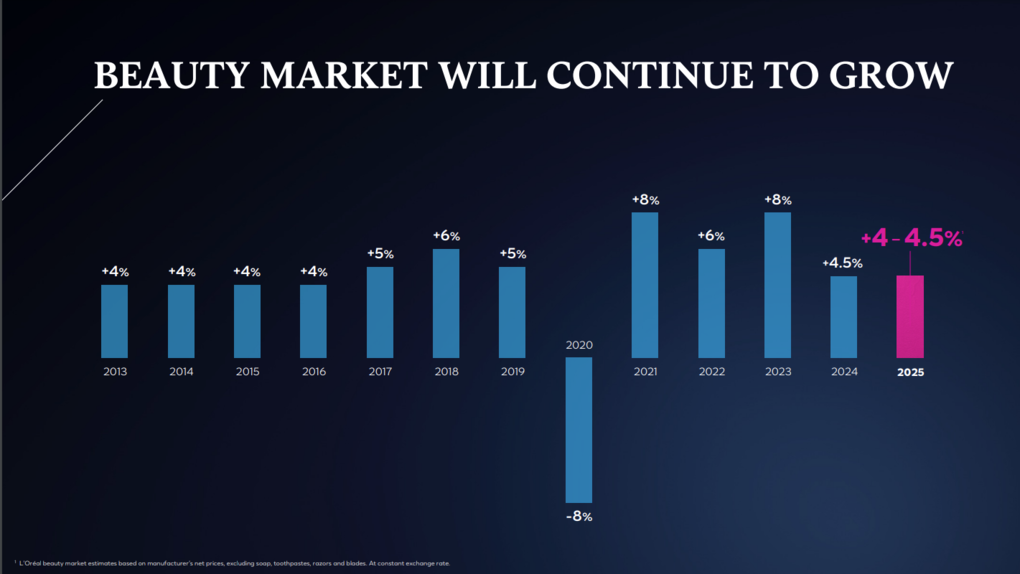

As reported, L’Or éal revealed +5.6% (reported; +5.1% like-for-like) year-on-year gross sales growth to EUR43.47 billion in what it referred to as“another year of outperformance in a normalising global beauty market” However, This autumn growth was merely +4.5% (+2.5% like-for-like) listed beneath the +4.4% like-for-like London Stock Exchange settlement, in line with Reuters.

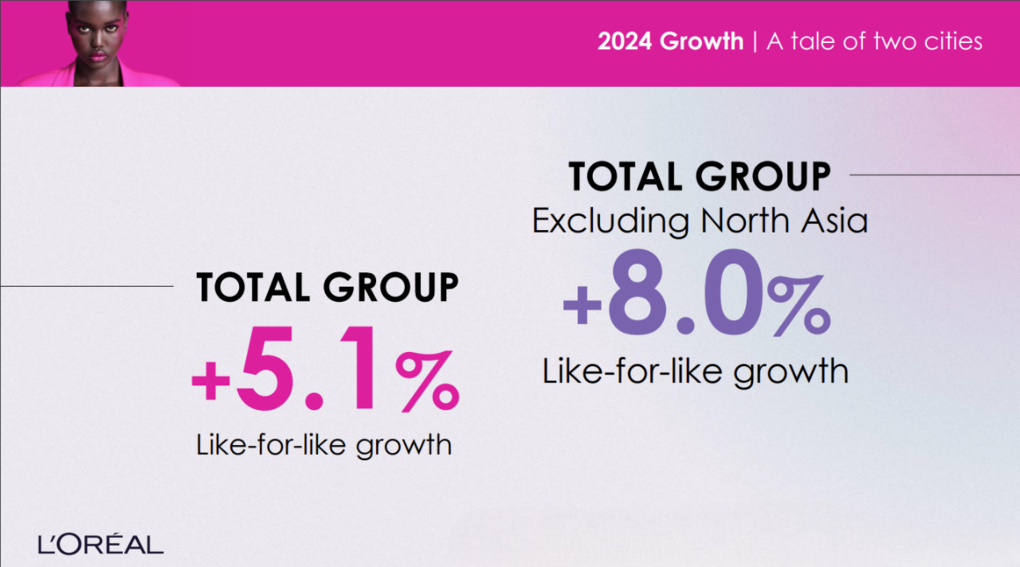

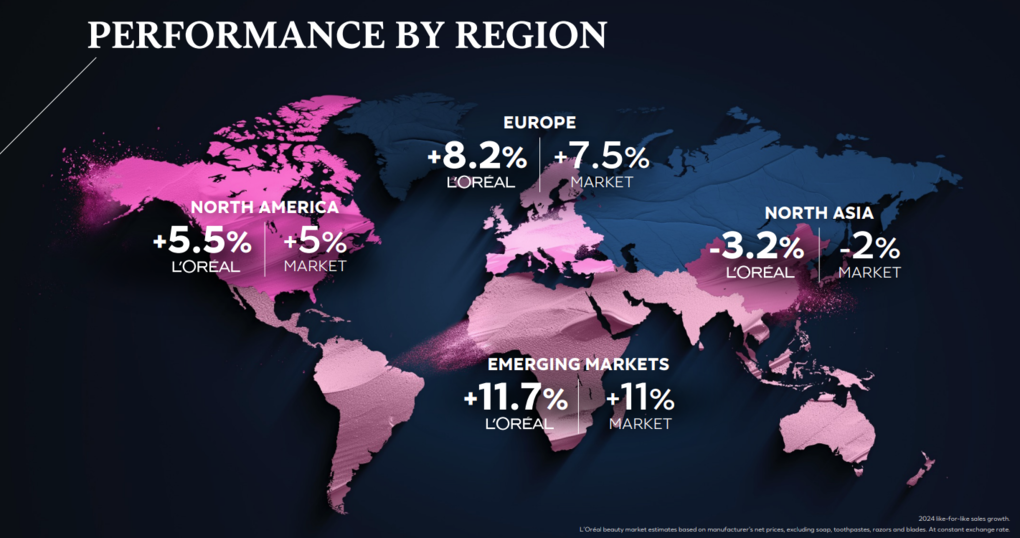

The enterprise created like-for-like growth in all areas apart from North Asia (-3.4% for the yr; -3.1% This autumn), which was adversely influenced by the touring retail obstacles [both reseller-related] in Hainan and South Korea, the community’s 2 important markets of present years.

L’Or éal Executive VP & & CFO Christophe Babule made use of a Dickensian insinuation to clarify the totally different ton of cash of North Asia et cetera of the globe, commenting: “2024 was the tale of two cities, and our like-for-like growth stood at +5.1%. But excluding North Asia, it amounted to a very strong +8%. All other regions contributed to that growth, led by Europe and our emerging markets.”

And whereas Dickens’ widespread ‘It was the best of times, it was the worst of times’ opening up line from A Tale of Two Cities actually didn’t pretty use, there’s little query precisely how enormously North Asia’s effectivity differed from its geographical equivalents.

“Momentum was strong in three of our regions, helping offset the softness in North Asia… [where] sales declined by -3.2% on a like-for-like basis. This was due to the continued weakness in both Mainland China and travel retail,” Babule claimed.

Perhaps the CFO was making ready for the French rugby group’s off-colour second-half effectivity in shedding versus England a day afterward when he included: “But ’24 was also a tale of two halves as a strong first half was followed by a softer second.”

Once as soon as extra, North Asia touring retail and Mainland China have been vital to that variant. Overall growth within the worldwide cosmetics market alleviated from a “dynamic” +5.5% within the preliminary fifty p.c to an additional modest +4.5% within the full yr, an anticipated stagnation as inflation-driven costs started to loosen up.

But the type of that stagnation different from what the enterprise had really anticipated, Babule claimed. “On the one hand, developed markets, especially Europe, held up better than anticipated. On the other hand, the Chinese ecosystem, which we had hoped will at least stabilise, did not.”

Hainan and Korean touring retail gross sales plunge from 2022 levels

In Asia touring retail, general magnificence market growth went from -3% within the preliminary fifty p.c to minus -10% within the full yr, pushed by each Hainan and Korea, Babule mentioned. “Together, they’re down -35% from 2022 ranges, after which we selected to accompany this lower in consumption with a discount in our inventory in commerce.

“We believe that the resizing of the travel retail business in Asia is now largely behind us, and I’m happy to say that we are entering ’25 with healthy inventory levels across the region.”

The North Asia obstacles evaluated on L’Or éal Luxe and particularly its important skincare profile, in line with L’Or éal Luxe President Cyril Chapuy.

“In North Asia, in a still challenging market context at minus -7%, we continued to gain market share evolving at minus -5.5%,” he claimed.

Skincare offered a special picture, he claimed with a tricky market context deeply influenced by the situation in North Asia, stabilized by quite a lot of important favorable minutes consisted of the world wide launch of Lanc ôme Genifique Ultimate– “executed to perfection everywhere”– the launch of Kiehl’s on Amazon, and the stable effectivity of present procurements Youth to the People, Takami and Aesop.

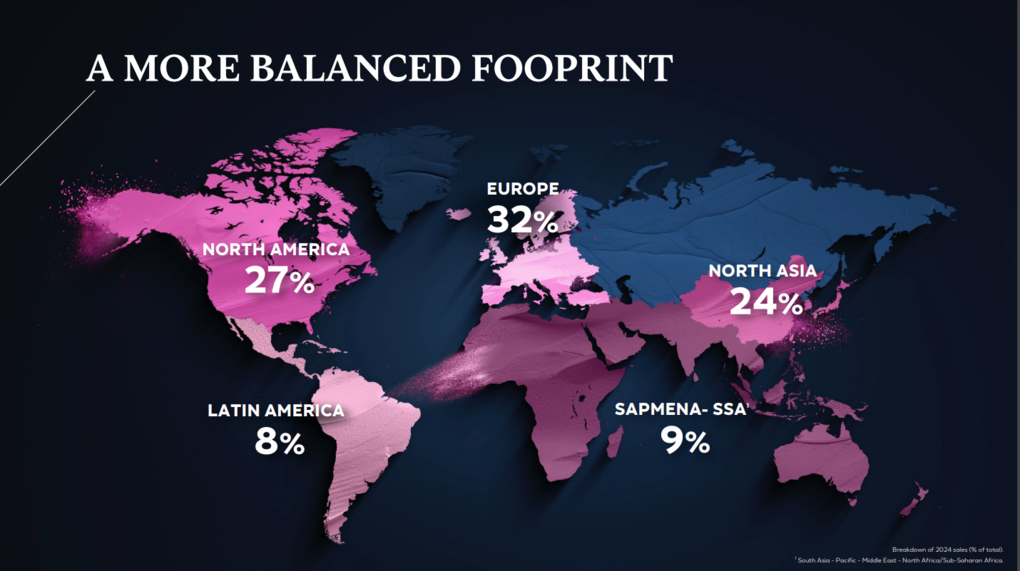

Hieronimus stored in thoughts the enterprise’s direct publicity to the Chinese neighborhood had really considerably decreased over the earlier 2 years, at present representing 17% of gross sales, nicely listed beneath the 2022 diploma. “We continue to believe in its future but are less dependent on it as our global footprint has become a lot more balanced,” he noticed.

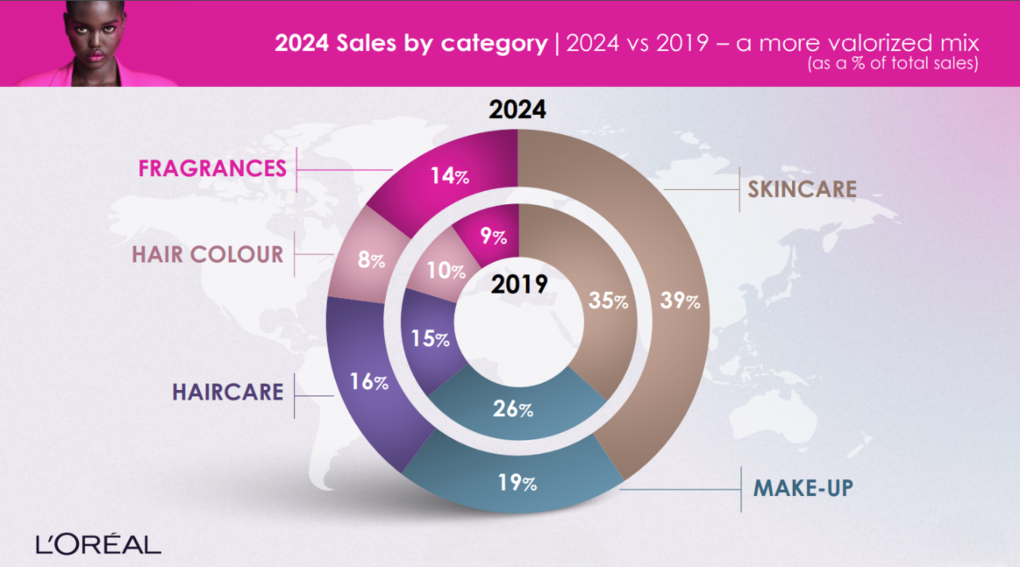

That rebalancing has really been highlighted by the motivating growth of arising markets which added to 36% of growth and at present characterize over 16% of gross sales, surpassing Mainland China for the very first time, Hieronimus claimed.

“The results I’m most proud of this year is our financial performance, our capacity to keep our P&L virtuous and deliver steady improvement in operating profit despite the turbulences in China and travel retail,” he commented.

“Our gross and working margins reached new document highs. At 20%, our working margin was up 20 foundation factors or 40 foundation factors if we exclude the impression of Aesop [acquired in April 2023]. On a comparable foundation, our model gas elevated by ten foundation factors.

“As a group, we have once again proven our ability and determination to consistently deliver on our promise to steadily improve our operating margins, all the while providing the fuel for our long-term growth. We are confident in the future, and we increased the dividend to our shareholders by +6%.”

Asked all through the inquiry and answer session relating to L’Or éal’s “exposure” to the touring retail community and the enterprise’s apparent cautiousness whatever the anticipated adjustment of sell-in and sell-out in North Asia, Babule reacted: “You’ve seen that the consumption in travel retail has been decreasing now for more than two years in a row. And of course, the weight of travel retail [internally] now has decreased quite sharply.”

However, he talked about, L’Or éal’s touring retail effectivity in Europe and North America remains to be boosting and Hainan stands for a lot lower than 1% of group gross sales.

“So the exposure to those difficult markets has dramatically decreased. That’s why we are confident that in 2025 we should expect – we don’t know when – probably a progressive recovery in the coming semesters.”

Hieronimus mentioned that the truth he continued to be “not super positive” relating to touring retail was partially pushed by a variation in between traveler web site visitors growth and buyer investing, preserving in thoughts: “We’re particularly seeing Hainan not growing in terms of sell-out.”

He included: “We see passengers rising [globally]. The pattern of air visitors could be very constructive. It ought to develop by +9% once more in 2025. We suppose, by the best way, that the market might be very dynamic within the west. In the east, over the vacations, the Hainan gross sales for all classes, not simply magnificence, have been nonetheless destructive. Korea is managing their stock. So… we’re hoping for a stronger rebound.

“We suppose we will have constructive sell-out throughout the yr. We have a wholesome stock, however we don’t see journey retail being a strong development engine, significantly firstly of the yr. The extra we transfer into beneficial comparatives, the higher it might be. But I might say that one of many dangerous outcomes of This autumn is that it went again into destructive territory once we have been hoping it wouldn’t.

“What’s important for us is – and that’s very key – is that we’re paying a lot of attention to inventory management to make sure that we stay always on the healthy side. And that’s where we are today.” ✈