Britain is readied to expertise the most important exodus of millionaires on the planet prematurely of the Government’s planned raid on non-doms, analysis has really found.

The share of the populace which can be millionaires is anticipated to dive by 20pc all through this Parliament, from 4.55 laptop presently to three.62 laptop over the next 5 years, based on an Adam Smith Institute analysis of UBS projections.

This stays compared to Germany, France and Italy, each one in all that are anticipated to broaden their share.

Wealthy locals are being repelled from Britain by variables consisting of excessive tax obligations, changes to the non-dom rules and “a hostile culture for wealth creators”, the mind belief acknowledged.

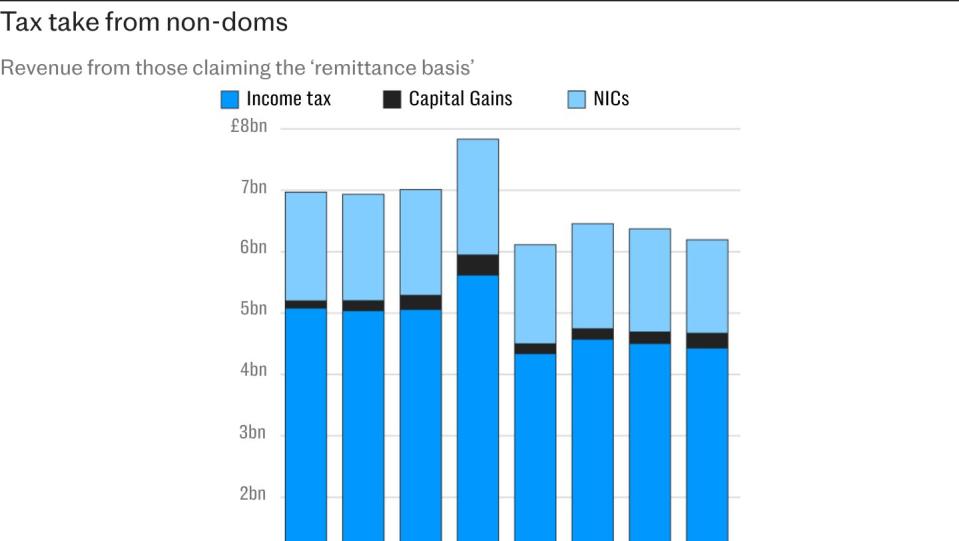

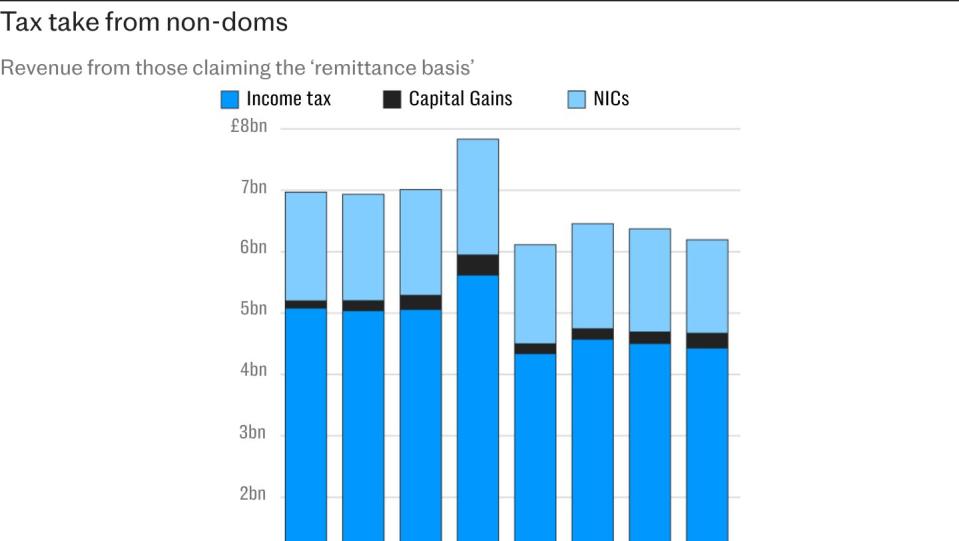

A ₤ 1bn suppression on non-doms was amongst Labour’s important assertion of perception guarantees, with the celebration pledging to close what it asserted had been “loopholes” within the system.

However, Ms Reeves is comprehended to be evaluating the plan in the midst of worries that it’ll actually compel many immigrants to depart that the step can set you again the UK essential tax obligation earnings.

This most present analysis examine contributes to increasing proof for the Chancellor to rethink the plan, with supposition likewise putting that she will definitely chill the rules round property tax.

Nadhim Zahawi, that functioned as chancellor in 2022, gotten in contact with Rachel Reeves to junk anti-non-dom plans and relieve tax obligations on big selection in her Budget in a while this month.

He acknowledged: “The price at which millionaires are leaving the UK is a vote of no confidence in each our present tax and regulatory regime, and anti-business and anti-prosperity measures that might be coming down the road.

“These individuals are often entrepreneurs and business owners. Their exit won’t just reduce necessary funds for public services – it will decrease investment in the wider economy too.”

The Adam Smith Institute acknowledged that the extraordinarily ample paid an out of proportion share of tax obligation, so their separationwas painful for the Exchequer The main 1pc of earnings earners paid 29pc of all earnings tax obligation, the mind belief acknowledged.

A HM Treasury consultant acknowledged: “We are addressing unfairness in the tax system so we can raise the revenue to rebuild our public services. That is why we are removing the outdated non-dom tax regime and replacing it with a new internationally competitive residence-based regime focused on attracting the best talent and investment to the UK.”