A big lower in energy prices has truly decreased common month-to-month rising price of dwelling again proper into the reserve financial institution’s goal, as residence mortgage homeowners maintain on to hopes of a value lower.

Inflation cooling all the way down to 2.7 % within the yr to August, beneath 3.5 % in July, introduced it to its flooring in nearly 3 years, primarily off the rear of energy aids.

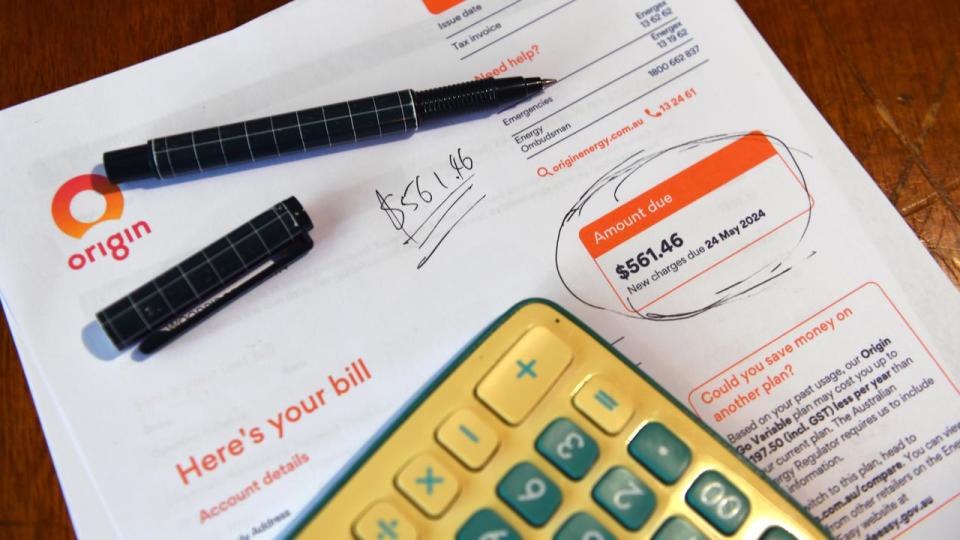

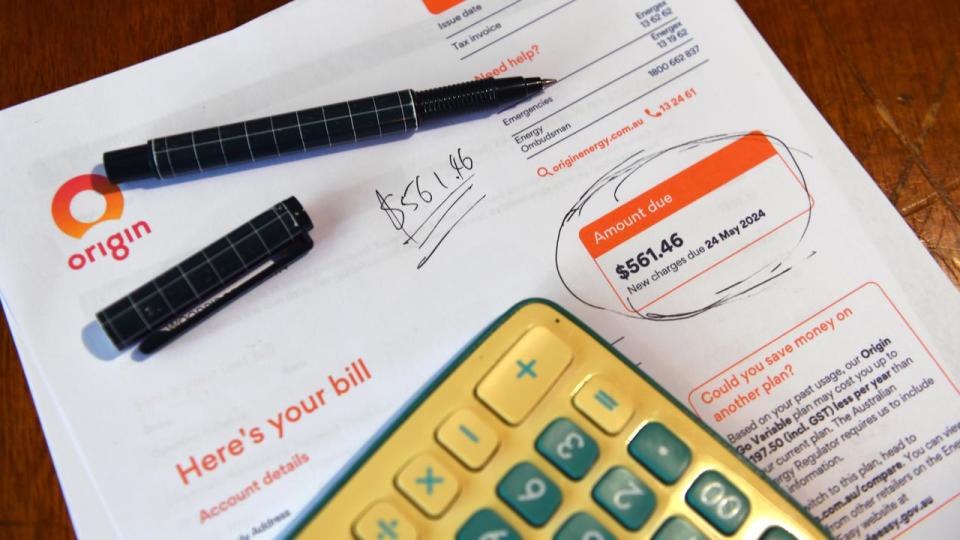

Federal and state energy aided carry energy bills down 17.9 %, the most important yearly autumn on doc.

Electricity bills will surely have leapt 16.6 % on condition that June 2023 with out the refunds, in response to the Australian Bureau of Statistics.

While rising price of dwelling is monitoring in the most effective directions, it’s not all glorious info for residence mortgage homeowners, with the lower imply – a quantity that removes uneven or momentary prices changes – will be present in at 3.4 % in August.

Although beneath 3.8 % in July, it’s nonetheless over the Reserve Bank’s goal band and the reserve financial institution pays much more focus to this scale of underlying rising price of dwelling when making costs selections.

The yearly lower quantity not noted the drops in gasoline and energy.

The volatility of the common month-to-month quantity made it a lot much less outstanding than the quarterly one, subsequent due in October, RBA guv Michele Bullock said.

Alcohol and cigarette prices climbed 6.6 %, meals and drinks 3.4 %, and actual property 2.6 % within the yr to August, nevertheless transportation dropped by 1.1 %.

Fuel sank 7.6 %.

Interest value walks have truly appeared for to take the wind off the rear of the financial state of affairs and slow-moving rising price of dwelling nevertheless a value lower isn’t anticipated up till 2025 after the RBA held costs at 4.35 % on Tuesday.

National Australia Bank aged financial knowledgeable Tapas Strickland anticipated the heading common month-to-month quantity is not going to make any form of distinction to the chance of the reserve financial institution decreasing costs

He anticipates the preliminary lower in May, whereas financial specialists at ANZ and Westpac have truly penned one in for February.