Looking for reward growth provides? These FTSE 100 provides are anticipated to produce stable fee growth over the next variety of years on the very least.

BACHELOR’S DEGREE Systems

Dividend return: 2.5% for 2024, 2.7% for 2025

The safe nature of arms investing implies help tends to be a well-founded business fordividends This is especially the state of affairs immediately, as cracks within the worldwide order drive fast rearmament within the West.

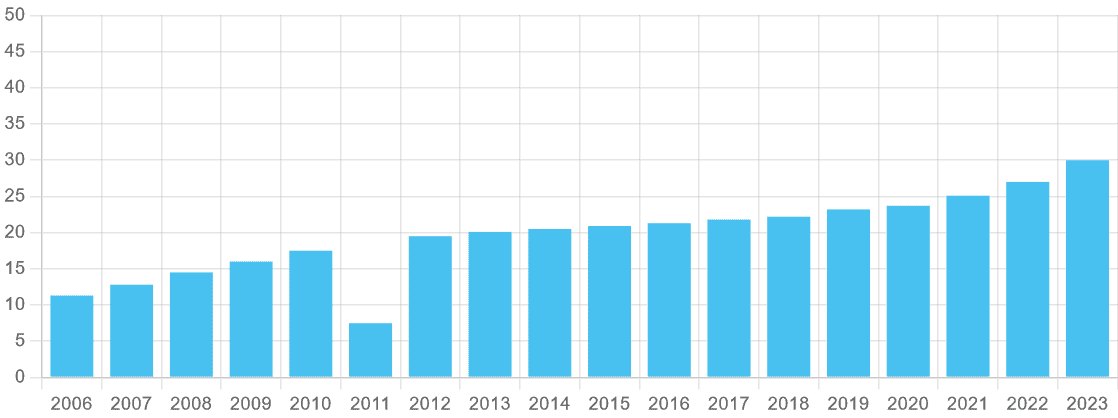

BACHELOR’S DEGREE Systems (LSE:BA.) is one skilled with a prolonged doc of notable reward growth. It’s elevated investor funds yearly as a result of 2011. It’s a sample City consultants anticipate to proceed, making it value a detailed search in my standpoint.

Payouts are anticipated to extend 8%, to 32.3 p per share, this yr. Dividend growth is anticipated to hurry as much as 10% in 2025, resulting in a full-year fee of 35.5 p.

Forecasts for following yr are sustained by anticipated revenues will increase of seven% and 12% in 2024 and 2025 particularly. As a repercussion, approximated returns for each years are lined 2.1 instances by anticipated incomes.

Both analyses are over the safety normal of two instances, supplying returns projections with additional metal.

BAE moreover has stable financial constructions to cash returns in state of affairs incomes let down. Profits may disappoint quotes on account of present chain issues, for instance, a substantial hazard to help firms’ yearly incomes immediately.

The Footsie firm had ₤ 2.8 bn of money cash on the annual report since June.

BACHELOR’S DEGREE Systems’ order stockpile is rising, and it struck a doc ₤ 74.1 bn on the omphalos of 2025. It appears readied to keep up climbing additionally, which bodes properly for longer-term returns.

Airtel Africa

Dividend return: 5.4% for 2025, 5.5% for 2026

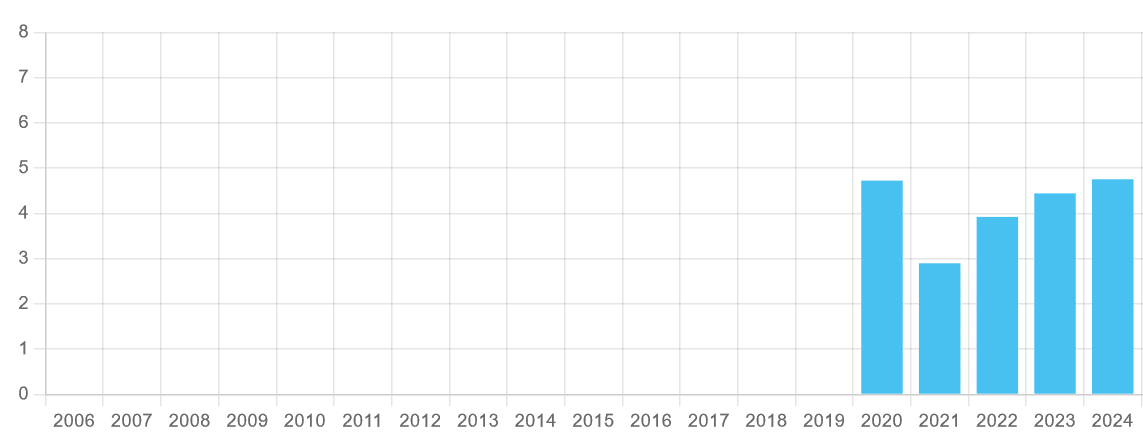

Telecoms service supplier Airtel Africa (LSE:AAF) doesn’t have a prolonged doc of reward growth like BAE. It’s simply been detailed on the London Stock Exchange for five years. It moreover decreased the yearly fee in 2021 because it rebased returns to scale back monetary debt.

However, money cash funds have truly risen ever since, and by larger than double-digit parts from time to time. It’s a sample that City brokers anticipate to proceed.

For this fiscal yr (to March 2025), an entire reward of 6.52 United States cents per share is anticipated, up 10% yr on yr. An further 3% enhance is anticipated for financial 2026, to six.70 cents.

However, I ought to advise that Airtel’s projections aren’t as sturdy as I ‘d ideally equivalent to.

Profits are skidding decreased on account of unfavorable cash motions (EBITDA went down 16.5% in between April and September). And reap the benefits of levels are dramatically increasing, with net-debt-to-EBITDA climbing to 2.3 instances since September.

Falling incomes moreover point out reward cowl transforms antagonistic for this yr, with anticipated incomes of 46.7 United States cents per share projection. On the plus facet, City consultants anticipate revenues to rebound extremely in financial 2026, leaving sturdy reward cowl of two.7 instances.

Yet whatever the not sure near-term expectation, I nonetheless suppose Airtel Africa shares deserve important issue to contemplate by risk-tolerant financiers.

What’s much more, I feel the lasting picture beneath stays extraordinarily eye-catching. Telecoms want for Africa stays to rocket, with Airtel’s shopper base climbing 6.1% yr on yr to 156.6 m in September.