Olivier Le Moal

Author’s Note: This is our month-to-month sequence on Dividend Stocks, usually printed throughout the first week of every month. We scan the universe of roughly 7,500 shares listed and traded on U.S. exchanges and use our proprietary filtering requirements to select 5 comparatively safe shares that might be shopping for and promoting cheaper compared with their historic valuations. Some sections throughout the article, like “Selection Process/Methodology,” are repeated each month with few modifications. This is intentional along with unavoidable, as that’s essential for the model new readers to have the power to conceptualize the strategy. Regular readers of this sequence would possibly skip such sections to steer clear of repetitiveness.

************

Markets are on a regular basis unpredictable. However, to be a worthwhile investor, fortunately, we don’t should know exactly the place the market goes. We think about it isn’t doable to catch the exact bottom (or the peak), so it’s greatest to take a place repeatedly and persistently in good, secure dividend-paying shares when their valuations are participating. Against this backdrop, holding some cash reserves and dry powder ready to deal with any state of affairs is important.

The most vital function of this sequence of articles is to shortlist and highlight companies which have a secure historic previous of paying and elevating dividends. In addition, we demand that these companies assist strong fundamentals, carry low debt, and are provided at a relatively cheaper valuation. These DGI shares won’t be going to make anyone rich in a single day, however when your function is to comprehend financial freedom by proudly proudly owning shares that may develop dividends over time, meaningfully and sustainably, then you definitely’re on the right place. These lists won’t be basically ideas to buy nonetheless a shortlist of doable candidates for added evaluation. The goal is to take care of our buy guidelines helpful and dry powder ready so we’re ready to make use of the prospect when the time is appropriate. Besides, we predict each month, if nothing else, this analysis can highlight some nuggets that may have in some other case skipped our consideration.

Every month, we start with roughly 7,500 shares that are listed and traded on U.S. exchanges, along with over-the-counter (OTC) networks. Using our filtering requirements, the preliminary guidelines is shortly narrowed to roughly 700 shares, largely dividend-paying and dividend-growing. From thereon, by the usage of quite a few info elements, along with dividend historic previous, payout ratios, revenue progress, debt ratios, EPS progress, and lots of others., we calculate a “Dividend Quality Score” for each stock that measures the relative safety and sustainability of the dividend. In addition to dividend safety, we moreover search cheaper valuations. We moreover demand that the chosen companies have a longtime enterprise model, secure dividend historic previous, manageable debt, and an investment-grade credit score standing.

This month, we highlight three groups with 5 shares each which have a median dividend yield (as a bunch) of three.62%, 5.77%, and 7.46%, respectively. The first guidelines is for conservative and risk-averse merchants, whereas the second is for merchants searching for higher yields nonetheless nonetheless wanting comparatively safe dividends. The third group is for yield-hungry merchants nonetheless comes with an elevated hazard, and we urge merchants to coach warning.

Notes: 1) Please phrase that after we use the time interval “safe” in relation to shares and investments, it should be interpreted as “relatively safe” because of nothing is completely safe in investing. Even though we present solely 5 to 10 shares in our remaining guidelines, one must have 15–20 shares at a minimal in a well-diversified portfolio.

2) All tables on this text are created by the author till explicitly specified. The stock info have been sourced from quite a few sources just like Seeking Alpha, Yahoo Finance, GuruFocus, Morningstar, and CCC-List (Dividend Radar).

The Selection Process

Note: Regular readers of this sequence would possibly skip this half to steer clear of repetitiveness. We embrace this half (partially) for model new readers to supply the required background and perspective. Readers can also study a additional detailed rationalization of the targets and the selection course of in our weblog submit here.

Criteria to Shortlist:

- Market cap > $8 billion (some exceptions might be made)

- Dividend yield > 1.0% (some exceptions are made to include top of the range nonetheless lower yielding companies)

- Daily widespread amount > 100,000

- Dividend progress earlier 5 years >= 0.

By making use of the above requirements, we obtained spherical 600 companies.

Narrowing Down the List

As a major step, we want to eradicate shares which have decrease than 5 years of dividend progress historic previous. We cross-check our current guidelines of over 600 shares in the direction of the guidelines of so-called Dividend Champions, Contenders, and Challengers initially outlined and created by David Fish. Generally, the shares with higher than 25 years of dividend will enhance are known as dividend Champions, whereas shares with higher than ten nonetheless decrease than 25 years of dividend will enhance are termed Contenders. Further, shares with higher than 5 nonetheless decrease than ten years of dividend will enhance are known as Challengers. Furthermore, since we want numerous flexibility and wider choice at this preliminary stage, we embrace some companies that pay dividends lower than the S&P500 nonetheless in some other case have a stellar dividend report and rising dividends at a fast tempo.

After we apply all the above requirements, we’re left with 375 companies on our guidelines. However, to this point on this guidelines, we’ve demanded 5 or additional years of fixed dividend progress. But what if a company had a very safe report of dividend funds nonetheless didn’t improve the dividends from one 12 months to a unique? At events, just a few of those companies are foreign-based companies, and ensuing from foreign exchange fluctuations, their dividends might appear to have been cut back in US {{dollars}}, nonetheless actually, that’s in all probability not true the least bit when checked out throughout the exact foreign exchange of reporting. At events, we might current some exceptions when a company might have cut back the dividend to this point, nonetheless in some other case, it seems compelling. So, by pleasant some conditions, roughly 70 additional companies had been thought-about to be on our guidelines. We identify them class ‘B’ companies. After along with them, we had a whole of 445 (375 + 70) companies that made our first guidelines.

We then imported the various info elements from many sources and assigned weights based mostly totally on completely completely different requirements as listed beneath:

- Current yield: Indicates the yield based mostly totally on the current worth.

- Dividend progress historic previous (number of years of dividend progress): This provides information on what variety of years a company has paid and elevated dividends on a continuing basis. For shares beneath the category ‘B’ (outlined above), we consider the general number of consecutive years of dividends paid barely than the number of years of dividend progress.

- Payout ratio: This signifies how comfortably the company pays the dividend from its earnings. We need this ratio to be as little as doable, which could level out the company’s talent to develop the dividend eventually. This ratio is calculated by dividing the dividend amount per share by the EPS (earnings per share). The cash-flow payout ratio is calculated by dividing the dividend amount paid per share by the cash circulation generated per share.

- Past five-year and 10-year dividend progress: Even though it’s the dividend progress value from the earlier, this does level out how briskly the company has been able to develop its earnings and dividends throughout the present earlier. The present earlier is likely one of the greatest indicator that we’ve to know what to anticipate throughout the upcoming years.

- EPS progress (widespread of earlier 5 years of progress and anticipated subsequent 5 years’ progress): As the earnings of a company develop, higher than probably, dividends will develop accordingly. We will consider the exact EPS progress of the sooner 5 years and the estimated EPS progress for the next 5 years. We will add the two numbers and assign weights.

- Chowder amount: So, what’s the Chowder amount? This amount has been named after well-known SA author Chowder, who first coined and popularized this situation. This amount is derived by together with the current yield and the earlier 5 years’ dividend progress value. A Chowder number of “12” or additional (“8” for utilities) is taken into consideration good.

- Debt/equity ratio: This ratio will inform us in regards to the agency’s debt load in relation to its equity. We all know that an extreme quantity of debt can lead to most important points, even for well-known companies. The lower this ratio, the upper it’s. Occasionally, we uncover this ratio to be detrimental or unavailable, even for well-known companies. This can happen for a myriad of causes and isn’t on a regular basis a trigger for concern. This is why we use this ratio along with the debt/asset ratio (lined subsequent).

- Debt/asset ratio: This ratio will inform us in regards to the debt load in relation to the company’s complete property. In almost all circumstances, this ratio could be lower than the debt/equity ratio. Furthermore, this ratio is important because of, for some companies, the debt/equity ratio simply isn’t a reliable indicator.

- S&P’s credit score standing: This is the credit score standing assigned by the rating firm S&P Global and is indicative of the company’s talent to service its debt. This rating might be obtained from the S&P website online.

- PEG ratio: This will also be known as the worth/earnings-to-growth ratio. The PEG ratio is taken into consideration to be an indicator if the stock is overvalued, undervalued, or fairly priced. A lower PEG might level out {{that a}} stock is undervalued. However, PEG for a company might differ significantly from one reported provide to a unique, counting on which progress estimate is used throughout the calculation. Some use earlier progress, whereas others might use future anticipated progress.

- Distance from 52-week extreme: We want to select companies that are good, secure companies however as well as are shopping for and promoting at cheaper valuations presently. They may be cheaper ensuing from some short-term down cycle or some combination of harmful info or simply having a nasty quarter. This criterion will help carry such companies (with a cheaper valuation) near the very best, as long as they excel in several requirements as properly. This situation is calculated as (current worth — 52-week extreme) / 52-week extreme.

- Sales or Revenue progress: This is the widespread progress value in annual product sales or revenue of the company over the past 5 years. An group can solely develop its earnings vitality as long as it might presumably develop its revenue. Sure, it might presumably develop the earnings by chopping costs, nonetheless which will’t go on with out finish.

Downloadable Dataset:

Below, we provide a hyperlink to the desk with associated info on virtually 400 shares. Readers can receive this desk for added analysis. Please phrase that the desk is sorted by “Total Weight” or “Initial Quality Score.”

File-for-export_-_5_DGI_-Sept_2024.xlsx

Selection Of The Top 50

We will first carry down the guidelines (of about 400) to roughly 50 names by automated requirements, as listed beneath. In the second step, which is often handbook and subjective, we’re going to carry the guidelines all the way in which all the way down to about 15.

- Step 1: First, take the very best 20 names from the above desk (based mostly totally on complete weight or prime quality ranking). At events, some enterprise segments are prone to get overcrowded on the prime, so we take the very best two (or three) and ignore the rest.

- Step 2: As a second step, we’re going to take the very best 10 names based mostly totally on the perfect dividend yield. When it includes dividend yield, some enterprise segments are often overcrowded. So, we’re going to take the very best two (or a most of three) names from any single enterprise part. We take the very best 10 shares after the sort to the last word guidelines.

- Step 3: Now, we’re going to sort our guidelines based mostly totally on five-year dividend progress (highest on the prime) and select the very best 10 names.

- Step 4: Not all companies have a 10-year streak of dividend progress, nonetheless many do. We will sort our guidelines based mostly totally on 10-year dividend progress (highest on the prime) and select the very best 10 names.

- Step 5: We moreover want to give priority to shares that are rated highest relating to credit score standing. So, we’re going to sort the guidelines based mostly totally on the numerical weight of the credit score standing and select the very best 10 shares with the most effective credit score standing. Again, we’re cautious to not have too many names from the equivalent sector.

- Step 6: Lastly, as a result of the determine of the sequence suggests, we want to have some names that might be shopping for and promoting cheaper in comparison with their historic valuation. So, we select the very best ten names with the perfect low value. However, they might presumably be shopping for and promoting low value for merely the fallacious causes, so we ought to be cautious that they meet our completely different prime quality requirements.

From the above steps, we now have a whole of 70 names in our remaining consideration. However, the subsequent shares appeared higher than as quickly as:

Stocks that appeared twice: ADP, CHDN, CI, DHI, MSFT, VOYA (6 duplicates)

Stock that appeared thrice: NKE (2 duplicates)

After eradicating ten duplicates, we’re left with 62 (70-8) names.

Since there are a variety of names in each enterprise part, we’re going to protect a most of two or three names (from the very best) from anyone part. Furthermore, if the dividend yield was too low (< 0.70%), we’d barely take away them at this stage till the enlargement potential is extraordinary. After some pruning, we’re left with 46 names. The prime names from each sector/enterprise part are launched:

Financial Services, Banking, and Insurance:

Banks-Regional:

Financial Services — Others: (MS), (BEN), (ARCC)

Security & Exchanges –

Asset Management/ Inv Bank –

Business Services/ Consulting:

Conglomerates:

(CSL)

Industrials:

Transportation/ Logistics:

(UPS)

Chemicals:

Materials/Mining/Gold:

Materials — others:

Mining (other than Gold): (RIO)

Gold:

Defense:

None

Consumer/Retail/Others:

Cons-discretionary: (NKE)

Cons-Retail: (TJX), (DKS), (QSR)

Communications/Media

Healthcare:

Healthcare Ins: (CI)

Healthcare Services:

Technology:

(MSFT), (QCOM), (LRCX), (CSCO)

Energy:

Oil & Gas (prod. & exploration): (EOG), (CTRA)

Pipelines/ Midstream: (MPLX), (ENB)

Utilities:

Housing/ Construction:

Home Building: (LEN)

Building Material: (OC), (VMC)

Construction & Engg:

REIT:

(AMH).

Final Step: Narrowing Down To Just Five Companies

In this step, we assemble three separate lists of 5 shares each, with completely completely different items of targets, dividend income, and hazard ranges.

The lists are:

1) Relatively Safe (Low-yield) Dividend guidelines,

2) Moderately High Dividend List,

3) Ultra High Dividend List, and

4) A blended guidelines of the above three (duplicates eradicated).

Out of the very best 50 (or 48 this time), we make our judgment calls to make these three lists, so principally, the alternate options are based mostly totally on our evaluation and perceptions. So, whereas most of the filtering until now was based mostly totally on automated requirements, the ultimate step is subjective. We try to make each of the three lists extraordinarily diversified amongst quite a few sectors and enterprise segments and try to guarantee that the safety of dividends matches the final hazard profile of the group. We really encourage readers to do extra evaluation on the highlighted names.

Nonetheless, listed beneath are our three remaining lists for this month:

Final A-List (Relatively Safe Income):

Criteria for this group:

- The yield for the group is between 2.75% and 4.25%.

- At least 4 names with ‘A’ rated.

- Solid observe report of dividends and progress.

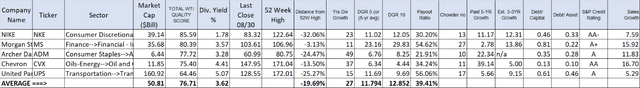

Average yield: 3.62%

Table-1A: A-LIST (Conservative Income)

We suppose this set of 5 companies (throughout the A-List) would sort a secure diversified group of dividend companies that could be fascinating to income-seeking and conservative merchants, along with retirees and near-retirees. The widespread yield is 3.34%, which is sort of 2.7x of what the S&P 500 pays. The widespread dividend historic previous is sort of 27 years. Furthermore, all 5 companies have an exquisite rating of ‘A’ or higher. If it is best to need higher dividends, consider B-List or C-List, launched later.

As conventional, we’re going to current a fast synopsis of each of the companies chosen proper right here; nonetheless, we received’t go into too many particulars as which will make the article unduly prolonged.

NKE (Nike, Inc):

Nike is the most important sneakers and athletics agency on this planet. Their closest competitor is Adidas (OTCQX:ADDYY). The form of enterprise they’re in requires them to spend large {{dollars}} on selling and promotion. Even though Nike’s mannequin is doubtless one of many strongest, it helps the company receive very extreme volumes and significantly premium prices. Nike’s energy is in its manufacturing and distribution channels. Nike’s share worth has cratered these days ensuing from sluggishness or lack of progress, notably ensuing from challenges in China. That’s the reason that, as per Morningstar, it’s undervalued by virtually 30%. Its difficulties are rising opponents from smaller and newer producers, along with completely different established names like Lululemon. In China, it faces opponents from native producers amid nationalistic fervor. With all that talked about, we think about Nike, with its strong financial properly being, mannequin vitality, and large distribution attain, will probably be able to overcome short-term challenges. It simply isn’t a high-growth agency, nonetheless it’s nonetheless liable to develop moderately. For dividend merchants, its dividend has grown at 12% yearly to this point 10 years and may probably proceed to develop at a near double-digit tempo. Its current dividend is form of double its 5-year trailing widespread yield. We are along with this throughout the A-List as a consequence of its safe, reliable, and rising dividends and its undervalued stock worth.

ADM (Archer-Daniels-Midland Company):

ADM was based mostly virtually 120 years prior to now (in 1902). Today, it generates over $100 billion in annual revenues by providing meals and eating regimen to every folks and animals. It has worldwide operations and serves over 200 nations. Broadly, the company procures grain crops all world wide and processes them in its higher than 300 processing crops to course of, produce, and promote all types of meals, feed, and dietary merchandise.

On the dividend entrance, it’s a dividend-king and has persistently elevated annual dividends for 50 years. Overall, it has paid dividends to its shareholders for the ultimate 91 years. Earlier this 12 months, the company elevated the dividend payout by 11% whereas ending the 50th 12 months of consecutive annual will enhance.

In the earlier six months, the stock has been hammered. The most vital catalyst for the drawdown was its announcement in January of this 12 months that it was beneath investigation by the SEC (Securities and Exchange Commission) and DOJ (U.S. Justice Department) on its accounting practices (attributed to its dietary enterprise part). Since then, nonetheless, it has recovered just a few of its losses. Still, the stock worth sits virtually -25% beneath its 52-week highs and, in reality, is offering a major low value. All that talked about, throughout the bigger picture, mainly, the company has not modified nor the potential of its corporations. Even then, we are able to’t deny that this cloud of uncertainty (in regards to the have an effect on of the investigation) will persist for some time.

In addition to the above, the company will also be going by some cyclical headwinds. The agency goes by rising manufacturing costs ensuing from inflation and decreased manufacturing volumes. This led to margin compressions and decreased profitability. However, most of the factors seem to be cyclical in nature, and progress must determine up when the cycle modifications.

For long-term merchants, we predict it’s a purchasing for different to grab its comparatively safe and rising 3.25% dividend yield. (ADM was actually helpful throughout the earlier months as properly for comparable causes).

MS (Morgan Stanley):

On the face of it, the share worth seems a bit expensive, because it’s shopping for and promoting very close to its all-time extreme, nonetheless that doesn’t current all the picture. It is just coming once more to the levels achieved in early 2022. For the ultimate two years the stock has traded in a very good range in a holding pattern, and solely these days, it has trended upwards. Even then, the stock has underperformed the S&P500 and the financial sector by a big margin. We suppose that’s the place we’re in a position to uncover some price. However, in response to Morningstar, it’s shopping for and promoting close to or barely above its truthful price. We suppose, for dividend merchants, it’s a very good buy at a very good worth. The agency has an exquisite dividend observe report. The earlier 5-year and 10-year dividend progress has been distinctive, at 23% and 29%, respectively. The payout ratio stays to be low cost at 54%. It these days elevated the dividend payout by virtually 9%, which bodes properly for future dividend progress. It moreover tells us that the interval of 25%-30% dividend progress is gone, nonetheless we’re in a position to nonetheless depend on near 10% progress going forward. The current yield could also be very respectable at 3.57%.

CVX (CHEVRON):

Chevron, as an Energy agency, needs no introduction. It is doubtless one of many two Oil & Gas majors that shall be there for a few years to return, whatever the native climate change fears. The worth of oil received right here down from its peak in 2022, nonetheless it’s nonetheless hovering between $70 and $80 a barrel, which is ample for companies like CVX to be extraordinarily worthwhile with its breakeven worth throughout the low to mid-40s. The share worth is simply 13% beneath its 52-week extreme nonetheless yields 4.40% in dividends. The payout ratio is decrease than 50% on an EPS basis nonetheless solely 35% on a free-cash-flow basis. The five-year dividend progress has been mediocre at 6.35%. However, a starting yield of 4.4% with a 6%+ annual progress would yield 8% in 10 years on a price basis. Besides, the company has bought once more numerous its shares, and the wonderful shares are loads lower than that they had been 5 years prior to now. The agency’s debt is relatively low compared with its annual revenue, and it helps an exquisite credit score standing of ‘AA’ from S&P. Morningstar put the truthful price close to 18% above the current worth. We suppose the company is an efficient long-term funding for income merchants for comparatively safe dividends for just a few years to return.

UPS (United Parcel Service):

UPS is one amongst two duopolies throughout the logistics sector (the other being FedEx) and appears to be a greater choice between the two relating to dividend consistency. The agency operates in 200 nations and generates higher than $90 billion a 12 months. Sure, with this agency, you aren’t going to double your money briefly order, nonetheless you would possibly prefer to take a place for comparatively safe dividends. Currently, the yield is at very participating ranges at 5.1%, which is 45% higher than its 5-year widespread of three.5%. Furthermore, the company has elevated its dividend for the earlier 15 years.

The share worth has dropped virtually 18% in 2024, so it has lagged the S&P 500 by a big margin. The enterprise is cyclical by its nature, and it’s going by some headwinds correct now. The working income declined throughout the first half of 2024 ensuing from lower working margin, which was pushed by the subsequent combination of low-margin e-commerce transport volumes. The margins moreover confronted headwinds due to the front-loading of higher costs coming from the model new labor contract. However, the margins are anticipated to boost by the second half of the 12 months. On the constructive aspect, UPS maintains a secure stability sheet and maintains an exquisite credit score standing of ‘A’ from the S&P. Its debt-to-adjusted EBITDA ratio is simply 2.45x, which is taken into consideration low cost and pretty safe. As per Morningstar, the share worth is sort of 15% beneath its truthful price. Furthermore, the current yield of 5.1% is form of 60% above its long-term 5-year widespread of three%.

Final B-List (High Yield, Moderately Safe):

Criteria for this group:

- Yield for the group between 4.75% to 6.25%

- At least two names with ‘A’ rated.

- Above-average observe report of dividends and progress

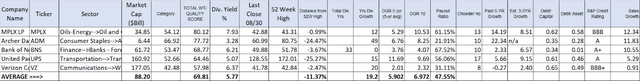

Average yield: 5.77%

Note 1: Very sometimes, we embrace numerous low-risk shares throughout the B-list and C-list. Furthermore, oftentimes, a stock can appear in numerous lists. This is completed on goal. We try to make each of our lists fairly diversified amongst completely completely different sectors/enterprise segments of the monetary system. We try to embrace numerous of the extraordinarily conservative names throughout the high-yield guidelines to make the final group loads safer.

Table-1B: B-LIST (High Yield)

NOTE: MPLX is structured as a partnership (not a company) and factors a Ok-1 tax sort in its place of the identical previous 1099-Div. Please use due diligence.

In the B-List, the final hazard profile of the group turns into barely elevated compared with the A-List. That talked about, the group (as a complete) will probably current safe dividends for just a few years. This guidelines provides a median yield for the group of just about 5.25%, a median of 23 years of dividend historic previous, and a median low value of -14% (from 52-week highs).

MPLX (MPLX LP):

We are altering CVX with MPLX throughout the B-List and C-List to spice up the yield. First, it’s a Partnership and factors a Ok-1 tax sort (partnership income) in its place of the identical previous 1099 in case of regular dividends.

MPLX is a diversified midstream energy agency structured as a grasp restricted partnership. It was common in 2012 by Marathon Petroleum Corporation (MPC) for the intention of proudly proudly owning, working, shopping for, and creating midstream energy infrastructure property. To date, MPC stays the most important unit holder of MPLX.

MPLX maintains a secure stability sheet with an investor-grade BBB credit score standing and pays a very participating yield, presently shut to eight%. It has paid and raised the dividend payout since its inception in 2012 and raised the payout by 9.65% in Nov. 2023. We can depend on one different elevate shortly, this November. Its dividend is properly lined, and dividend safety stands roughly at 1.6x. In the earlier 5 years, the worth appreciation has been important, and the stock has gained virtually 17% year-to-date (excluding distributions), so we’d even see worth appreciation decelerate going forward. However, that’s an income funding, and we’re in a position to depend on a very safe dividend of over 8% for the foreseeable future.

BNS (The Bank of Nova Scotia):

BNS (The Bank of Nova Scotia, moreover known as Scotiabank) is doubtless one of many largest three banks in Canada. Besides Canada, it has an infinite presence in Latin American nations as properly. The monetary establishment’s historic previous goes once more virtually 200 years, and it has had a historic previous of paying dividends since its early days. Due to foreign exchange fluctuations between the US dollar and Canadian dollar, we commonly see the dividends fluctuate in US dollar phrases. The monetary establishment maintains a secure stability sheet and has an exquisite credit score standing of ‘A+’ from S&P. It provides a broad range of banking companies, along with retail banking, personal and industrial banking, wealth administration, and funding banking. Even though the stock worth appears to be close to a 52-week-high, it’s nonetheless down virtually 30% from its 2022 ranges, though it has recovered pretty a bit from its Oct. 2023 lows. The dividend yield inside cause extreme at 6.3%.

VZ (Verizon Communications):

Verizon had a difficult couple of years in 2022 and 2023. The stock had misplaced virtually 40% of its price from the peak. However, throughout the remaining six to eight months, it has recovered pretty a bit (virtually 40% from the underside). Even then, it nonetheless might be going undervalued and helps a very extreme dividend yield of shut to 6.4%.

In 2023, there have been numerous elements that precipitated the market to panic. Among them had been the peak charges of curiosity and the extreme debt burden of the company. Verizon stays to be the strongest participant among the many many three large telecom companies throughout the U.S. Moreover, we’ve already seen peak charges of curiosity, and the Fed is predicted to start decreasing the costs in a short time. The declining charges of curiosity will do wonders for companies like VZ. The stock worth has appreciated these days, and the dividend yield has come down from 7% to the current stage. But we predict the company stays to be a purchase order for dividend merchants.

Final C-LIST (Yield-Hungry, Less Safe):

Criteria for this group:

- Yield for the group between 7.0% to eight.0%

- All names with funding investment-grade scores.

- Some potential for progress.

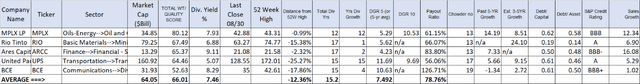

Average yield: 7.46%

Notes:

Note 1: Oftentimes, a stock can appear in numerous lists. We try to embrace one or two conservative names throughout the high-yield guidelines to make the final group loads safer.

Table-1C: C-LIST (Yield-Hungry, Elevated Risk)

ARCC (Ares Capital):

Ares Capital is doubtless one of many largest BDCs (Business Development Companies) relating to market capitalization and web asset values. ARCC provides a very extreme yield of roughly 9.1%. Being a BDC, it invests in small and medium-sized companies. ARCC has investments in virtually 500 companies, making it a very diversified portfolio. It has a report of manufacturing a extreme NII (web Investment income), which presently exceeds $1 billion on an annual basis. Based on core EPS, its payout ratio is beneath 81% for the ultimate 12 months, and per the latest quarter, it’s at 79%, which may be very respectable for a BDC. Based on the Net Investment Income, it comes out to be 82.7%. The dividend safety stands at 1.20%. The debt to equity (web of cash) stands at 1.01x. The market for BDCs is popping into aggressive, and with the declining fees, the one method these companies can improve their earnings is that if they are going to do additional enterprise. ARCC is in a robust place to extend its enterprise because of it trades at a premium to its NAV. Last quarter, it funded an extra $1.7 billion of loans by issuing additional equity. The administration has a confirmed report of performing properly every in extreme and low-interest value environments.

With over 9% dividend yield, there’s not loads scope left for capital appreciation, nonetheless we should always don’t forget that that’s an funding for income.

RIO (Rio Tinto Group)

Rio Tinto Group is a British-Australian multinational agency that’s the world’s second-largest metals and mining firm, solely behind the BHP Group (BHP). RIO is a dual-listed agency on every the London Stock Exchange and the Australian Securities Exchange. The agency has most important mining operations in Australia, which provides it the advantage of being close to Asian and Chinese markets, the place most of the world’s raw provides are processed. It moreover has one among many lowest operational payments compared with its buddies. The agency may be very diversified in all the first segments of mining, notably iron ore, copper, aluminum, and completely different minerals. Recently, RIO has expanded its copper portfolio due to the rising electrification developments. In addition, RIO has a robust stability sheet with a very low amount of web debt and an excellent credit score standing of ‘A’ from S&P. All this bodes properly for the long-term merchants throughout the agency.

On the dividend entrance, it provides a dividend payout bi-annually, with a gift annual yield coming to roughly 6.88%. The dividend payout is variable and would possibly fluctuate from 12 months to 12 months. That talked about, if acquired by the low end of the cycle, one can depend on a median of 6% to eight% dividend yield in any given 12 months. Again, one mustn’t buy this agency for capital appreciation nonetheless for income period. One should be cautious to buy the shares at a time when the prices are on the low end of the cycle. One can also use limit orders or PUT selections to take care of the purchasing for value low. Currently, the prices are virtually 14% lower than what that they had been only some months prior to now, and we consider it a reasonable buy.

BCE (BCE Inc):

BCE is the most important communications agency in Canada. In some methods, its positives and challenges are similar to these of Verizon (VZ) throughout the US. It provides quite a lot of telecommunications companies, along with wi-fi, wireline, Broadband, and TV corporations, to roughly 22 million subscribers in Canada. Currently, BCE is paying a very participating dividend yield of 8.3%, which is manner higher than Verizon’s yield of 6.4%. Due to the present worth surge for every companies, their yields have come down a bit. Moreover, BCE has paid and raised the dividend payouts consecutively for 15 years (in Canadian dollar phrases).

However, there are some risks that merchants ought to concentrate to. It operates in a extraordinarily aggressive ambiance, and just like completely different telecom companies throughout the enterprise, it carries a giant debt burden of just about $25 billion. The previous couple of years have been highly effective for any agency with quite a few debt, nonetheless that’s about to ease going forward. The present dividend progress of the ultimate three years has been on the low end at 2.5%, in line with its buddies. However, with an 8.3% current yield and a 2.5% progress, it’s going to yield virtually 10% (on a price basis) in 5 years. This agency is barely an income funding, and one must make investments with that function in ideas. Moreover, with an 8.3% yield, you don’t need loads appreciation in case your function is to have a extreme income.

===

Apparently, this guidelines (C-List) is for yield-hungry DGI merchants. The yield goes up as loads as 7.55%. However, this guidelines simply isn’t for conservative merchants. As you may even see, the widespread credit score standing of this set of companies is manner lower than the A-List and even B-List. Dividends are moderately safe on this guidelines, nonetheless the yields are very participating. At least just a few companies on this guidelines embody an elevated stage of hazard. We urge due diligence to seek out out if it’s going to suit your personal situation. Nothing comes freed from cost, so there shall be additional hazard involved with this group. That talked about, it’s a extraordinarily diversified group unfold amongst 5 completely completely different enterprise segments.

We want to warning that each agency comes with certain risks and concerns. Occasionally, these risks are precise, nonetheless completely different events, they could be a bit overblown and short-term. So, it’s on a regular basis actually helpful to do extra evaluation and due diligence.

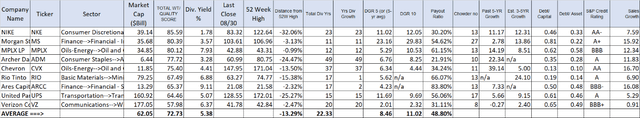

What If We Were to Combine the Three Lists?

If we combine the three lists and take away the duplicates (as a consequence of combining), we’d be left with 9 names.

Two-time duplicates: ADM, MPLX (2 duplicates).

Three-time duplicates: UPS (2 duplicates)

After eradicating these six duplicates, we’re left with 11 names.

From the facility sector, we’ve two names (CVX and MPLX), nonetheless one is an energy most important whereas the other one is a mid-stream agency. So, we’re in a position to perhaps protect every. Similarly, at first look, there are two names from the finance sector, nonetheless as soon as extra, they’re pretty completely completely different. Between VZ and BCE, we protect VZ. Furthermore, from MS, BNS, and ARCC, we protect MS and ARCC. We are lastly left with 9 names.

The blended guidelines may be very diversified in as many as seven completely completely different sectors. The stats for the group of 9 are as follows:

Average yield: 5.38%

Average low value (from 52WK High): -13.3%

Average 5-yr dividend progress: 8.46%

Average 10-yr dividend progress: 11.02% (from seven names)

Average Payout Ratio: 43.20%

Average Total Quality Score: 73.54.

Table 2:

Conclusion

In the first week of every month, we start with a fairly large guidelines of dividend-paying shares and filter our method all the way in which all the way down to solely a handful of shares that meet our selection requirements and income targets. In this textual content, we’ve launched three groups of shares (5 each) with completely completely different targets in ideas to swimsuit the assorted needs of a wider viewers. Even though the hazard profile of each group is completely completely different, each group in itself is fairly balanced and diversified.

This month, the first group yields 3.62%, whereas the second group elevates the yield to 5.77%. We moreover launched a C-list for yield-hungry merchants with a 7.46% yield. The blended group (all three lists blended with duplication eradicated) provides an rather more diversified group with 9 positions and a 5.38% yield.

Analyst’s Disclosure: I/we’ve a useful prolonged place throughout the shares of ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, TSN, ADM, BTI, MO, PM, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, ARCC, ARDC, AWF, BST, CHI, DNP, USA, UTF, UTG, RFI, RNP, RQI, EVT, EOS, FFC, GOF, HQH, HTA, IFN, HYB, JPC, JPS, JRI, TLT each by way of stock possession, selections, or completely different derivatives.