Some of our pals are permabears. They are intelligent monetary specialists and planners that always are typically bearish. We purpose to them for an entire analysis of what can fail for the financial local weather and the inventory trade. They are actually singing and gasoline nice offers of pessimism relating to the longer term amongst the financial press and most people.

In motion, to supply some equilibrium, we analyze what can go proper. Often, we find that the permabears have truly missed out on one thing of their evaluations. Since they emphasize the downsides, they incessantly cease working to see the positives, or they place unfavorable rotates on what’s mainly favorable.

We seldom have something to contribute to the bearish scenario because the bears’ evaluations usually are typically so thorough. So our efforts to supply equilibrium incessantly create us to emphasise the positives whereas nonetheless recognizing the downsides. Not remarkably, we receive slammed for being as properly favorable when it pertains to the overview for the United States financial local weather and inventory trade and acquire known as “permabulls.”

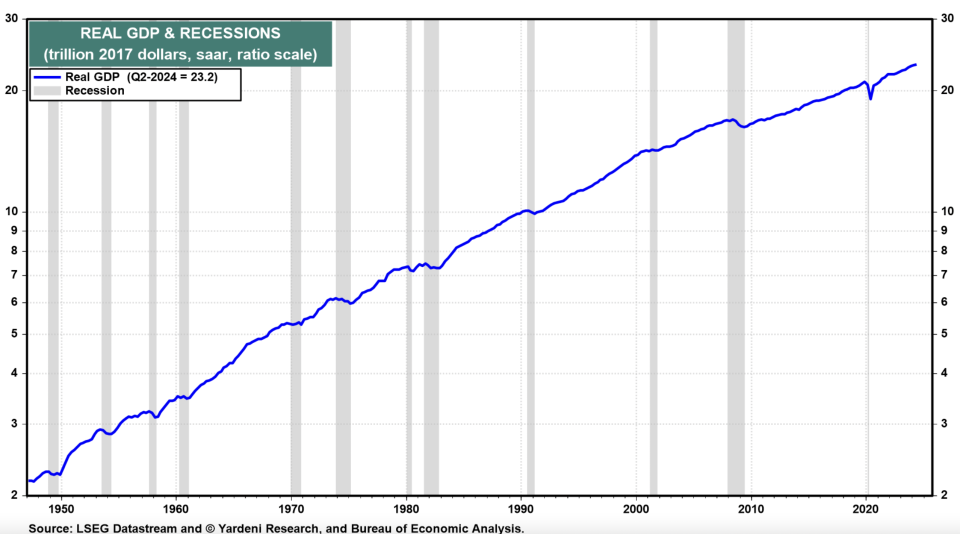

That’s alright with us, contemplating that the United States financial local weather incessantly expands at a robust charge, and the inventory trade has truly gotten on a good lasting uptrend consequently. Consider the next:

1. Recessions are irregular and don’t final lengthy

In the United States, the National Bureau of Economic Research (NBER) is the authority that specifies the start and ending days of financial downturns. According to the NBER, the odd United States financial downturn over the period from 1854 to 2020 lasted round 17 months.

In the article-World War II period, from 1945 to 2023, the odd financial downturn lasted round 10 months. Since 1945, there have truly been 12 financial downturns that occurred all through merely 13% of that point interval.

2. Bear markets are moreover irregular and don’t final lengthy contemplating that they usually are typically introduced on by financial downturns

There have truly been 28 bearishness within the S&P 500 contemplating that 1928, with a typical lower of 35.6%. The odd dimension of time was 289 days, or roughly 9.5 months. ABC News reported that contemplating that World War II, bearishness usually have truly taken 13 months to go from prime to trough and 27 months for the availability charge index to get well shed floor. The S&P 500 index has truly dropped roughly 33% all through bearishness over that point framework.

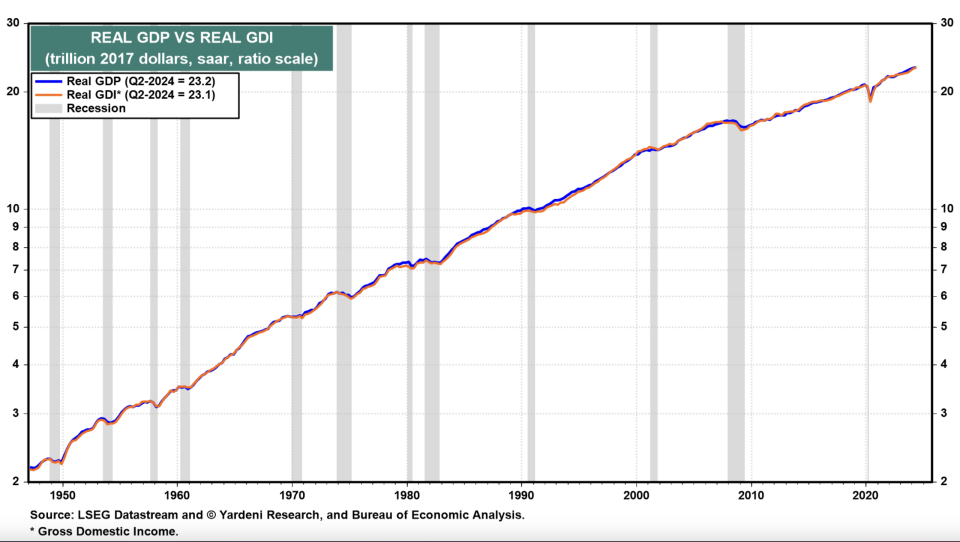

3. United States Economy: Significant Upward Revisions Show No Landing

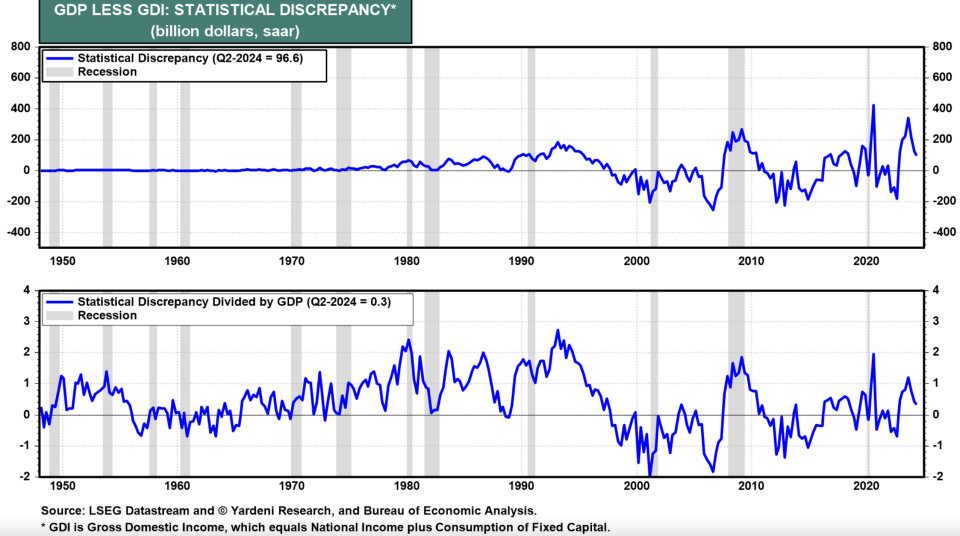

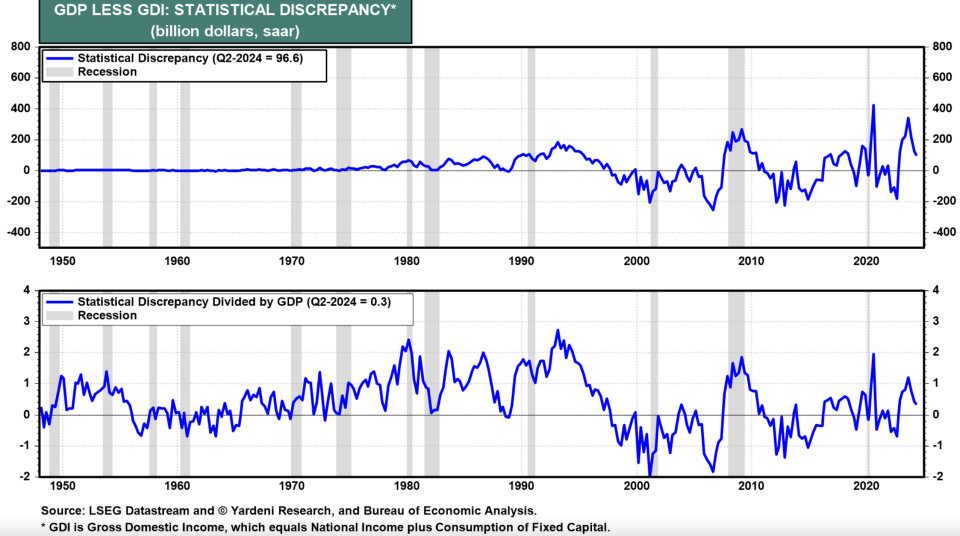

Among the present cynical circumstances of the permabears is that precise Gross Domestic Production (GDP) has truly been increasing faster than precise Gross Domestic Income (GDI). The 2 alternate actions of the United States financial local weather have considerably diverged, recommending that one thing is inaccurate with the precise GDP info which it’s sure to be modified downward, fixed with the cynics’ pessimism. They haven’t mentioned why they think about the GDI info to be a way more actual step of economic activity than the GDP info.

Indeed, the Bureau of Economic Analysis (BEA), which places collectively each assortment, prefers GDP over GDI: “GDI is an alternative way of measuring the nation’s economy, by counting the incomes earned and costs incurred in production. In theory, GDI should equal gross domestic product, but the different source data yield different results. The difference between the two measures is known as the ‘statistical discrepancy.’ BEA considers GDP more reliable because it’s based on timelier, more expansive data.”

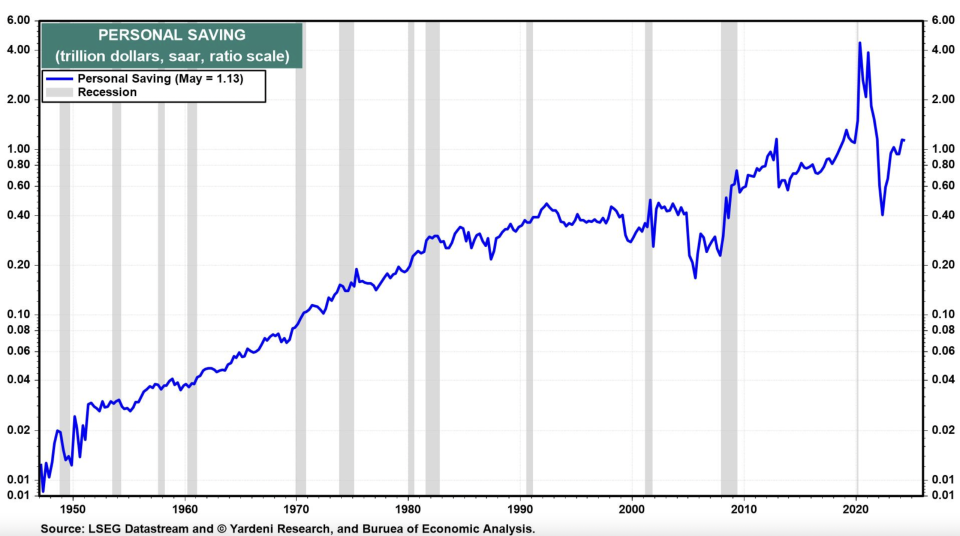

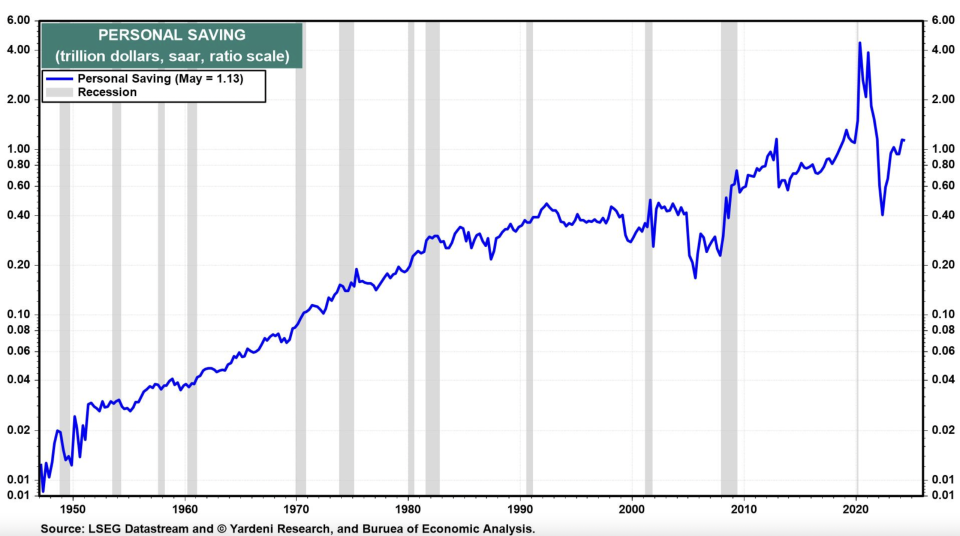

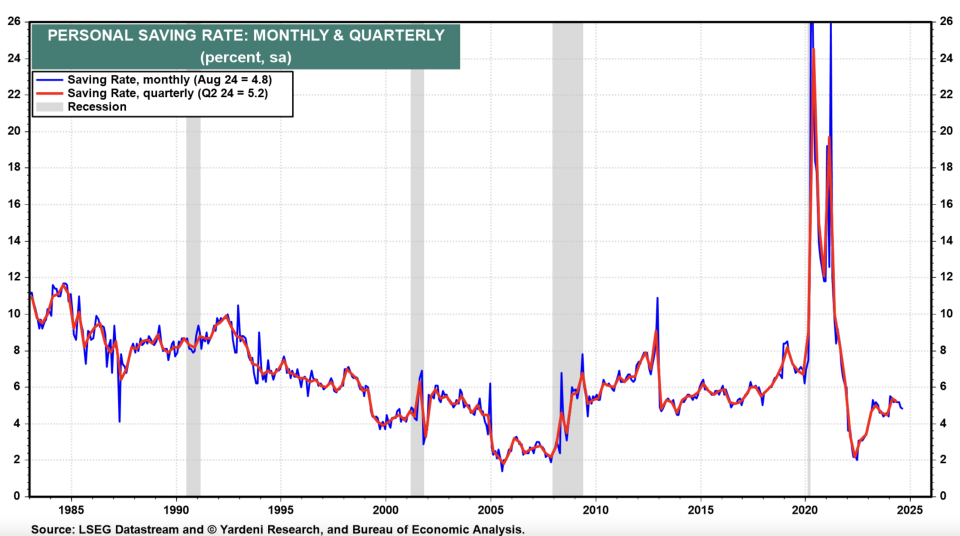

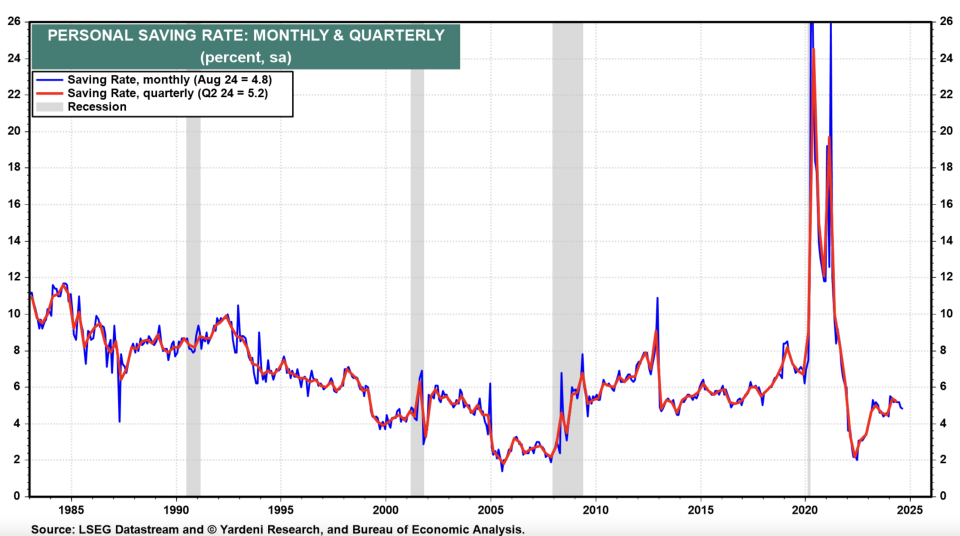

Meanwhile, the permabears have truly moreover been calling the alarm system bell relating to the person conserving value not too long ago. It had truly gone down to three.3% all through Q2-2024, in keeping with the earlier value quote, probably the most inexpensive contemplating that Q3-2022. One permabear composed on September 25 that “historical past suggests when the SR sinks this low, it often proves unsustainable with a subsequent rise triggering a recession.

The slide within the SR from 4% in the beginning of this 12 months was not because of households dipping into to their pandemic-era extra financial savings, which have been lengthy since spent. But it appears that evidently households have develop into used to operating down their financial savings and might’t break the behavior.” His verdict was that “the super-low US saving ratio [is] a ticking economic timebomb.”

The actually following day, on September 26, the BEA launched its latest modifications of Q2-2024 GDP and GDI. Much to the disgrace of the permabears, precise GDI was modified considerably higher, led by the next modification in earnings and wages– which moreover created a considerable larger modification within the particular person conserving value!

Here is the delighted info from the BEA:

( 1) GDP & & GDI.

Real GDI enhanced 3.4% (saar) in Q2, the next modification of two.1 ppts from the earlier value quote.Real GDP climbed an unrevised 3.0% all through Q2. The commonplace of precise GDP and precise GDI– a supplementary step folks monetary activity that simply as weights GDP and GDI– enhanced 3.2% in Q2, the next modification of 1.1 ppts from the earlier value quote.

Even Q1’s numbers have been modified higher, additionally a lot to the bears’ disgrace. Real GDP was modified up from 1.4% to 1.6%, and precise GDI was modified up from 1.3% to three.0%. The commonplace of the GDP and GDI was elevated from 1.4% to 2.3%.

The analytical disparity in between each actions of the financial local weather is small presently. In present bucks, it was modified to 0.3% from 2.7% all through Q2.

( 2) Personal value financial savings

Personal conserving was $1.13 trillion in Q2, the next modification of $74.3 billion from the earlier value quote.

The particular person conserving value– particular person conserving as a % of non reusable particular person earnings– was 5.2% in Q2, in comparison with 5.4% (modified) in Q1. The earlier quotes for the conserving value have been 3.3% in Q2 and three.7% in Q1.

( 3) Wages & & wages(* )upwards modifications to each the GDI and the person conserving value confirmed the next modification in small earnings and wages settlement.

The buyer investing was strong all through the very first fifty % of the 12 months, whereas the person conserving value stayed pretty excessive, and positively greater than the So projection.“timebomb”( 4)

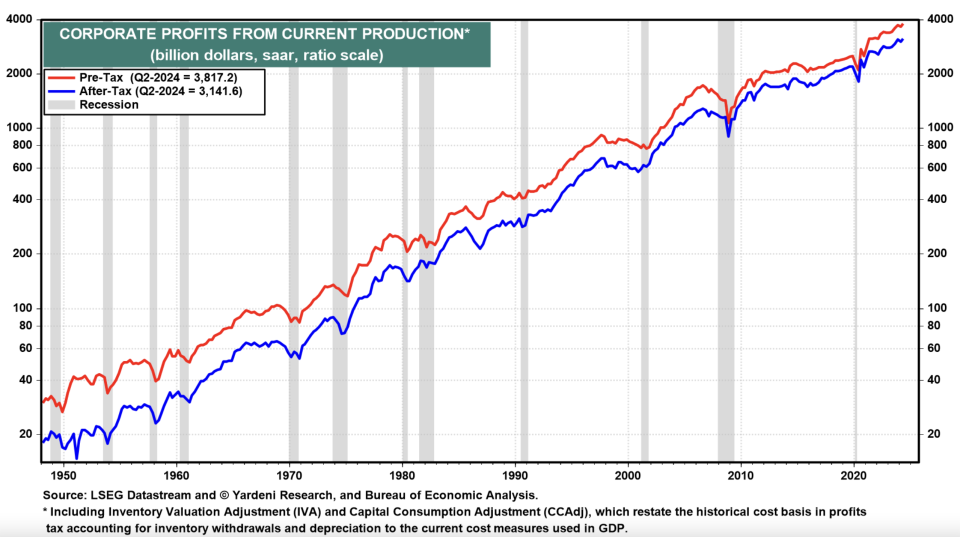

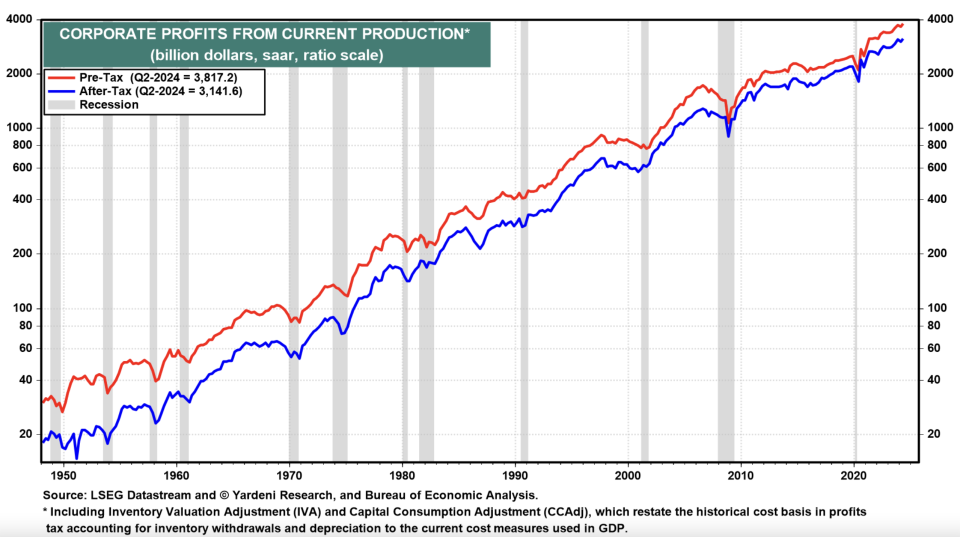

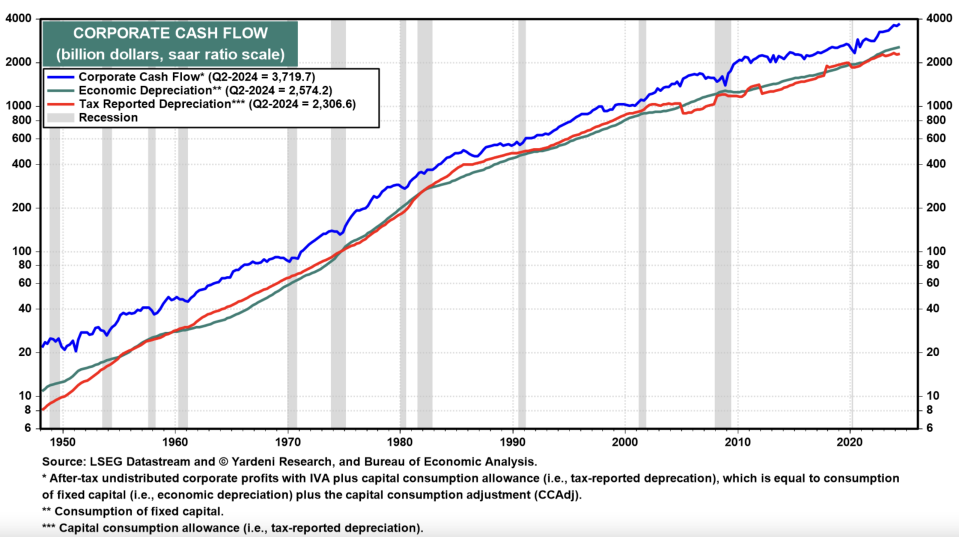

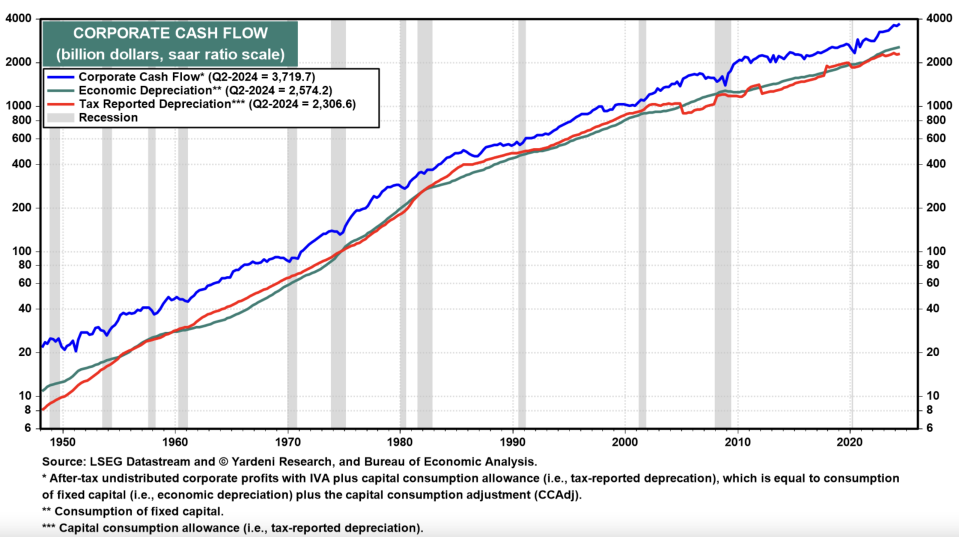

earningsCorporate’s way more:

There- tax obligation enterprise profit from present manufacturing (enterprise earnings with provide analysis and funding consumption adjustments) was modified up by 3.5% to a doc $3.1 trillion (saar).After/

So rising to a brand-new doc excessive of $2.0 trillion was enterprise returns.

Also( 5)

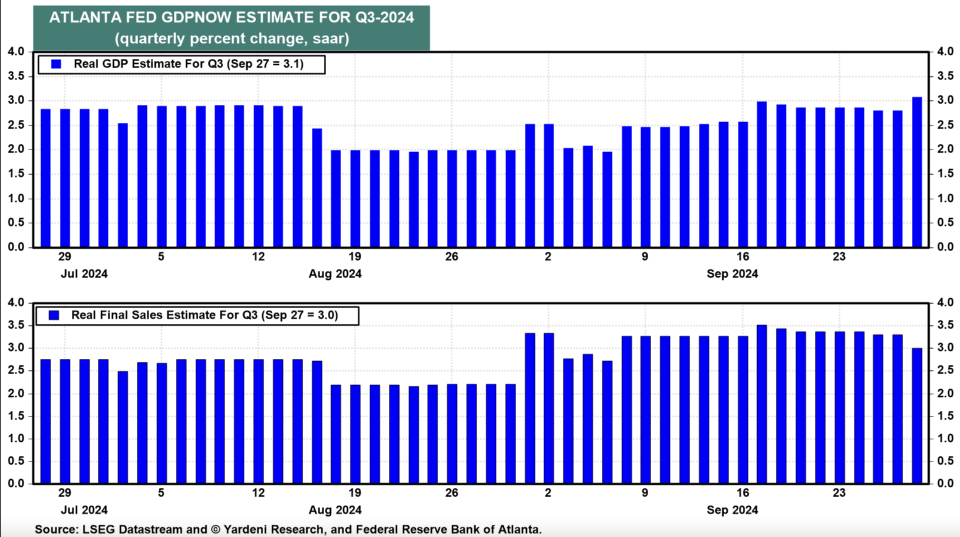

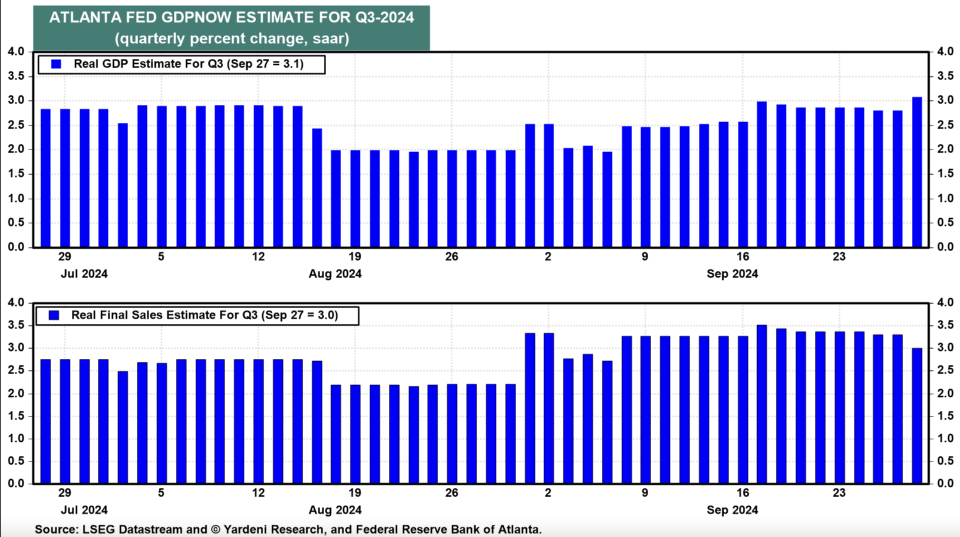

Q3’s GDP. present quarter will definitely stay to annoy any kind of staying hard-landers.

The’s The Atlanta Fed model reveals precise GDP up 3.1% (saar) all through Q3. GDPNow‘s the next modification from 2.9% on That 18.September GDP

Real( 6)

landing. No latest BEA modifications additionally removed the technological financial downturn all through H1-2022 when precise GDP dropped 2.0% and 0.6% all through Q1 and Q2 of that 12 months.

The 2 numbers have been modified to -1.0% and 0.3%.Those proceeds to not seem.

The “Godot recession”, a shifting financial downturn has truly struck a few markets that have been most acutely aware the tightening up of economic plan. Instead the overall financial local weather has truly stayed sturdy and far much less interest-rate delicate than previously.But an end result of the latest standards modifications, Q2’s precise GDP and precise GDI are 1.3% and three.8% larger than previously approximated.

As’s no powerful or delicate landing within the modifications. There financial local weather continues to be flying excessive, because it has truly been contemplating that the two-month pandemic financial downturn all through The and March 2020!April,

So the Why Did? Fed Ease’s an incredible inquiry supplied all of the above.

That resolution is that

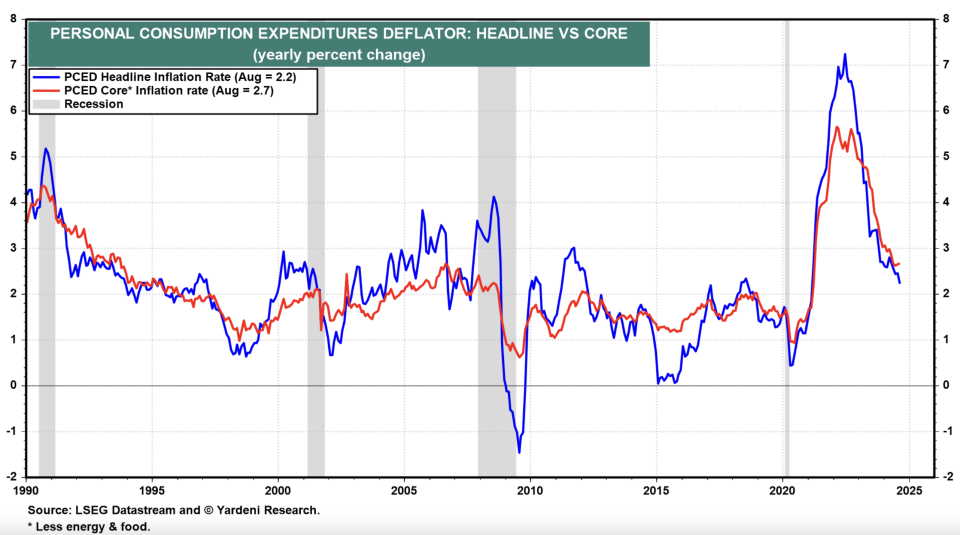

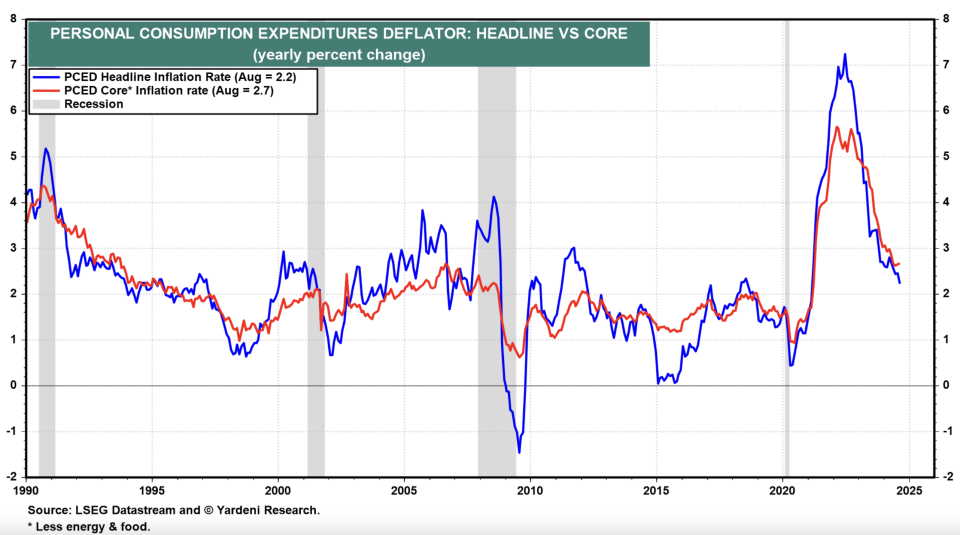

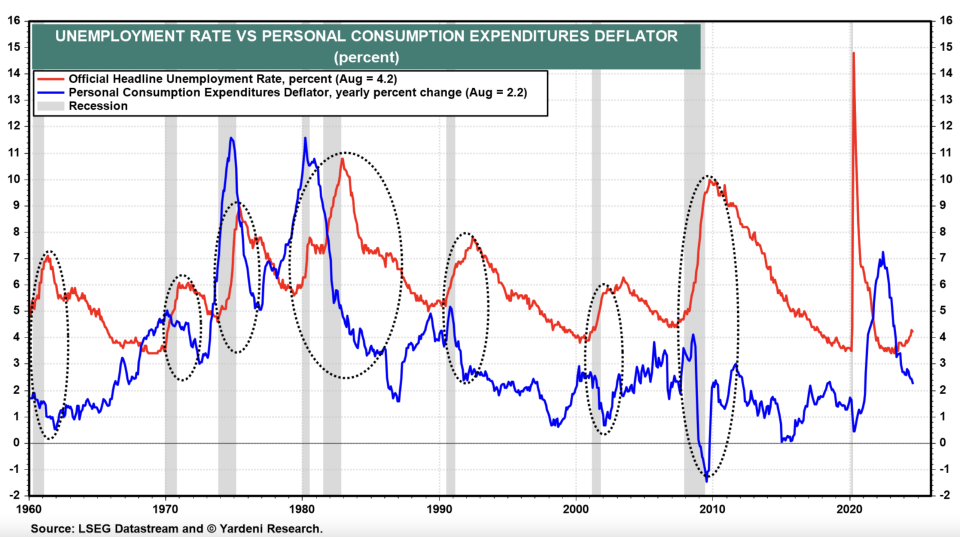

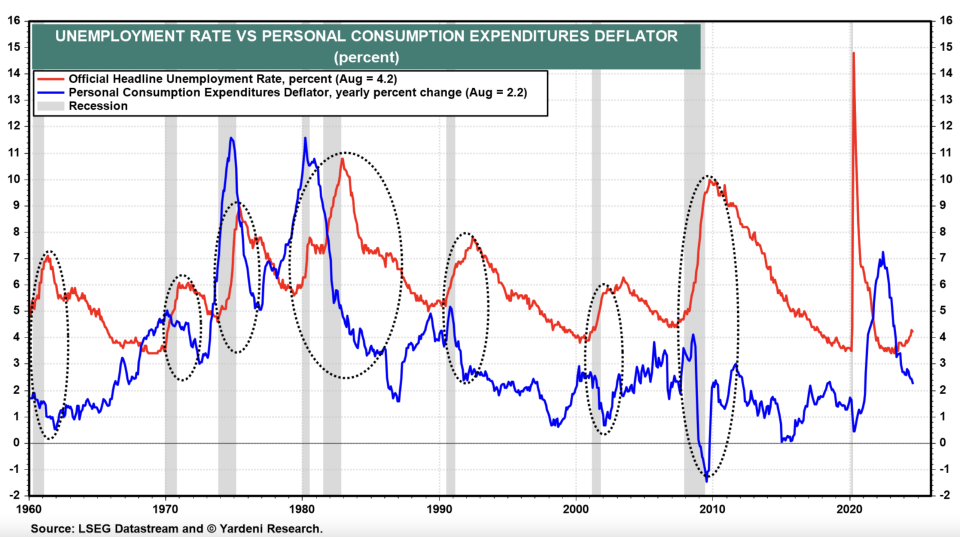

The knowledgeable the Congress to scale back by mandating that monetary plan must intend to take care of each the rising value of dwelling and the joblessness costs diminished. Fed authorities can positively declare that they’ve truly completed this superb harmonizing act. Fed, the joblessness value was simply 4.2%, and heading and core PCED rising value of dwelling costs have been to 2.2% and a couple of.7%.In August PCE

Fed it was completed with out an financial downturn as was wanted previously to do the duty.“Mission accomplished!” And PCED

However andApril January’s the key issue that That & &Powell decided to scale back the federal government funds value by 50bps not too long ago.Co picked to miss

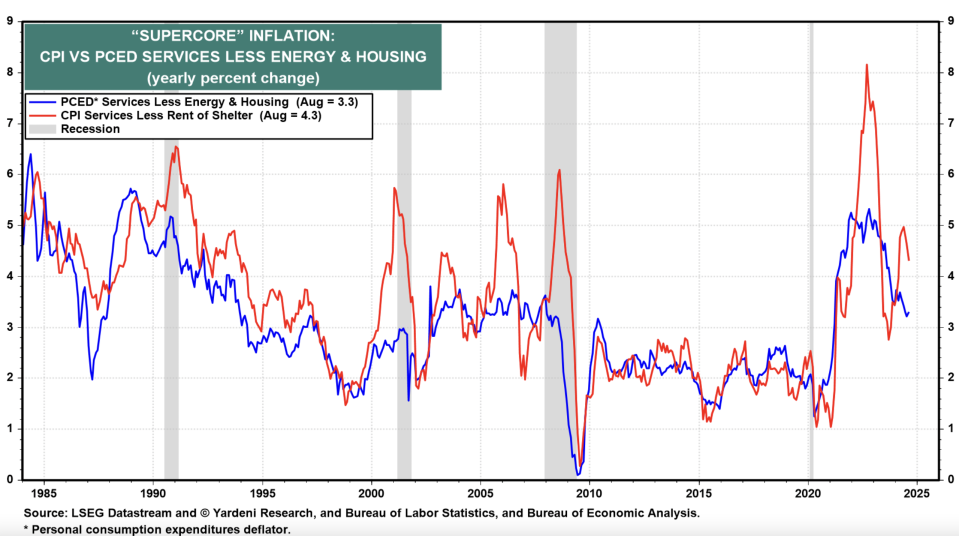

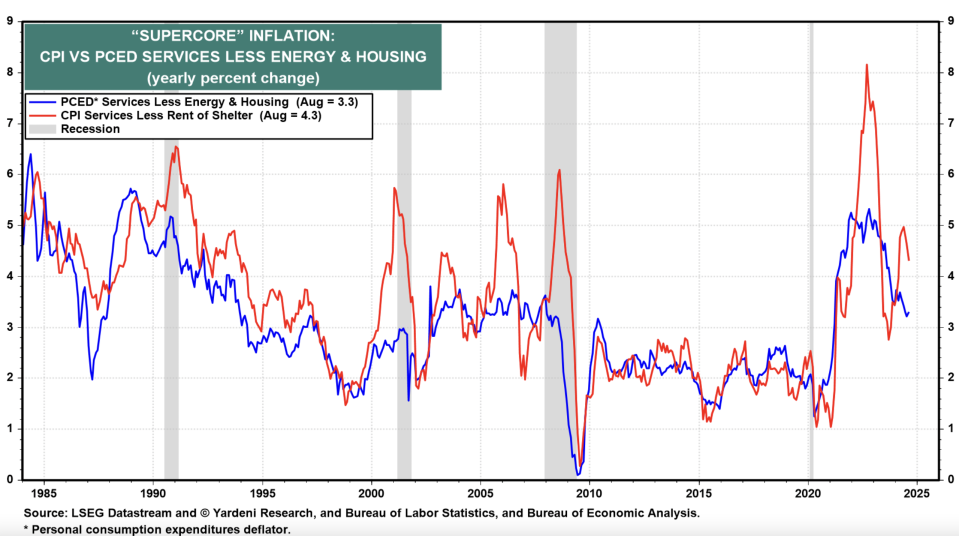

They’s sticky analyses of the August rising value of dwelling value (i.e., buyer charge rising value of dwelling for options leaving out energy and actual property), which was 3.3% for the PCED and 4.3% for the CPI.“supercore” their objective isn’t fully achieved thought-about that

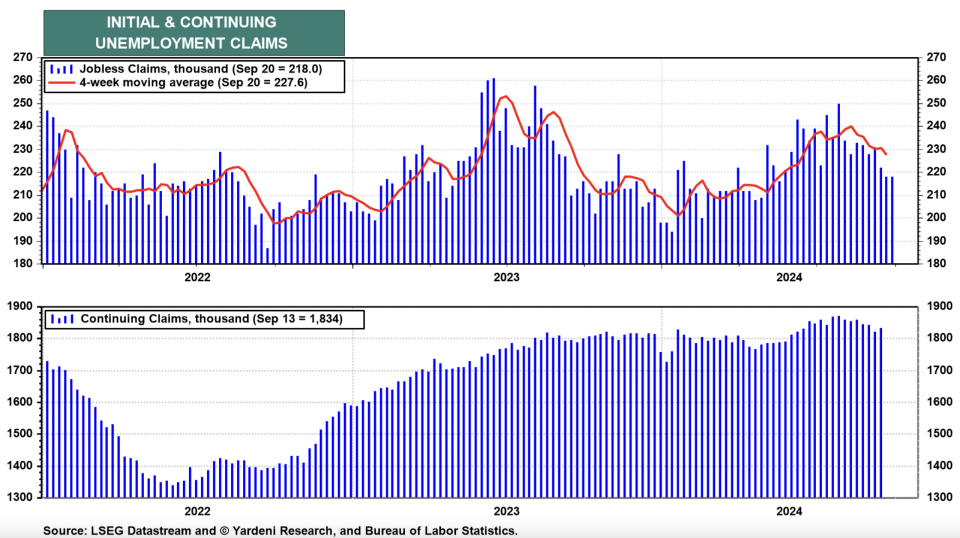

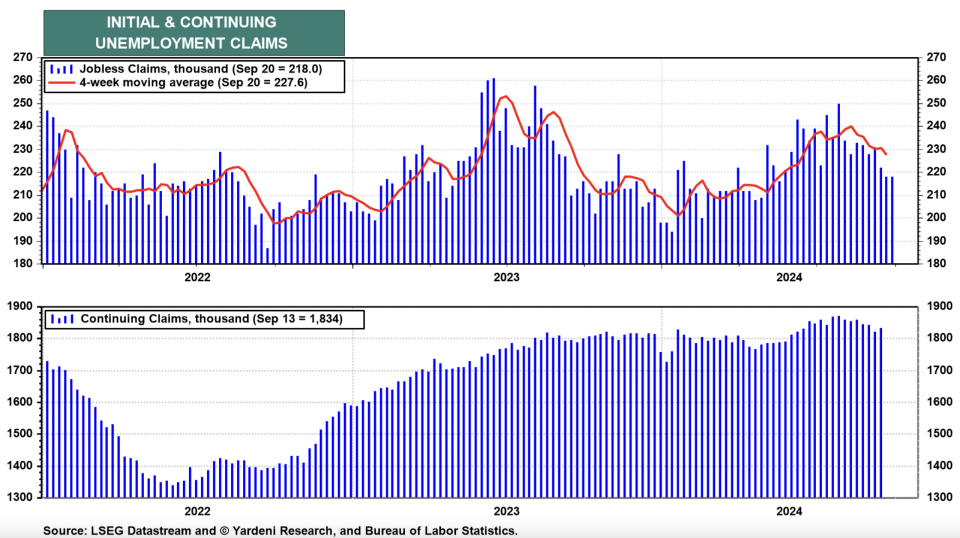

So very first mentioned Fed Chair Jerome Powell rising value of dwelling in his speech on the “supercore” on Hutchins Center and Fiscal on the Monetary Policy again on Brookings Institution 30, 2022. November made a big supply relating to it. He noticed that it made up over half of the core PCE index. He no extra discusses it.He, discharges proceed to be restrained, as proven by the most recent preliminary joblessness asserts info.

Meanwhile & &

Fed their easing of economic plan is concentrated on rising monetary want and the necessity for labor, i.e., activity openings, which stayed over the pre-pandemic levels in

So.July/

That can heat up rising value of dwelling. That can the financial plans of the next resident of the So.White House why did the

So authorities select to scale back? Fed why may they continue to be to scale back?And need to accomplish that to forestall an financial downturn and to develop much more activity openings.

They need to take the prospect of blowing up buyer prices together with possession prices. They need them good luck. We any kind of event, any kind of staying diehard hard-landers want to remember the outdated expression: In.