Factors behind the Reserve Bank’s selection to depart charges of curiosity on maintain are readied to be uncovered, with consultants looking for any sort of imply possible future exercise.

Minutes of the reserve financial institution’s September board convention will definitely be launched on Tuesday, clarifying the selection to take care of charges of curiosity at 4.35 %.

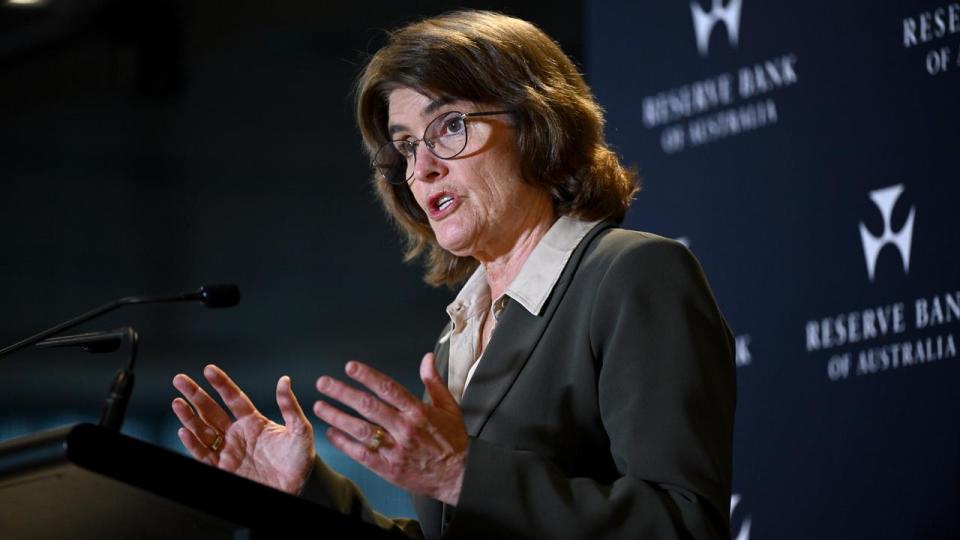

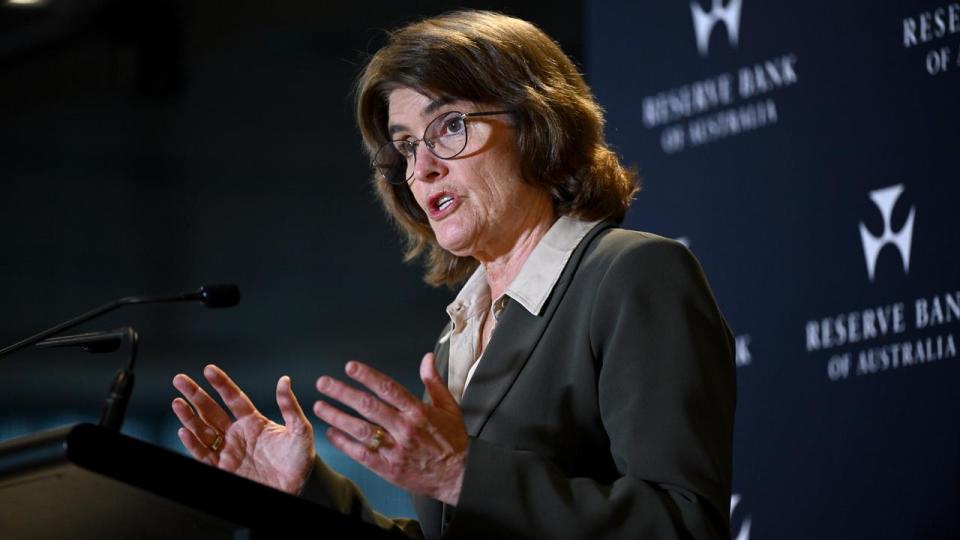

Rates have truly gone to a 12-year excessive contemplating that November, with guv Michele Bullock previously suggesting the September convention was the very first time contemplating that March the monetary establishment’s board didn’t clearly take into consideration a lift to the money cash worth.

Rates have truly been left on maintain for 7 conferences straight and consultants anticipate they won’t boil down until very early 2025.

Also on Tuesday, the monetary establishment’s alternative guv Andrew Hauser will definitely provide a speech to financiers concerning the state of the financial local weather.

Bendigo Bank main monetary skilled David Robertson claimed the timing of any sort of future charges of curiosity lower will surely depend on precisely how swiftly rising value of residing regulated.

Headline rising value of residing was as much as 2.7 % in August, the very first time it was again throughout the Reserve Bank’s goal band contemplating that August 2021.

However, the reserve financial institution had truly proven it was ready to see quarterly info on rising value of residing, which is way much less primarily based on volatility, prior to creating an evaluation on rising value of residing.

“The strength in labour markets and ongoing population growth have shielded our economy from the full effects of higher interest rates and the inflation shock,” Mr Robertson claimed.

“As a result, we predict the first rate cut here in Australia to occur by May 2025, with a strengthening case for February next year.”

While Australians are usually not more likely to see a lower to charges of curiosity sooner or later, New Zealand’s reserve financial institution is extensively tipped to decrease its money cash worth.

Analysts have truly forecasted a 50 foundation issue decline all through the ditch to 4.75 %, whereas Commonwealth Bank monetary consultants have truly moreover anticipated an moreover 50 foundation issue lower in November as inflationary stress comfort.

Closer to house, the latest buyer self-confidence index info will definitely be launched on Tuesday.

The Australian Bureau of Statistics will definitely moreover reveal construction job numbers for the June quarter on Wednesday.

Data from the March quarter revealed a 0.5 % rise within the number of full residences, whereas financial sector properties climbed by 4.8 %.

The March quarter moreover revealed a decline of three.1 % in varied different residences within the financial sector.

Meanwhile, the Australian securities market is readied to open up higher on Monday, after Wall Street climbed on Friday when a stronger-than-expected duties report assured financiers fretted about weak level within the United States financial local weather.

The United States federal authorities claimed firms included 254,000 much more duties to their pay-rolls final month than they diminished.

That was a velocity from August’s using velocity of 159,000 and blew earlier monetary consultants’ projections.

The joblessness worth was as much as 4.1 %, the document revealed.

The United States Dow Jones Industrial Average climbed 341.16 elements, or 0.81 %, to 42,352.75, the S&P 500 obtained 51.13 elements, or 0.90 %, to five,751.07 and the Nasdaq Composite included 219.37 elements, or 1.22 %, to 18,137.85.

The Australian futures market is indicating beneficial properties when buying and selling resumes right this moment, after the first equities index settlement included 26 point out 8215 in weekend break buying and selling.

On Friday, the neighborhood S&P/ ASX200 index accomplished 55.2 elements diminished at 8,150, a lack of 0.67 %, whereas the broader All Ordinaries went down 57.7 elements, or 0.68 %, to eight,416.6.