Too a number of securities market financiers fall quick to provide excessive returns over the long run. Usually, the issue for his or her failing is just not an absence of data or initiative, nonetheless an underappreciation of the price of simpleness when on the lookout for to uncover the easiest provides for his or her profile.

Our reasoning for encouraging guests to buy FTSE 250-listed Cranswick in July 2022, for instance, was not particularly made advanced. We simply felt it was a monetarily audio, high-grade firm that had a powerful lasting improvement method. Furthermore, our companied consider it equipped nice price for money adhering to a pointy autumn in its share price.

Since our first suggestion, the farmer, producer and vendor of a wide range of meals consisting of sausages, ready meats and dips has truly created a 55pc assets achieve. This stands for a 42 % issue outperformance of the FTSE 100 and is 43 % components upfront of the FTSE 250’s achieve over the exact same length. When rewards obtained or acknowledged provided that our preliminary referral are consisted of, the provision has truly generated a 62pc general return in bit better than 2 years.

In Questor’s sight, the agency’s shares are positioned to provide extra assets positive factors and index outperformance for primarily the exact same components as these offered on the time of our first referral.

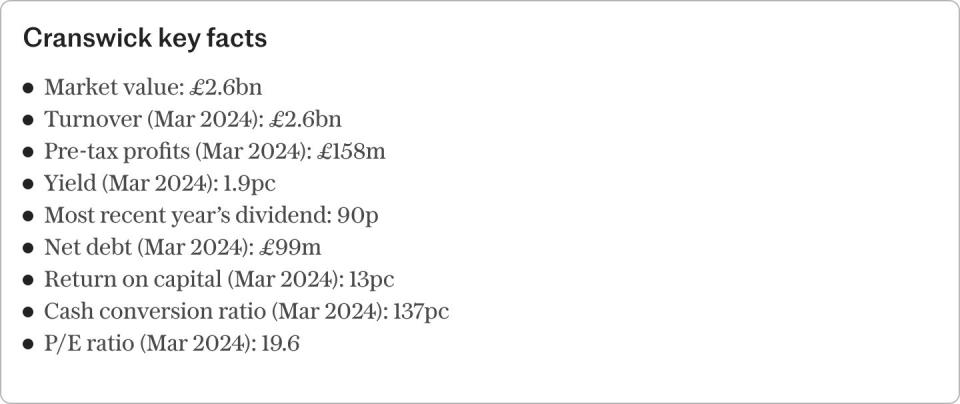

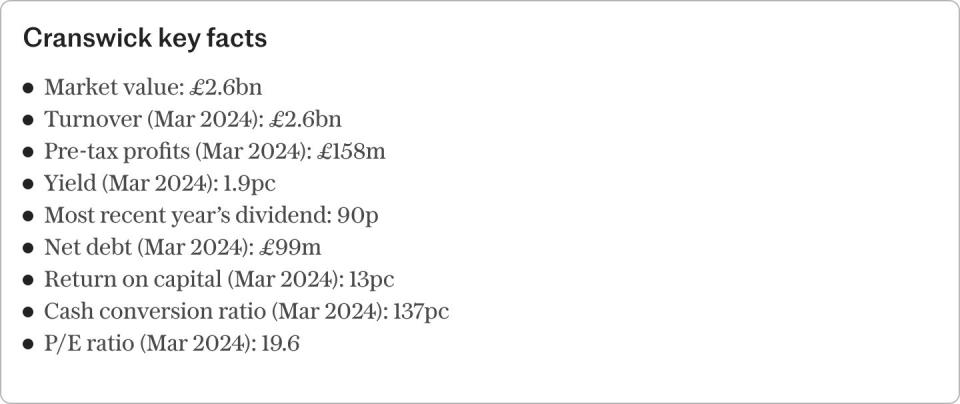

Notably, the agency’s financial standing continues to be audio amidst an unpredictable length for the UK and worldwide financial climates. Its net gearing ratio totals as much as 11pc, which is extremely lowered in comparison with varied different FTSE 350 corporations, whereas web ardour cowl of about 19 recommends the agency would possibly shortly handle to make ardour repayments on its monetary debt should success come below stress within the near time period.

A powerful annual report likewise signifies higher extent for purchases. Indeed, the corporate invested round ₤ 46m in 2014 on 2 appreciable acquisitions. Further purchases to enhance its reasonably priced setting would definitely be utterly unsurprising– particularly if agency evaluations drop amidst an unpredictable monetary expectation within the temporary run.

The firm’s return on fairness of roughly 13pc in 2014, despite having extraordinarily small monetary debt levels, reveals that it nonetheless has a transparent reasonably priced profit, which should relate to growing earnings over the long-term. Its up and down included firm design moreover distinguishes it from opponents and signifies it’s significantly better in a position to handle abrupt changes in its working environment.

In its latest quarter, the corporate printed a 6.7 pc enhance in income and talked about that it will get on observe to meet earlier financial help for the whole 12 months. This column anticipates its financial expectation to boost over the approaching years as a length of small rising price of residing corresponds to a lot much less larger stress on costs, thus sustaining income margins. Its success must likewise be enhanced by effectiveness and efficiency renovations being produced by steady monetary funding in automation.

Further charges of curiosity cuts, however, are almost certainly to catalyse want for the agency’s prices gadgets. A continuous autumn within the Bank Rate, when built-in with lowered rising price of residing, is almost certainly to suggest growing non reusable revenues in real phrases as soon as time delays have truly handed. In flip, this should encourage prospects to finish up being a lot much less price conscious and improve their willpower to commerce roughly much more expensive elective issues.

The firm’s financial potential prospects proceed to be constructive many due to appreciable improvement prospects all through a wide range of gadgets, consisting of pretty brand-new areas equivalent to pet meals and international markets.

Of program, Cranswick‘s appreciable share price enhance provided that our first suggestion signifies that it at present has a dramatically better market evaluation. Then, it had a reasonably plentiful price-to-earnings (P/E) ratio of 15.8. Now, its P/E proportion stands at an additionally better 19.6.

Although this means there may be a lot much less extent for a better rerating than on the time of our preliminary suggestion, the agency’s shares nonetheless stay to offer nice price for money. The firm has robust rules, as confirmed by its strong annual report and clear reasonably priced profit, whereas its improvement method continues to be rational and is readied to be turbocharged by an enhancing working environment within the coming years.

Simply positioned, each one in all these variables should allow the provision to provide extra assets positive factors and index outperformance over the approaching years. Keep buying.

Questor claims: buy

Ticker: CWK

Share price at shut: ₤ 47.65

Read the latest Questor column on telegraph.co.uk each Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm.

Read Questor’s rules of investment previous to you observe our concepts.