I’m on the lookout for high-yield returns shares to get now. I’m moreover in search of to increase my holdings by getting a big-paying exchange-traded fund (ETF).

Here are 3 such monetary investments on my guidelines in the present day. As you may see, the returns returns on these London Stock Exchange– supplied instruments cruise over a ahead customary of three.6% for FTSE 100 shares.

| Dividend provide | Forward returns return |

|---|---|

| Greencoat UK Wind (LSE:UKW) | 7.6% |

| Invesco United States High Yield Fallen Angels ETF (LSE:FAHY) | 6.7% |

Dividends are by no means ever assured. But if projections are precise, a ₤ 15k monetary funding unfold equally all through these shares and this ETF would definitely supply me a ₤ 1,080 straightforward income in 2025.

I’m optimistic, additionally, that returns will definitely march larger over the second. Here’s why I would definitely get them if I had the money cash useful to spend in the present day.

Greencoat UK Wind

Energy producers like Greencoat UK Wind are generally considered a number of of probably the most protected returns provides to get.

Keeping mills in nice functioning order generally is a expensive, earnings-damaging service. But corporations just like this moreover benefit from excellent earnings publicity many due to their ultra-defensive procedures. This could make them much more safe returns payers than quite a few numerous different UK shares.

Electricity want continues to be safe no matter monetary, political, or social dilemma goes alongside. And so Greencoat UK Wind, which creates energy from 49 web sites and presents it onto energy distributors, takes pleasure in a continuing circulation of income it could possibly pay to its buyers.

While returns are by no means ever assured, Greencoat’s pledge to pay “an attractive and sustainable dividend that increases in line with RPI” has really held as a result of its Initial Public Offering a years earlier.

In reality, returns in 2023 elevated virtually 30% 12 months on 12 months, skyrocketing earlier market value rising value of dwelling (RPI) of 13.4%. Greencoat has the power to take care of this doc up as most of its agreements are linked to both RPI or buyer price rising value of dwelling (CPI).

Given the extraordinary overview for renewable useful resource want, I assume Greencoat UK may be a number one returns payer for a number of years.

Invesco United States High Yield Fallen Angels ETF

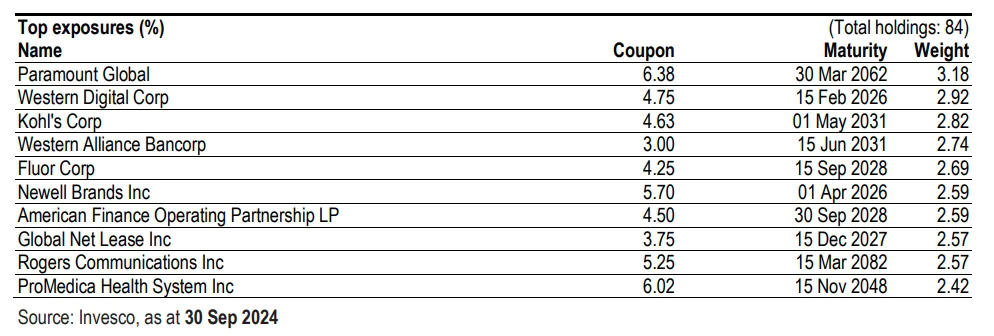

The Invesco United States High Yield Fallen Angels ETF offers a way for capitalists to earn cash from the bond market. More notably, it intends to gauge “the performance of ‘Fallen Angels,’ bonds that were previously rated investment grade and were subsequently downgraded to high yield bonds”.

Around 85% of credit score scores rankings on its enterprise bonds are ranked BB, with the remaining at B.

While rankings go lots lowered, these sub-investment-grade security and securities suggest that capitalists are nonetheless subjected to a larger diploma of credit score scores risk than numerous different bond-holding funds. A devalued rating signifies troubles with the bond supplier’s underlying financial well being and wellness.

However, with this higher risk comes the capability for higher profit. And on this occasion the returns return is a hair removed from 7%.

What’s much more, the fund has a steady yearly value of 0.45%, which supplies sturdy value. It’s yet another technique I would definitely consider focusing on a giant passive income following 12 months.