Millions of retired persons are readied to acquire a 4pc rise of their state pension plan, value ₤ 460, a 12 months from April.

However, specialists have really alerted that numerous pensioners won’t actually really feel the affect of the three-way lock rise as means-testing winter fuel payments will definitely deny quite a few roughly ₤ 300, leaving them with merely ₤ 160 much more.

Furthermore, for retired individuals which are better value taxpayers, the value of the common ₤ 8.85 improve will definitely be deteriorated to round ₤ 5, in line with Mike Ambery, retired life monetary financial savings supervisor at Standard Life.

Under the triple lock, the state pension plan climbs yearly in accordance with both September’s rising value of residing, wage growth or 2.5 laptop, whichever is the best.

With rising value of residing presently at round 2pc, it’s risk-free to forecast that the benefit will definitely be boosted in accordance with in the present day’s typical incomes growth variety of 4pc.

Labour’s option to means-test winter months gasoline settlements will definitely deny 10 million pensioners of the benefit, leaving numerous having a tough time to heat their houses. Sir Keir Starmer encounters a face-off afterward in the present day when the selection comes previous to Parliament.

Furthermore, icy tax obligation braces point out the rise will definitely press 1000’s further pensioners proper into paying tax obligation.

Alice Haine, particular person financing skilled at Bestinvest claimed: “Throw in frozen tax thresholds, with the full new state pension edging ever closer to surpassing the standard personal allowance of £12,570 – the point at which any income is liable for tax; the potential loss of the winter fuel allowance and the threat that housing secretary Angela Rayner may abolish a council tax break for households with only a single occupant and it’s easy to see why pensioners feel under siege.”

Pensioners that received to state pension plan age previous to April 6, 2016 will definitely get on the previous state pension plan and will definitely get hold of an uplift of ₤ 353.6 from April.

The rise will definitely take the yearly benefit to ₤ 9,167 a 12 months.

11:15 AM BST

Thanks for adhering to in the present day’s real-time weblog website

That’s all from the Money weblog website within the meantime. Thanks for adhering to the assertion with us in the present day.

Stay roughly day on the state pension plan and winter months gasoline allocation at Telegraph Money and share your concepts with us by emailing cash@telegraph.co.uk.

10:38 AM BST

‘To tax pensioners would be just wrong’

Roger Jude, 80, claimed the state pension plan uplift was a “reasonable boost”, and is happy the three-way lock continues to be undamaged.

However, he will get on the cusp of the better value tax obligation restrict, over which earnings is strained at 40pc. This signifies an enormous portion of his pay improve will definitely be gnawed in tax obligation. Labour has really devoted to keep up limits iced over until a minimal of 2028.

Mr Jude claimed: “I just have to take the medicine, I don’t have much choice. [The threshold freeze] is not very welcome but there we are.”

He thinks Rachel Reeves made the wrong choice in ditching winter months gasoline settlements for quite a few pensioners, value roughly ₤ 300.

“It’s a really poor resolution – even the Labour celebration thinks so, though they dare not vote towards Keir.

“I just hope when Reeves does her budget she’ll find a way not to tax pensioners. She’s got to raise money but to target that group of people is just wrong.”

10:27 AM BST

Old state pension plan to extend by merely ₤ 6.80 every week

Pensioners that received to state Pension age previous to April 6, 2016 will definitely get on the previous state pension plan and will definitely get hold of an uplift of ₤ 353.6 from April following 12 months.

The rise will definitely take the yearly benefit to ₤ 9,167 a 12 months.However, not each particular person on the previous state pension plan obtains particularly the traditional value. In sure, numerous workers that remained in ‘contracted out’ work-related pension plan methods may get hold of a lot lower than the entire value and their work-related pension plans will generally improve by no better than rising value of residing, in line with earlier pension plans priest Steve Webb.

Some people on the previous system that likewise have ‘additional’ state pension plan will definitely see that part of their pension plan improve simply in accordance with rising value of residing, presently 2.2 laptop.

10:03 AM BST

‘Labour has conned pensioners’

The Chancellor’s concept that retired persons are significantly better off is a instantly lie, composes the Telegraph’s head of moneyBen Wilkinson

It’s garbage for the Chancellor to suggest that pensioners will be £1,700 better off beneath Labour since in precise phrases they’ve really presently shed so long as ₤ 300.

Labour’s switch to restrict winter months gasoline settlements to these in bill of pension plan credit score rating has really presently been subjected of what it’s– a breakout and fierce alternative that could kill thousands of pensioners.

The celebration’s political election dedication to the three-way lock was continually nugatory– and Labour acknowledged it. After 2 years of overpriced rising value of residing, the damages triggered by the three-way lock was primarily achieved.

The rise to search out in April simply exhibits incomes overtaking rising value of residing, and the three-way lock will not be prone to set off the Treasury a lot downside over the next 4 years.

09:54 AM BST

More than fifty p.c of state pension plan uplift shed to rising value of residing

The brand-new state pension plan is readied to extend ₤ 460 in 2025, “but more than half of this is to keep pace with rising prices” in line with earlier pension plans priest Steve Webb:

“Part of subsequent April’s improve is solely to maintain tempo with rising costs. Based on the present inflation determine of two.2pc, the brand new state pension would want to rise by simply over £250 merely for pensioners to face nonetheless.

Whilst an above-inflation improve of £460 will likely be welcomed, solely the additional £210 represents an actual improve. And that is earlier than permitting for the earnings tax which most pensioners pays on their state pension rise. Those who lose £200 or £300 in Winter Fuel Payments will subsequently nonetheless be worse off in actual phrases subsequent April.

09:46 AM BST

How Labour may take away your state pension

With Labour promising to not improve taxes for “working people”, it’s been afraid that Britain’s 12 million pensioners may be on the sharp finish of Rachel Reeves’s “painful” October Budget.

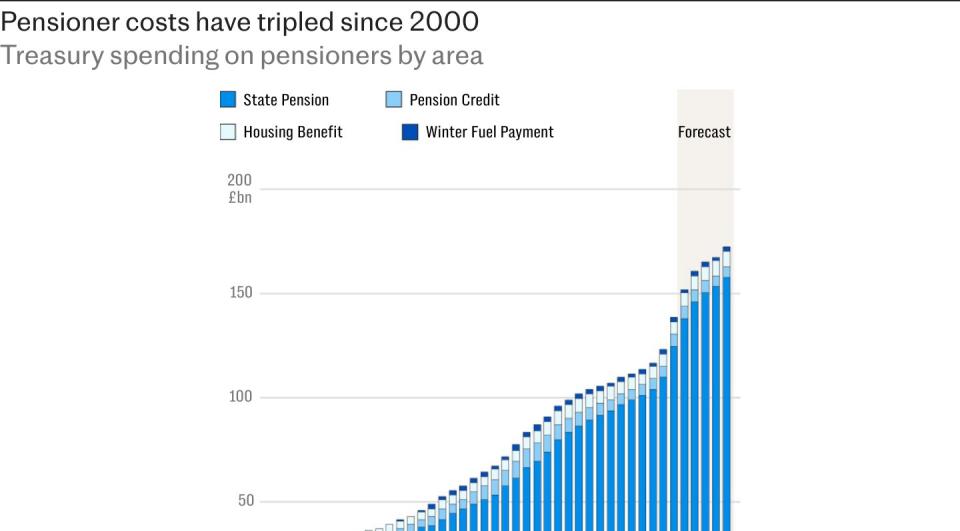

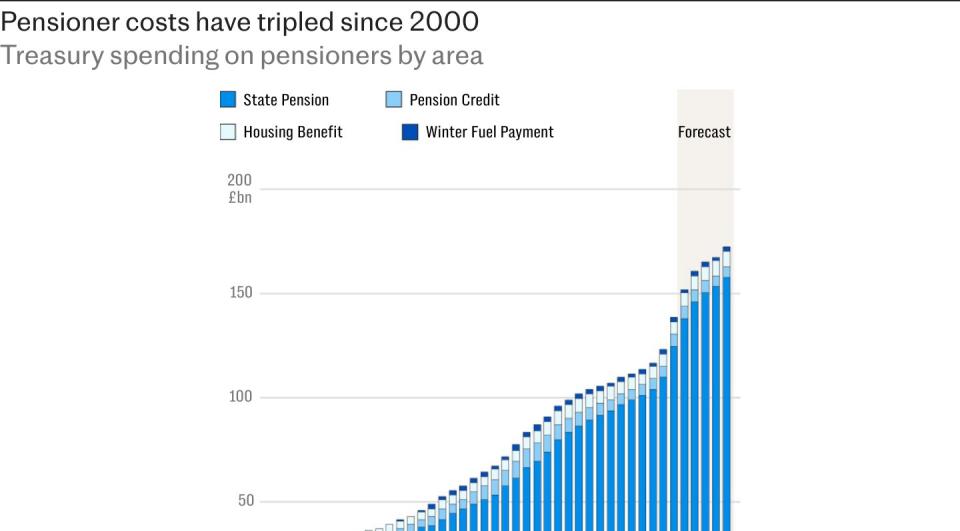

The state pension plan provides an financial safeguard for pensioners with out varied different earnings. It is likewise expensive, setting you again the Treasury over ₤ 100bn annually– a quantity anticipated to proceed climbing.

According to the Chancellor there’s a ₤ 22bn “black hole” to attach, and specialists declare selections require to be made to scale back the nation’s ballooning multi-billion further pound state pension plan prices.

Senior money press reporter Mattie Brignal has really thought-about whether or not Labour may claw again the expense of the state pension plan, and how could such a raid cost you?

09:02 AM BST

Readers on the state pension plan improve

08:59 AM BST

Martin Lewis retains in thoughts that simply 1 in 4 pensioners get hold of the ‘new’ state pension plan

Good data. The full ‘brand-new’ state pension plan is to extend ₤ 460 a 12 months subsequent 12 months because of the three-way lock. That is a real improve of regarding ₤ 200 over rising value of residing. Yet there are 2 factors I’d point out within the context of the argument in regards to the winter months gasoline settlement.

1. That begins followingApril This …

— Martin Lewis (@Martin SLewis) September 10, 2024

08:49 AM BST

4,000 may cross away with out winter months gasoline settlement

Almost 4,000 pensioners may cross away if Labour scraps winter months gasoline settlements, in line with the celebration’s very personal analysis research.

A damning document launched in 2017, when Keir Starmer remained within the darkness closet, asserted that restricting the allowance to pensioners on benefits will surely set you again numerous lives.

Money press reporter Tom Haynes has further:

The analysis by the Resolution Foundation mind belief was appointed by Labour within the run-up to the 2017 political election. It asserted 3,850 pensioners’ lives will surely go to risk through being incapable to heat their houses.

The darkness chancellor, John McDonnell, claimed as “removing the winter fuel payments from millions of pensioners could leave thousands of the most vulnerable at even more risk this winter”, together with that pensioners would struggle to heat their homes if the allocation was ditched.

08:29 AM BST

Winter gasoline settlements may take 4 years to get to pensioners

The number of pensioners registering for pension credit has really elevated in 5 weeks after Chancellor Rachel Reeves launched methods to ditch international winter months gasoline settlements.

However, specialists alerted that regardless of the take-up, it would nonetheless take 4 years for all pensioners eligible for the settlement to make use of.

Money press reporter Madeleine Ross has the knowledge:

As numerous as 880,000 pensioners that may be declaring the benefit don’t, Department for Work and Pensions numbers suggest.

The plan, which was launched on July 29, is readied to extend ₤ 1.4 bn. But if each one of many 880,000 pensioners which are certified use, the Treasury would face a tax bill of £3.8bn, a document by Policy in Practice found.

Sir Keir Starmer likewise refuted that the Cabinet was divided over the cuts to the settlements, which had really previously been supplied to all these over state pension plan age. Most obtained a settlement of ₤ 200, with these over the age of 80 acquiring ₤ 300.

08:03 AM BST

State pension plan disappoints minimal normal of life

The brand-new state pension plan is readied to tip over ₤ 3,000 besides the amount required for a minimal requirement of residing at retired life, in line with Interactive Investor.

The triple-lock pension plan promise exhibits that the state pension plan want to extend by 4pc to round ₤ 460 in April, in accordance with the standard incomes numbers. This will surely take the entire state pension plan for guys birthed after 1951 and women birthed after 1953 to ₤ 11,962 within the 2025/26 tax obligation 12 months.

This is ₤ 2,895 listed beneath the ₤ 14,857 (gross) required for a minimal normal of life, as specified by the Pensions and Lifetime Savings Association.

Myron Jobson, aged particular person financing skilled, interactive financier, claimed:

“Our calculations supply a stark reminder that whereas the state pension is a crucial part of retirement earnings, it falls wanting masking even the minimal earnings wanted to get pleasure from a cushty retirement.

“Worryingly, our research has exposed a looming national pension emergency, with people at the crunch stage of their retirement planning not saving enough into their pensions to secure a comfortable living standard in retirement.”

07:50 AM BST

Over 2 million decreased earnings pensioners to shed winter months gasoline allocation

2.5 million older people on decreased revenues are readied to shed their winter months gasoline settlement as an consequence of the Government’s means-testing alternative and will definitely have a tough time with out it in line with charity Age UK.

The actual quantity may be additionally better as the current value quote omits the unidentified number of pensioners with better revenues which are sick or handicapped and that encounter unavoidably excessive energy bills consequently.

-

1.6 million older people which are staying in hardship will definitely shed their winter months gasoline settlement as they don’t seem to be acquiring any one of many certifying benefits.

-

An extra 900,000 older people whose revenues are merely over the hardship line will definitely likewise shed the settlement. These people have revenues which disappear than ₤ 55 every week over the hardship line.

The issue a lot of the 900,000 older people have revenues merely over the road is that they’ve slightly work-related pension plan. They conserved all through their functioning lives to aim to ensure they could benefit from an additional comfortable retired life, nevertheless when the second comes the unfairness of the pension credit ‘cliff-edge’ signifies they’re nonetheless having a tough time monetarily.

07:42 AM BST

Loss of winter months gasoline leaves pensioners sensation ‘under siege’

Rachel Reeves, the Chancellor, launched in July that winter months gasoline settlements of roughly ₤ 300 will definitely be gotten rid of from quite a few pensioners, and can simply be provided to these on pension plan credit score rating.

As an consequence, the ₤ 460 state pension plan uplift will definitely deserve merely ₤ 160 to most of these which are readied to shed the winter months allocation.

Alice Haine, particular person financing skilled at Bestinvest claimed:

“Pensioners who’re set to lose the Winter Fuel Allowance may solely discover themselves £160 higher off come April 2025 because the £300 deficit eats right into a state pension improve.

“Throw in frozen tax thresholds, with the full new state pension edging ever closer to surpassing the standard personal allowance of £12,570 – the point at which any income is liable for tax; the potential loss of the winter fuel allowance and the threat that housing secretary Angela Rayner may abolish a council tax break for households with only a single occupant and it’s easy to see why pensioners feel under siege.”

07:31 AM BST

Higher value taxpayers see common rise of merely ₤ 5

While these on the entire state pension plan will definitely see their common earnings enhanced by ₤ 8.85 from April, better value taxpayers won’t actually really feel the entire benefit.

For pensioners paying the better value of tax obligation, the value of the common ₤ 8.85 improve will definitely be deteriorated to round ₤ 5, in line with Mike Ambery, retired life monetary financial savings supervisor at Standard Life.

“However, a brand new state pension of £11,962.60 may even be 95pc of the private allowance, presently frozen at £12,570 till 2028 – in contrast, in 2021/22 the brand new state pension was equal to 74pc of the allowance.

“This indicates pensioners will certainly require simply ₤ 607.40 of various other earnings prior to paying earnings tax obligation,” he mentioned.

07:17 AM BST

Pay grew 4pc from May to June 2024

Pay excluding bonuses grew by 5.1% within the 12 months to May to July 2024; together with bonuses it was up 4.0%, although this comparability is affected by final 12 months’s NHS and civil service one-off funds.

Read Labour market overview ➡️ pic.twitter.com/So7ERyAv1Q

— Office for National Statistics (ONS) (@ONS) September 10, 2024

07:13 AM BST

Pensions increase amid winter gas backlash

The information comes because the Government faces ongoing backlash over its resolution to scrap winter gas funds as a common profit.

Ten million pensioners will lose as much as £300 this winter after Chancellor Rachel Reeves introduced the fee will solely go to those that obtain pension credit score.

Last week, the Chancellor steered pensioners can afford the lower, nevertheless figures present even the most vulnerable will be hit by the raid.

More than 1.5 million retirees residing beneath the poverty line are set to lose the profit.

A crunch vote on the difficulty goes forward in Parliament in the present day, with Labour braced for a rebel inside its personal benches. The Telegraph’s politics weblog can have all you want to know this afternoon.

07:03 AM BST

State pension to rise by £8.85 every week

Good morning,

Thank you for becoming a member of me vibrant and early. The state pension is predicted to rise by 4pc from April based mostly on the rise in common earnings in July, because of the triple lock assure.

Under the triple lock promise, the state pension rises annually consistent with the best of September’s inflation, wage progress or 2.5pc.

This works out as an additional £8.85 every week within the pockets of pensioners and an annual advantage of round £12,000.

However, the ultimate resolution on a pension improve will likely be made by secretary of state, Liz Kendall, < a href =” October rel =

goal =(* )data-ylk =

course=”internet hyperlinkThe ‘staggering’ figure needed to match the full state pension internet hyperlink (* )rel =Savers goal =” _ area

slk: additionally probably the most vulnerable will definitely be struck by the raid.; elm: context_link; itc:0; sec: content-canvas State pension leaves retirees £5,000 short of basic living standard internet hyperlink” href =Forecast rel =(* )goal =” _ area

slk:How Labour could take away your state pension the three-way lock assurance,; elm: context_link; itc:0; sec: content-canvas (* )internet hyperlinkMillions rel =Rachel Reeves goal =” _ area Budget

slk: upfront ofWhy a Labour plot to means-test the state pension would be a disaster ‘s budget.; elm: context_link; itc:0; sec: content-canvas” > in advance ofThe Government’s funds plan.

5 factors to start your day (* )1)How pensioners could be targeted in Reeves’s Budget |From will surely require to develop a substantial unique pot to vary the basic earnings

Source link 2) (* )|(*) rise in settlements from three-way lock machine will definitely do little to close void (*) 1 )(*) |(*) of retired individuals run the danger of going to the sharp finish of (*)’s impending (*) 4) (*) |(*) has really been prompted to limit qualification to make it further monetarily lasting(*) 5) (*) |(*) means-tested benefits to a twin fatality tax obligation, retired individuals stay within the capturing line(*)