-

united state work report, Powell speech will definitely stay in emphasis immediately.

-

Tesla is a purchase with better-than-expected Q3 distributions anticipated.

-

Levi Strauss is a promote with underwhelming revenues on deck.

-

Looking for much more workable career ideas to browse the prevailing market volatility? Unlock access to InvestingPro for less than $8 a month!

united state provides completed mixed on Friday, with the Dow Jones Industrial Average closing at a recent doc as traders absorbed managed rising value of dwelling info that elevated hopes of another outsized charges of curiosity decreased on the Federal Reserve’s November plan convention.

All 3 vital united state provide indexes revealed a third straight week of good points, with the superb Dow and benchmark S&P 500 each growing concerning 0.6% via. The tech-heavy Nasdaq Composite progressed nearly 1% all through the week.

Source:Investing com

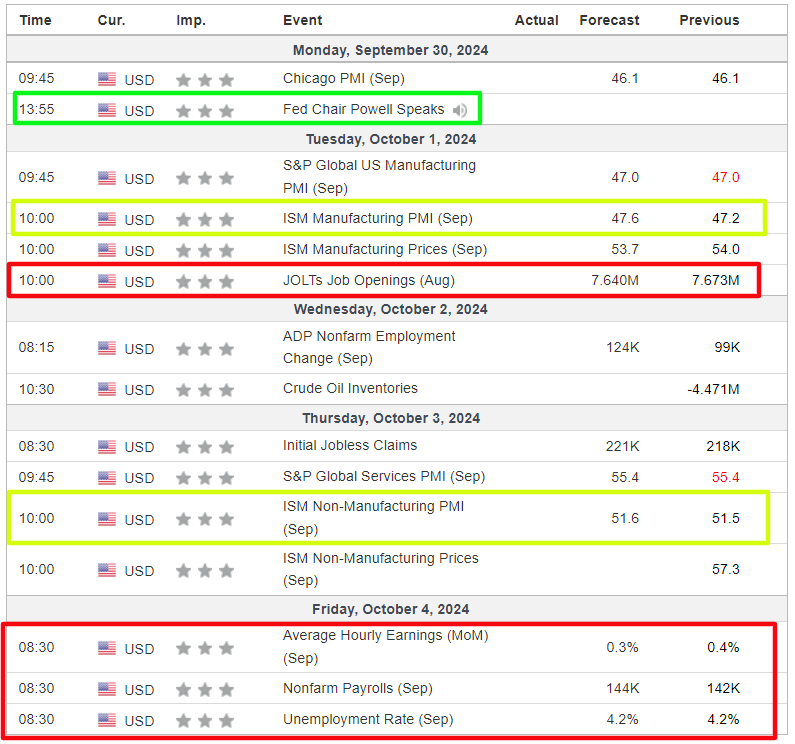

The week upfront is anticipated to be an energetic one as financiers stay to guage the Fed’s overview for value cuts. Markets are completely valuing in a minimize of a minimal of 25 foundation elements in November, with assumptions for a minimize of 50bps supplied a 48.1% risk, in response toInvesting com’s Fed Monitor Tool.

Most essential on the monetary schedule will definitely be Friday’s united state work report for September, which is anticipated to disclose the financial state of affairs included 144,000 placements, contrasted to work growth of 142,000 inAugust The joblessness value is seen holding constant at 4.2%.

Ahead of the work report, the ISM manufacturing and options PMIs will definitely moreover be very carefully loved.

Source:Investing com

That will definitely be include by a hefty slate of Fed audio audio system, consisting of Chairman Jerome Powell on Monday early morning.

Elsewhere, the revenues timetable for following week consists of data from merely a few vital enterprise. These encompass Nike (NYSE: NKE), Carnival (NYSE: CCL), Levi Strauss (NYSE: LEVI), and Constellation Brands (NYSE: STZ).

Regardless of which directions {the marketplace} goes, listed under I spotlight one provide prone to be wanted and another which might see recent downside. Remember nevertheless, my length is merely for the week upfront, Monday, September 30 – Friday, October 4.

Stock to Buy: Tesla

The main driver driving Tesla (NASDAQ: TSLA)’s provide immediately is the extraordinarily anticipated launch of its third-quarter distribution numbers, that are anticipated to be revealed on Wednesday early morning.

The EV agency’s Q3 effectivity want to come back alongside after a tough preliminary fifty p.c of the yr, the place want was affected by slowing down growth in very important worldwide markets.

Wall Street consultants are anticipating 462,000 vehicle distributions for the quarter, up 6% contrasted to Q3 2023. This would definitely be aware the EV producer’s third-best quarterly total, adhering to a record-setting 484,507 in This fall 2023 and 466,140 in Q2 2023.

Tesla’s strong distribution numbers are sustained by elevating want, particularly in China, the place federal authorities aids and low-priced funding have really sustained gross sales.

Tesla creates the Model 3, the Model Y, Model X and Model S, together with the Semi andCybertruck The Model Y crossover make up most of gross sales. The Austin, Texas- primarily based agency is extensively acknowledged because the worldwide chief within the electrical vehicle market, holding a number one market share within the united state and China.

Investors will definitely moreover be very carefully seeing Tesla’s Robotaxi event on October 10, the place updates on the agency’s self-driving fashionable expertise and professional system will definitely be shared. This event is most definitely to supply buzz round Tesla’s AI skills and future group potentialities, consisting of self-governing ride-hailing options.

Source:Investing com

TSLA provide rose 9.3% not too long ago to complete Friday’s session at $260.46 per share, its biggest closing fee provided that July 10. Shares are up 4.8% within the yr to day.

At current levels, Tesla has a market cap of $812 billion, making it the globe’s most essential automotive producer, bigger than names resembling Toyota (NYSE: TM), Volkswagen (ETR: VOWG_p), General Motors (NYSE: GM), and Ford (NYSE: F).

Source: Investing Pro

It deserves discussing that Tesla has an above-average ‘Financial Health Score’ of three.0 out of 5.0, as examined by Investing Pro’s AI-backed variations, highlighting its sturdy fundamentals, technological stamina, and market administration in electrical lorries and AI-based automation.

Be sure to look into Investing Pro to stay in sync with {the marketplace} fad and what it signifies on your buying and selling. Subscribe now to InvestingPro with an exclusive 10% discount and position your portfolio one step ahead of everyone else!

Stock to Sell: Levi Strauss

In comparability to Tesla’s optimistic overview, Levi Strauss is preventing with compromising want amidst a troublesome monetary background.

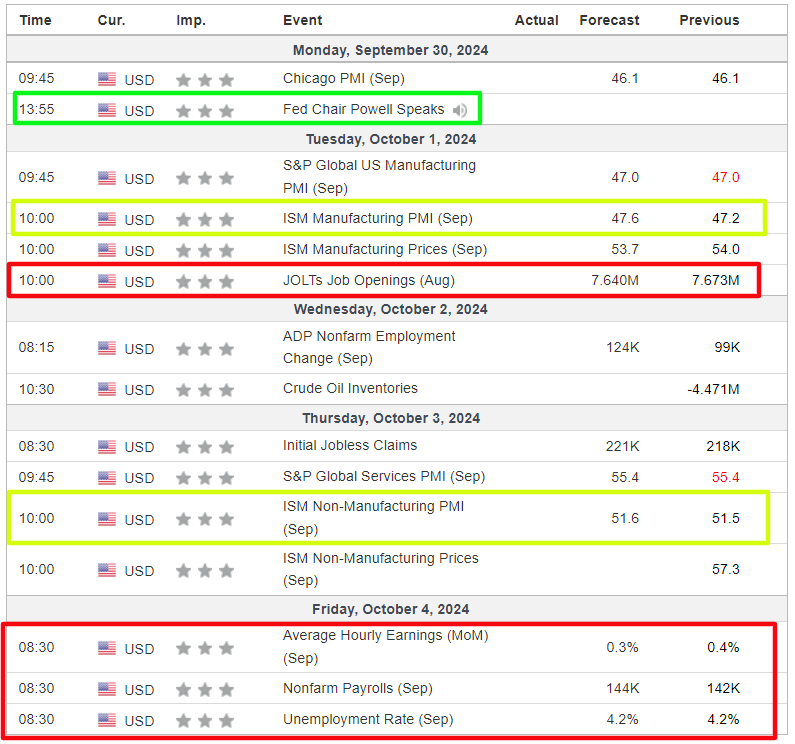

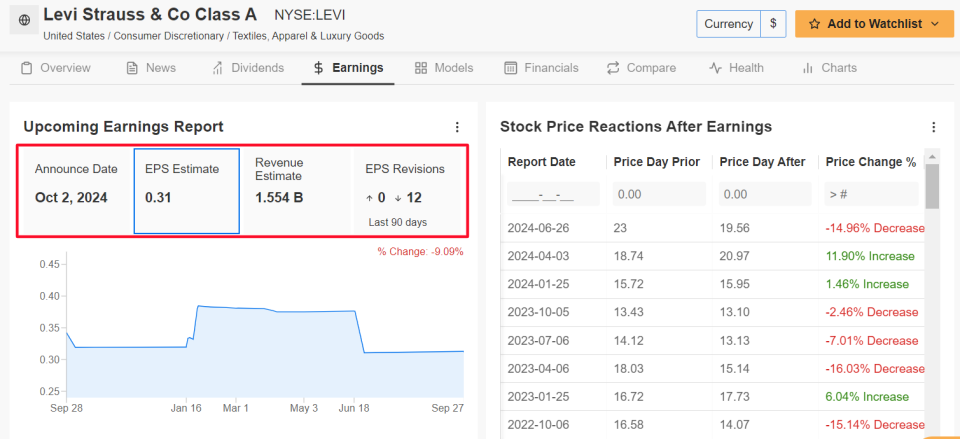

The famend denimwear agency is anticipated to add uninteresting revenues for its third quarter financial report, which schedules after {the marketplace} shut on Wednesday at 4:10 PM ET.

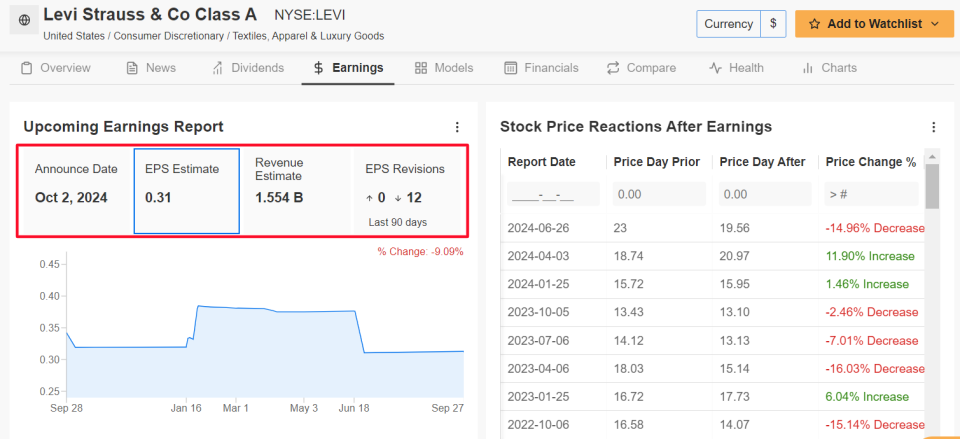

Investor view round Levi Strauss continues to be bearish, with consultants decreasing their income projections within the run-up to the revenues launch. As per Investing Pro, all 12 consultants protecting LEVI have really decreased their revenues value quotes within the final 90 days, mirroring increasing issues concerning the agency’s overview.

Market people anticipate a considerable swing in LEVI provide after the improve decreases, in response to the alternate options market, with a possible indicated step of roughly 9.2% in both directions. Earnings have really been drivers for outsized swings in shares this yr, primarily based on info from Investing Pro, with Levi Strauss provide rolling 15% when the agency final reported quarterly numbers in late June.

Source: Investing Pro

Analysts anticipate revenues per share of $0.31, a bit of up from $0.28 a yr again, whereas revenue is anticipated to extend 3% to $1.55 billion.

Despite these average growth numbers, Levi Strauss has really been struck arduous by compromising buyer want, as rising value of dwelling stays to push dwelling spending plans worldwide. With larger costs of dwelling and rising value of dwelling lingering for longer than anticipated, quite a few clients are drawing again on elective investing, consisting of clothes acquisitions.

Taking that proper into consideration, I believe there may be an increasing downside hazard that the agency can cut back its full-year revenues and gross sales growth overview amidst a degrading retail ambiance.

Source:Investing com

LEVI provide shut at $21.65 on Friday, the very best diploma provided that June 26. Shares have really gotten 30.9% in 2024. At its current evaluation, San Francisco- primarily based Levi Strauss has a market cap of $8.5 billion.

It should be stored in thoughts that Levi Strauss’ near-term overview for earnings and complimentary capital reveals up high-risk, in response to Investing Pro, which flags its excessive revenues evaluation quite a few as a cause for downside.

Whether you’re an novice financier or an skilled investor, leveraging InvestingPro can open a globe of monetary funding potentialities whereas lessening risks amidst the tough market background.

Subscribe now and unlock accessibility to numerous market-beating capabilities, consisting of:

-

Advanced Stock Screener: Search for the perfect provides primarily based upon quite a few chosen filters, and requirements.

-

Investing Pro Fair Value: Instantly uncover if a provide is underpriced or miscalculated.

-

AI ProPicks: AI-selected provide victors with tried and examined report.

-

Top Ideas: See what provides billionaire financiers resembling Warren Buffett, Michael Burry, and George Soros are getting.

Disclosure: At the second of making, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR ® S&P 500 ETF, and the Invesco QQQ Trust ETF. I’m moreover lengthy on the Technology Select Sector SPDR ETF (NYSE: XLK).

I frequently rebalance my profile of personal provides and ETFs primarily based upon recurring hazard analysis of each the macroeconomic ambiance and enterprise’ financials.

The sights talked about on this write-up are solely the viewpoint of the author and have to not be taken as monetary funding steering.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for much more inventory change analysis and understanding.

Related Articles

1 Stock to Buy, 1 Stock to Sell This Week: Tesla, Levi Strauss